Narrowing price gap between beef and lamb drives shopper switching

Friday, 6 February 2026

As the price difference between beef and lamb continues to narrow, shoppers are beginning to change their buying habits. We've explored the data to understand what this means in practice and the potential opportunities for retailers and meat suppliers.

According to the Office for National Statistics (ONS), retail lamb inflation reached 8.0% in December 2025. This is 1% lower than the three-year average.

Lamb products saw a 3.8% increase in volumes purchased, accompanied by a 5.4% increase in spend year-on-year. Average prices paid increased by 1.6%.1*

This is a weighted average, which shows that shoppers are moving towards cheaper lamb products to counteract price rises.

Figure 1. Volume, spend and average price per volume % change year-on-year of lamb from 2023 to 2025

Source: Worldpanel by Numerator UK, 12 w/e 28 December 2025

For the total lamb category, consumers have been turning away from discount stores and heading to major supermarkets instead.

A rise in promotions at supermarkets has led to a decrease in average prices, attracting cost-conscious shoppers.

Discounters, who are less reliant on promotions, have, therefore, seen a decrease in volumes purchased.

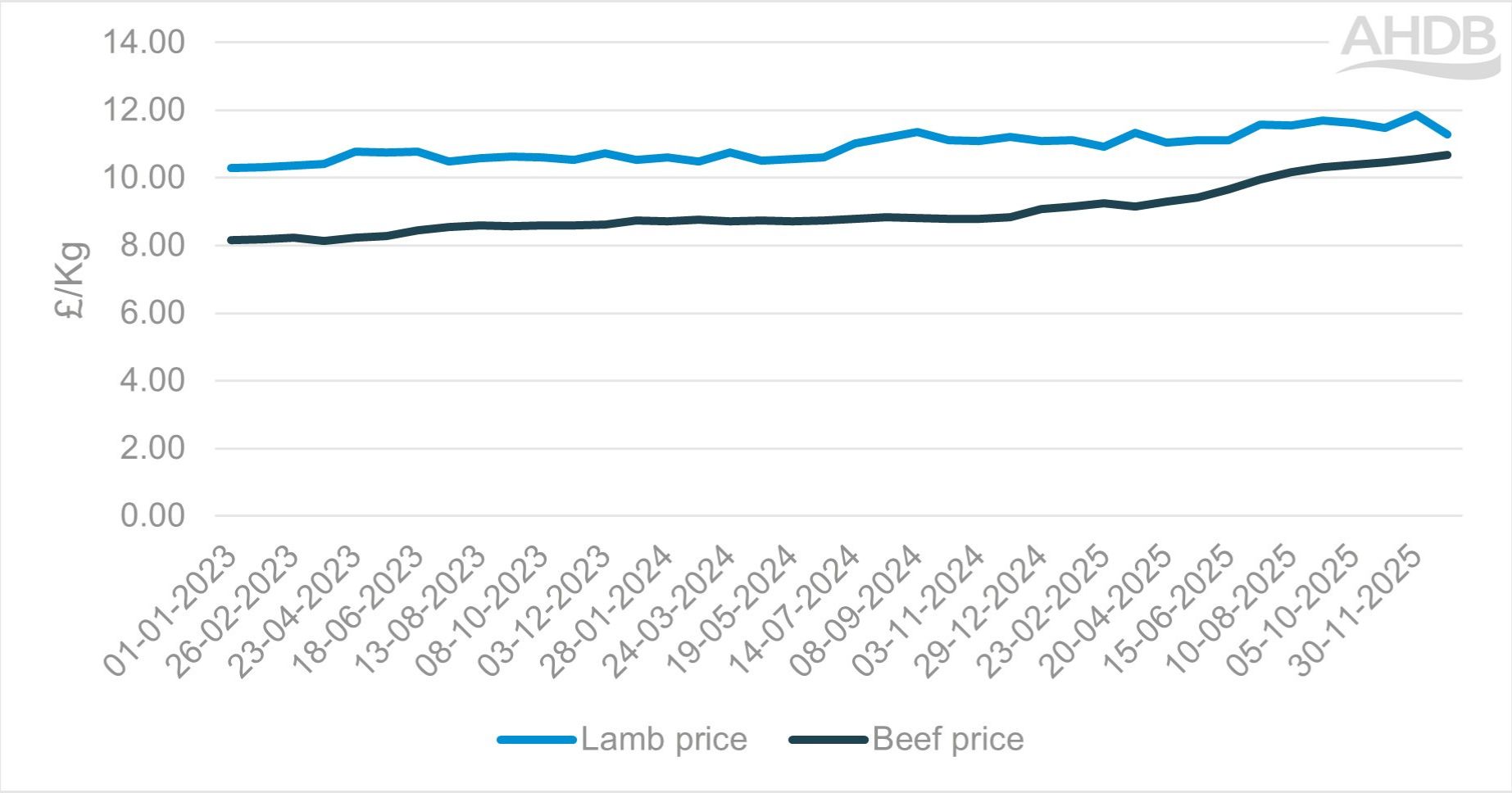

Figure 2. Average total lamb and beef prices from 2023 to 2025

Source: Worldpanel by Numerator UK, 12 w/e 28 December 2025

The price gap between beef and lamb has been narrowing (Figure 2) as beef has suffered from average price increases and consumers have switched to cheaper protein options.

The gap has gone from £2.13/kg at the start of 2023 to £0.59/kg at the end of 2025.

Beef has lost volumes to consumers switching to cheaper proteins, lamb has gained 346 t from this.1

The biggest winners were pig meat pig meat and chicken as they are the cheapest protein options.

What’s happening with lamb?

The lamb roasting joint category has seen a 12.2% increase in volume, followed by a 6.4% increase in spend and a 5.2% increase in average prices.1

Lamb sales soared during the Christmas period, with roasting joints performing particularly well.

There were more promotions during the Christmas period, and the average price per volume decreased by 7.8%. This resulted in an 18.3% increase in volumes sold.1

Premium tier roasting sales decreased, whereas standard tier roasting sales increased.

This suggests consumers are looking for better value for money, as lamb remains one of the more expensive roasting options.

