Frozen red meat: what are the opportunities?

Thursday, 30 January 2020

Spend on frozen food overall is steady, but frozen red meat is being left in the cold. We find out why frozen red meat is struggling and what the opportunities are for the category.

Opportunities

- Cost and convenience; with consumers watching their spend, frozen food is ideally placed to target those on a budget, while bringing those quality and convenience elements that are still so important to shoppers

- Ranging and choice; address consumer frustration with lack of choice through innovation, and provide more in-store recipe inspiration at frozen fixtures

- Green credentials; appeal to the greener shopper by showing off the benefits that buying frozen can have on helping to reduce food waste along the supply chain

How big is the frozen red meat market?

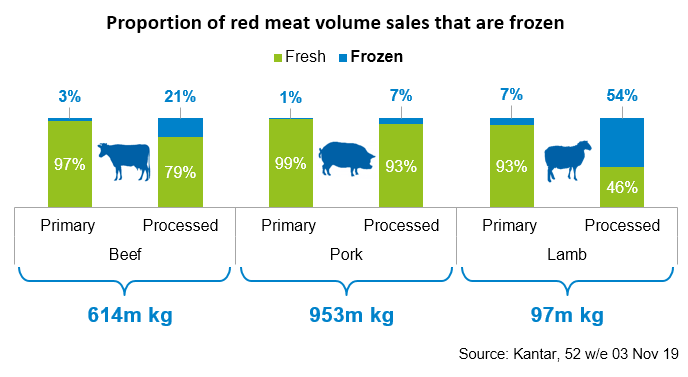

The frozen food category was worth over £6.3 billion in the year to November 2019, unchanged on the previous year1. Total frozen red meat (including primary, processed and added value products) accounted for 10% of this spend (just over £603 million), which – despite rising prices – has waned over recent years, due to falling volumes.

Volume sales of frozen primary red meat have fallen by 13% from November 2018, while volumes of frozen processed red meat are down by 11%2. These declines are a lot steeper than the equivalent total fresh market for red meat, and of frozen chicken and fish (primary, processed and added value), which are down 4% and 3% in volume, respectively1.

What are the opportunities for frozen red meat?

The frozen category is most important to processed red meat, particularly to lamb and beef through burgers and grills. Frozen has a relatively low share of the red meat primary category, the largest part being beef mince.

The frozen red meat market is small and challenging. However, it is important to remember how the attributes of the frozen sector can be used to maximise on consumer trends.

Cost and convenience

Cost and prep times remain the top considerations of consumers when deciding what to eat³. Research by IGD shows 51% of consumers are interested in frozen meat, fish and poultry products that help them save time in the kitchen⁴, with cost being more important to consumers in frozen meals, meat and fish than the average category⁵. Over the past year, the volume of frozen red meat sold on promotion has fallen, contributing to the rise in price and decline in sales, potentially showing the benefit that tactical pricing could have for the category.

Recent analysis by Kantar shows that consumers are beginning to display eating behaviours akin to those displayed during the 2008 financial crisis, i.e. spending less on food and cooking from scratch at home more often. Frozen may play a role here for those on a budget, with average prices for frozen primary and processed red meat still lower than their fresh counterparts, despite the price gap narrowing over recent years.

Frozen may be well placed to attract those shoppers who are watching their spend but are still seeking quality and enjoyment. There may be opportunity to engage with consumers who are forgoing eating out to save money but are still looking for convenience and indulgence at home.

Ranging and choice

Research by IGD indicates that consumers are frustrated over the lack of choice and inspiration in the frozen meals, meat and fish category, highlighting an opportunity for innovation and widening ranges⁵. Shoppers also say they wish to see more in-store recipe inspiration and ideas to help them make decisions when shopping the category. According to IGD, 52% of consumers are interested in trying new recipes or ways of using frozen meat, fish and poultry⁴. This may be an opportunity to encourage shoppers to trade up, through clear messaging around quality, health and provenance, such as Iceland’s ‘Power of Frozen’ campaign.

Green credentials

While cost and convenience are important, the environmental credentials of food are becoming more significant to shoppers. Food waste is the top environmental consideration of consumers when thinking about the food they eat³ and something that frozen food is uniquely placed to help tackle. Freezing preserves food for longer, helping to minimise waste along the supply chain and in the home – a positive environmental message that may appeal to the greener shopper.

1 Kantar, 52 w/e 03 Nov 2019

2 Kantar, 52 w/e 03 Nov 2019 vs 52 w/e 04 Nov 2018

³ AHDB/YouGov, 06 Dec 2019

⁴ IGD, Category Benchmarks 2016 – Frozen, 2017

⁵ IGD, Frozen Category Benchmark report, July 2019