Hitting the mark with consumers in North America

Wednesday, 1 February 2023

North America has some of the highest red meat and dairy consumption rates per capita in the world – driven in the US and Canada by higher incomes and a high urbanisation rate. Population growth and consumer preferences are expected to drive an increased consumption over the coming decade, presenting opportunities for exporters in the UK. AHDB are undertaking detailed analysis on the global opportunities for UK red meat and dairy exports which will be published in March.

In order to maximise on these opportunities, it is important to understand the wider consumer landscape in the US, Canada and the Mexican market which opened for UK pork exports in September 2021. In this article, we explore overarching buying behaviours and examine some of the key trends across all three countries.

Consumer trends

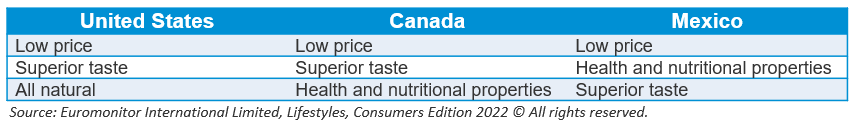

Across North America we see four overarching themes when it comes to all food choices which are affordability, taste, the health and nutritional quality of food, and naturalness. Individual market tendencies need to be considered to build a successful export enterprise.

Key influences on consumers choice of food according to Euromonitor

Affordability

The US is the biggest consumer in North America for red meat and dairy. When it comes to purchasing red meat, value for money is the top priority for consumers. While American consumers want to pay a low price for their meat, they still expect high quality products, therefore UK exporters should ensure messaging around the strong credentials of UK meat to justify any price premium.

Price is also a top priority in Canada and has been for many years. However, more affluent consumers are willing to pay extra for products with superior taste and quality. With Canadian consumers having the same top two priorities when it comes to buying food as American consumers, exporters in the UK should again highlight the unique offering in order to justify the cost to price-conscious consumers.

Whilst it’s a smaller market, Mexico is projected to be the third largest grocery market in the Americas by 2027 (IGD). Price is incredibly important with inflation remaining high in the region. IGD predicting discount stores will become the most popular modern retail channel, as Mexicans continue to focus on saving money, so having a presence in the expanding discount market is key.

Taste and meal focus

Around 40% of North American consumers see superior taste is a top priority. Taste plays heavily into consumers shopping habits and they will continually look for those enjoyable indulgent occasions, particularly when times are hard.

In the US, there is a stereotypical view of American cuisine, but it’s not all burgers and barbecues. There are region-specific dishes and trends, as well as a diverse selection of dishes which blend a range of cultures and traditions. For example, the fusion between American and Hispanic cuisine led to the popular ‘tex-mex’ meals. Other trends include ham and beef joints often eaten at Christmas and generally red meat is the most favoured meat for evening meals.

Home-cooked meals are preferred by Canadians (above the global average) whilst ready-meals, takeaways, and eating-out is well below the global average here (Euromonitor International). The focus for exporters will be within the retail market in Canada and demonstrating freshness of the food they provide.

Also, when it comes to eating out, North American cuisine is the most popular for Americans and Canadians. There is a diverse selection of dishes which blend a range of cultures and traditions across the regions. This is present across the food service market, with Asian cuisine a firm favourite among consumers (Euromonitor International).

Mexicans are food traditionalists, flat breads (tortillas), rice and processed beans are amongst the most popular foods. Poultry is the main fresh meat selected, followed by beef and then pork. This suggests traditional Mexican dishes such as a tacos and quesadillas remain firm favourites at home (Euromonitor International).

Health

There has been a meaningful shift in global perceptions of health and wellbeing since the COVID-19 pandemic and this is strongly reflected in what we eat. While affordability of food still outweighs health across North America, it is an increasingly important priority for consumers. Therefore, communicating health benefits and highlighting the naturalness of products will be integral to value. Although health is a resounding theme across the whole region, each country has its own drivers of health which should also be considered.

The US and Canada have a strong gravitation towards naturalness, organic, and the specific health and nutritional qualities food provides when they shop. There are also signs in the market of interest in non-GMO, hormone-free and antibiotic-free which link into consumers desire for naturalness.

In Canada, claims such as reduced salt and fat feature strongly in the meat sector and messaging around food intolerance, such as gluten-free, also feature. In the US, rising obesity rates have led to a higher demand for reduced-fat meat products. This provides an opportunity for UK meat to add health claims to their packaging to increase margins or be viewed as more competitively priced.

We see a slightly different set of health drivers in Mexico. COVID-19 left a lasting impact here but there has also been an active effort by the government to improve the nutritional quality of food eaten. Mexico has one of the highest rates of obesity in the OECD with73% of over 15’s either overweight or obese. Health initiatives imposed by the government include taxes on sugary drinks and high calorie non-essential foods as well as mandatory front-of-pack food labelling. According to Euromonitor International, 67% of Mexican consumers look for healthy ingredients. Young consumers particularly Gen Z are engaging more with health, 28% say they are on weight-loss diets and 41% actively monitor what they eat.

Opportunities

With all three markets open to UK red meat exports, the US, Canada and Mexico offer a wealth of opportunities for our exporters. However, there are challenges, with price being the biggest obstacle to overcome, and with inflation pushing prices higher, consumers are generally trading down to less expensive meats. But red meat remains a favoured dish across North America and there are plenty of opportunities through seasonal and sporting events and holidays, where food plays a central role. Consumers are willing to spend extra money on cuts with a more expensive price point such as beef during these times.

Health is a recurring theme with North American consumers looking to make up for less healthy lifestyles during the pandemic. Therefore, to maximise on the opportunities across these three regions, exporters need to promote the health credentials of UK red meat, alongside our high standards of production and food safety, to justify any price premium.

This article has examined the overarching consumer trends for the region but further bespoke research by AHDB has looked in-depth at red meat purchase decisions. This further analysis helps unearth opportunities that exist for British red meat to excel in this market.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: