Premium red meat products outperform the market

Friday, 30 July 2021

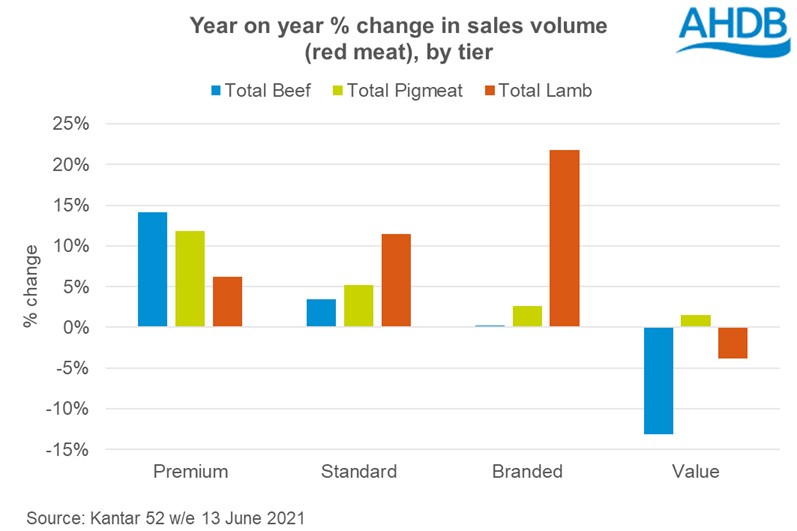

COVID-19 has spurred on retail meat sales, with numerous categories seeing growth since the start of the pandemic. Over the past year, premium private label sales have been well supported by consumers, with more people reaching for these products on shelves than the previous year. Although there’s been variation by red meat type, premium private label red meat has seen a 15% lift in spend, with a 12% growth in volume overall (Kantar, 52 w/e 13 June 2021).

This growth rate means that premium private label meat is growing faster than other tiers. Both standard private label and branded red meat products have also seen volume growth over the past year, lifting 5% and 2% respectively (Kantar, 52 w/e 13 June 2021).

by tier.png)

Despite large year-on-year growth, premium private label remains a small proportion of the total red meat market at 8.8%, with standard private label continuing to make up the majority of sales.

june.jpg)

Which proteins have seen an uplift in premium sales?

Looking at specific proteins, both beef (+14% in volume) and processed pork (+10% in volume) have been key contributors to premium private label’s positive performance (Kantar 52 w/e 13 June 2021).

For beef, an uplift in purchases of premium steaks and mince have driven this growth. Latest statistics show that consumers have been more likely to choose steaks as a treat occasion over the past year (Kantar Usage, 52 w/e 16 May 2021). Recent price promotions will also have enabled shoppers to trade into the premium tier (Kantar, 52 w/e 13 Jun 2021).

For pork, premium sliced ham has been a standout product over the past year. In-home lunches have seen a large increase in occasion, with many of us working from home and opting for sandwiches more regularly. Similarly, more cooked breakfasts and in-home evening meals have seen premium pork sausages being consumed more frequently, with taste being a key growth factor here (Kantar Usage, 52 w/e 16 May 2021).

What’s driving this growth?

According to the AHDB/YouGov Consumer Tracker, 17% of meat shoppers say that quality (e.g. premium/value) has become more important to them when buying meat compared to before the pandemic, whereas only 5% say it’s less important (May 2021).

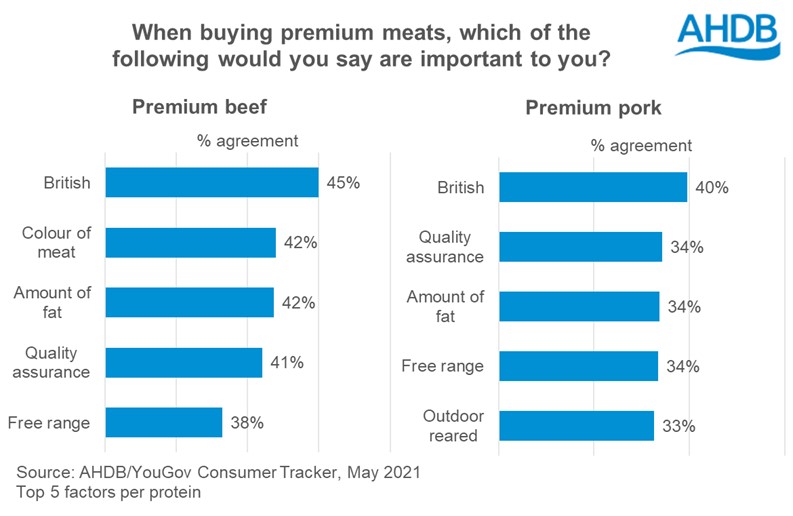

The same survey also showed that, when buying premium beef and pork, meat shoppers say that British origin is the most important factor, at 45% and 40% respectively. This is a statistically significant increase when compared to pre-pandemic, back in February 2020, which highlights the heightened support for British farming during the pandemic.

In addition to this, higher welfare aspects (e.g free range, outdoor bred) matter to shoppers. IGD research supports the notion that shoppers make the link between factors such as this and quality, with data showing that 27% of shoppers use ethical factors to help define a product as higher quality, while 26% also consider environmental factors (IGD Quality in Focus, 2019).

Looking at our previous research, we also know that taste is one of the most important factors consumers consider. As such, shoppers may look to trade up to premium products in store or online, on the basis that these products may taste better or be more enjoyable. Therefore, appearance of the meat, as well as taste cues on pack, are important considerations.

Overcoming the price challenge

We know that premium private label products are often more expensive than standard. For example, premium beef steaks are 50% more expensive on average per kg than its standard equivalent (Kantar, 52 w/e 13 June 2021). The factors mentioned above, relating to meat appearance, country of origin and higher welfare, are all key in getting shoppers to trade up.

However, tactical support is also key – premium private label has performed particularly well when included as part of promotions, which could enable trade up when the prices are closer to the standard alternative. Indeed, 66% of premium private label volume was sold via a price promotion in the 52 w/e 13 June 2021, up from 58% the year prior (Kantar, Meat, fish and poultry). By contrast, 38% of standard tier was sold on promotion, a year-on-year decline of three percentage points.

This information highlights the need for tactical price and promotion support for premium private label, as well as the need for a considered and strategic long-term focus on how to differentiate premium from other tiers and across retailers.