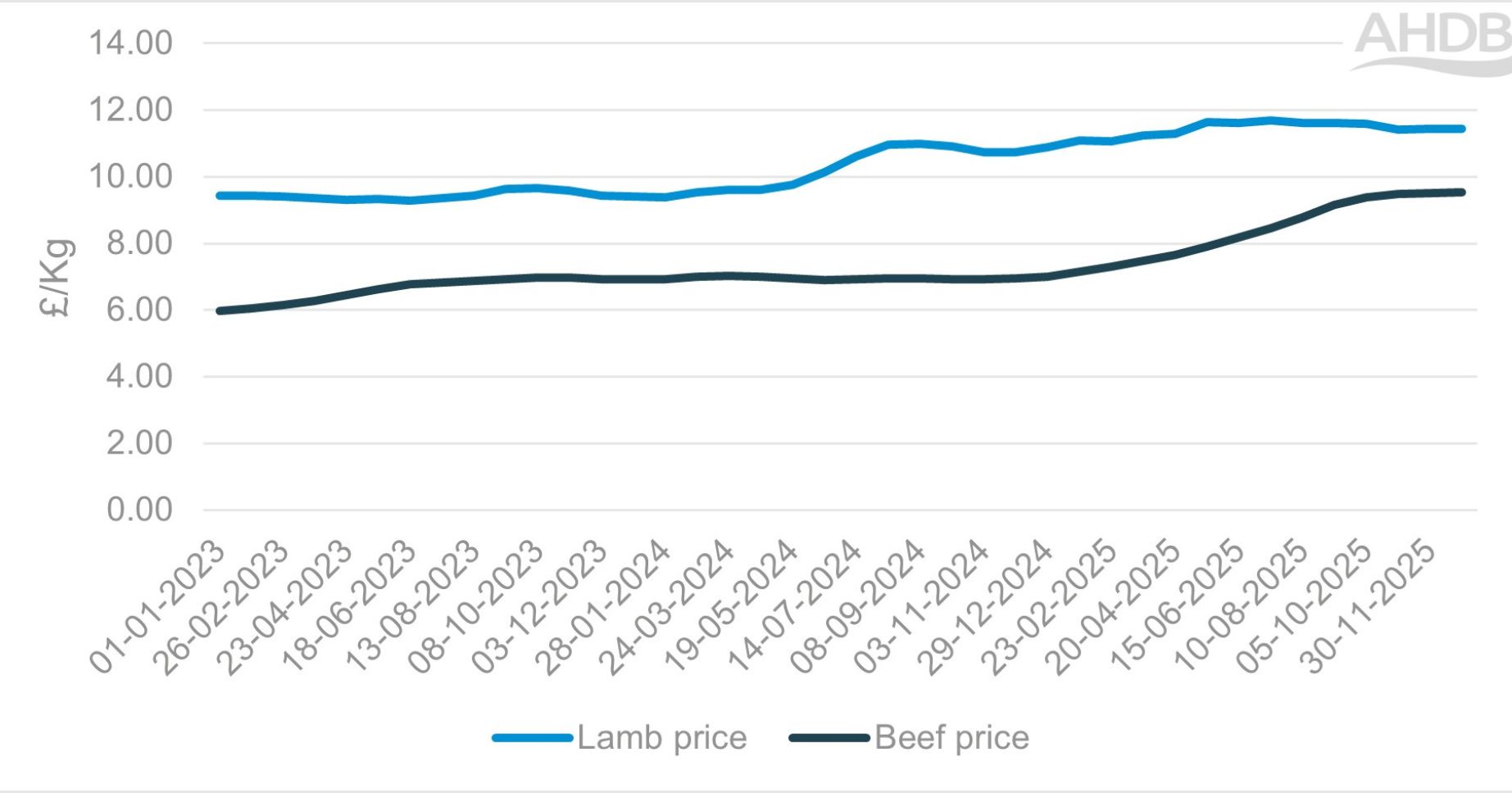

Figure 3. Average lamb roasting and beef roasting prices from 2023 to 2025

Source: Worldpanel by Numerator UK, 12 w/e 28 December 2025

The average price of a lamb roasting joint was £10.95, whereas the average price of a beef roasting joint was £12.40 (Figure 3), making lamb a desirable and more affordable Sunday roast treat.

Leg roasting joints

Leg roasting joints make up the largest proportion of the lamb roasting category.

In the 12 w/e 28 December 2025, sales of leg roasting joints increased by 15.3% while spend increased by 7.8%.1

Consumers were attracted by the 6.5% decrease in average prices due to a large increase in promotions.

Shoulder roasting joints

In the 12 w/e 28 December 2025, there were fewer promotions for shoulder roasting joints than for leg joints.

This could explain the 8.4% decrease in volume, 4.0% increase in spend and 13.5% increase in average prices.1

The volume declines were not enough to counteract the large volume increases seen by leg roasting joints.

Lamb mince

Lamb mince has seen a 12.2% increase in spend, a 6.7% increase in volume and a 5.1% increase in average price.1

Figure 4. Average lamb and beef mince prices from 2023 to 2025

Source: Worldpanel by Numerator UK, 12 w/e 28 December 2025

Lamb mince has benefited from the rising price of beef mince and diced beef, and despite lamb being the most expensive mince, volumes are increasing.

For the 12 weeks ending 28 December 2025, the price differential between lamb and beef mince was £1.91/kg, the lowest it has been over the last two years (Figure 4).

Lamb sous vide

In the 12 w/e 28 December 2025, there was an 11.8% increase in spend on sous vide lamb, a 3.8% increase in volume and a 7.6% increase in average prices.1

Figure 5. Average lamb and beef sous vide prices from 2023 to 2025

Source: Worldpanel by Numerator UK, 12 w/e 28 December 2025

The price differential between lamb and beef sous vide has narrowed to just £0.26/kg for the 12 weeks ending 28 December 2025 (Figure 5).

Despite rising prices in both supermarkets and discounters, supermarkets saw volume increases of 4.6%.

Promotional activity increased slightly, but not to the same extent as seen in other categories.

Lamb sous vide has benefited marginally from consumers switching away from beef sous vide.

With consumers prioritising convenience for their meal choices, and the average meal preparation time decreasing, items such as sous vide are becoming more popular.

Opportunities for retailers and meat suppliers

- Promoting lamb’s taste, health benefits and convenient product options will help continue to drive volume increases

- Targeting promotions on lower-performing cuts will help to increase sales, especially during seasonal celebrations when shoppers are more likely to treat themselves and trade up into lamb

- Leverage the price gap with beef. With beef price inflation unlikely to ease in the near future, lamb may be seen as better value, creating an opportunity to increase retail demand

1 Worldpanel by Numerator UK, 12 w/e 28 December 2025

*This article is based on Worldpanel by Numerator UK period 13 data release

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: