Premium products boost demand for cheese and yogurt

Tuesday, 4 November 2025

The British dairy market is experiencing change, shaped by evolving consumer preferences and a growing demand for products that deliver both quality and versatility. While overall dairy consumption faces headwinds, cheese and yogurt – especially in premium ranges – are experiencing stronger growth and offering opportunities for the sector.

Figure 1: Value and volume performance of yogurt, cheese and premium varieties

|

|

Value % change |

Volume % change |

|

Total dairy |

+8.2% |

-1.1% |

|

Yogurt |

+13.8% |

+7.0% |

|

Premium yogurt |

+34.2% |

+28.2% |

|

Cheese |

+6.5% |

+0.8% |

|

Premium cheese |

+9.8% |

+7.1% |

Source: NIQ Homescan POD, Cows dairy, 12 w/e 4 October 2025

Yogurt: Everyday luxury driving demand

Premium yogurt is making the move from being a niche expense to everyday indulgence, capturing the attention of British shoppers.

Figure 2: Key performance indicators for premium yogurt in the last year

|

Penetration |

Buyers |

Frequency of purchase |

Kilos per occasions |

|

29.9% |

8.8 million |

More than 8 times per year |

0.5kg |

|

+1.9ppt |

+7.6% |

+4.9% |

+7.4% |

Source: NIQ Homescan POD, 52 w/e 4 October 2025

For all key performance indicators, premium yogurt has seen growth year-on-year, not only attracting new shoppers to the category and encouraging greater volumes to be purchased per shopper, but also benefitting from switching gains from all other tiers of own label and branded varieties.

Promotional activity has supported this momentum, with 11% of volume sold on deal, though this remains significantly below branded yogurt levels. Price growth has been steady, rising slightly faster than branded alternatives, which suggests shoppers are willing to pay more for perceived quality and indulgence.

Yogurt at home consumption

In-home consumption patterns reinforce premium yogurt’s appeal. Breakfast and evening meals are the most significant occasions, accounting for 33% and 28% of all yogurt consumption respectively (Worldpanel by Numerator Usage, 52 w/e 23 February 2025). Consumers enjoy yogurt on average three times a week at breakfast. Its versatility is highlighted by frequent pairings with cereals, fruit, and nuts – over three-quarters of breakfast yogurt occasions involve such combinations.

At dinner, yogurt is more often consumed as part of the dessert course, though there is potential for growth in savoury applications such as sauces and dressings.

Health is one of the top reasons for choosing yogurt and gaining share of servings over the last five years, especially gut health variants. The category’s versatility, health benefits, and ability to pair with other foods position it as a staple for both breakfast and dinner, with opportunities for further innovation in product formats and meal integration.

Premium cheese: Quality and indulgence is key

Premium cheese has experienced a parallel surge in popularity and has been consistently gaining share.

Figure 3: Key performance indicators for premium cheese in the last year

|

Penetration |

Buyers |

Frequency of purchase |

Kilos per occasions |

|

51.0% |

15.0 million |

More than 6 times per year |

0.4kg |

|

+1.8ppt |

+4.4% |

+5.0% |

+0.4% |

Source: NIQ Homescan POD, 52 w/e 4 October 2025

Despite commanding on average an extra £3.36/kg compared to total own label cheese offerings, premium is appearing as better value to consumers. On average prices have increased by 0.6% compared to the same period last year, while total own label cheese has seen average price increases of 3.7% and branded cheese saw prices rise by 4.2% over the last year. This may be helping to boost demand and cement premium cheese as an everyday luxury.

Price changes in cheddar vary by tier and branded cheddar has seen the steepest price rises up 4.6% in the last year. In contrast, premium own label has seen a price reduction of 1.4% driven by an increase in promotional activity.

This has not gone unnoticed by consumers who have increased their purchase volumes of premium own-label cows' cheddar by a huge 20.5% in the last year whilst sales of branded cheddar have lost 4.7% year-on-year. Overall cheddar volumes have remained flat.

However, different cheese types have variable performance across different tiers.

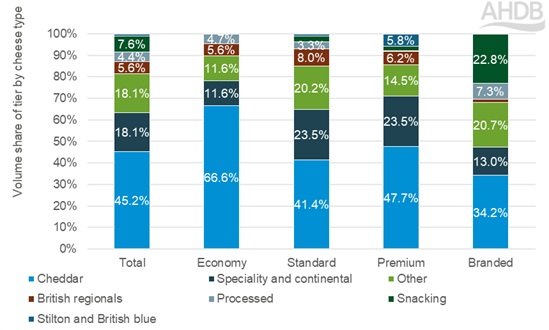

Figure 4: Volume share of tier by cheese type

Source: NIQ Homescan POD, 52 w/e 4 October 2025

This indicates that there may be opportunities to expand ranges to ensure there are options available for all budgets which could help boost overall demand particularly for areas which are less accessible to consumers on strict budgets where there are no economy options. It also provides trade up opportunities for processed and snacking options which don’t currently have more premium offerings.

Cheese at home consumption

Despite the success of premium, the broader cheese category faces challenges. Overall cheese consumption is in decline, with total occasions falling by 2.3% year-on-year and by nearly 12% compared to 2021 (Worldpanel by Numerator Usage, 52 w/e 15 June 2025).

Lunch and dinner are the heartland for cheese consumption, especially cows’ cheese, but breakfast and snacks are emerging as areas of growth, particularly for British regionals. The versatility of cheese is increasingly recognised, with consumers using it not only in traditional sandwiches and cooked dishes but also as part of breakfast spreads and snack platters.

This shift reflects broader changes in eating habits, with more people seeking convenient, protein-rich options throughout the day. Continental cheeses, led by mozzarella, are increasingly present at meals, while British regionals such as Wensleydale and Red Leicester are finding new opportunities at lunch and evening meals.

Declines in cheddar, and particularly branded cheddar, is further bad news for cheesemakers who are already facing falling commodity prices for mild cheddar (down to £3110/t in October) that has been made with expensive milk.

AHDB continue to support efforts towards building up exports for these products. Quarterly exports of cheese and curd recorded a five-year high at 52,300t in Q2 2025, which saw a notable increase to non-EU nations in some MENA countries (Algeria, Lebanon, Morocco, Saudia Arabia), Asian nations including China, Philippines, Hong Kong, and Canada. In terms of value, cheese exports were worth £246mn.

Opportunities for future demand

There are several opportunities which could boost demand going forwards:

- Innovate products: Meet evolving consumer needs, such as gut health variants and high-protein options through yogurt and cheese products and messaging

- Expand savoury applications: Explore growth in savoury uses for yogurt – sauces, dressings, and meal accompaniments to help boost relevance at lunch and dinner

- Emphasise health credentials: Highlight natural ingredients, probiotic benefits, and lower fat, salt, and sugar content to appeal to health-conscious shoppers

- Cater to all consumer budgets: Ensure that there are options available to cater to all consumer budgets for the wide range of British cheeses particularly where premium options are not currently available

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: