Quality, value and convenience key at Christmas

Monday, 17 February 2025

This Christmas total Meat Fish and Poultry (MFP) volumes remained flat versus Christmas 2023 but at an elevated level of +2.0% versus Christmas 2022 (Kantar 4 w/e 29 December 2024). Convenience, quality and value for money are key drivers of red meat purchasing throughout the year, but how much more do these factors impact sales in the busy Christmas period?

Quality

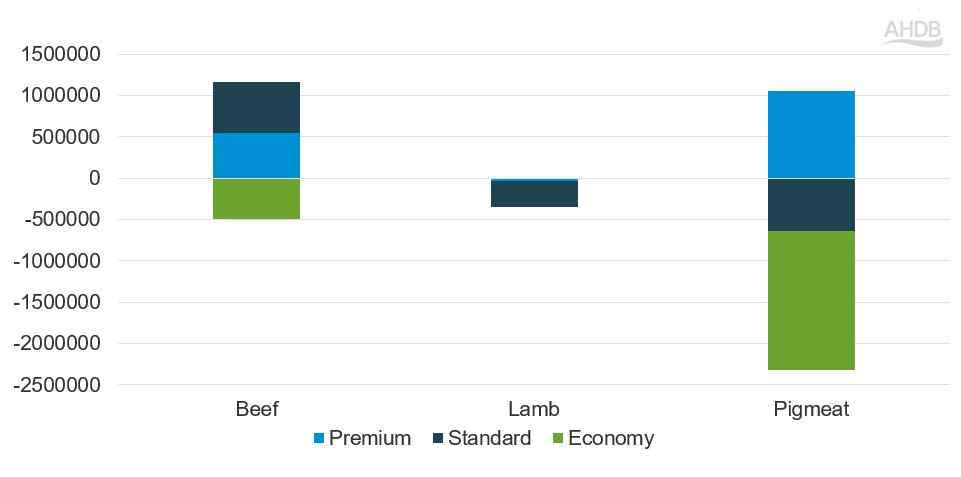

Prior to Christmas, 37% of consumers claimed that high quality products were important to their Christmas meat purchases (You Gov/AHDB Pulse November 2024). This desire for quality was seen as one of the key drivers to purchase this Christmas, with positive volume change year-on-year seen for premium offerings for both beef and pigmeat, outperforming offerings in the economy tier (Kantar 4 w/e 29 December 2024).

Contribution to volume change (Kg)

Source: Kantar 4 w/e 29 December 2024

Although the premium tier has had a positive performance throughout 2024, this growth was enhanced over Christmas, highlighting the importance for premium offerings in the festive period.

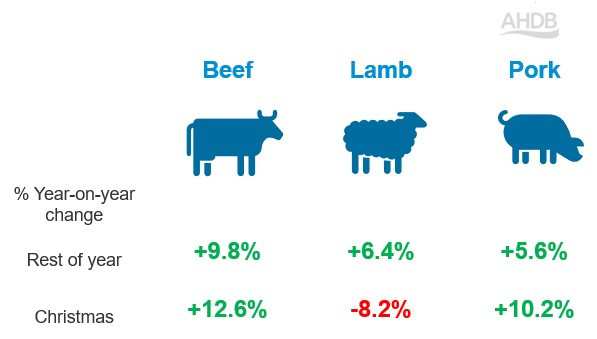

Percentage year-on-year change for premium tier volume

Source: Kantar Christmas 4 we 29 December 2024 | Rest of year 48 we 01 December 2024

When buying premium beef and pork meat, around 2 in 5 consumers state that buying British is the most important factor and that assurance around quality is important. For beef, visual factors such as the colour of the meat, the amount of fat and the level of marbling are important quality cues for premium meat (YouGov/AHDB Tracker November 2024). Quality messages have been seen to be key for red meat pack labelling and in-store point of sale communication.

Lamb, with higher market average prices per kilo in general (£10.45 vs £9.48 for beef, £7.53 for pork) already plays at the expensive end of meat offerings and as such the premium tier represented only 4% of volumes at Christmas this year (Kantar 4 w/e 29 December 2024).

For Christmas 2025, continued focus on the premium tier will be important, including premium own-label offerings allowing consumers to up trade to a treat at Christmas.

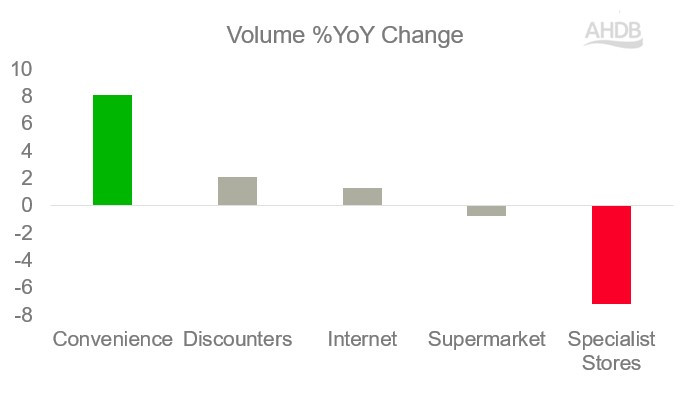

Convenience

Convenience, whether regarding shopping or cooking has played a part this Christmas. From a shopping perspective, convenient location is seen as the top performing driver of main store choice (IGD Shopper Tracker 01 December 2024) and this Christmas we saw the convenience channel growing 8.1% year-on-year, outperforming the growth of all other channels.

Channel volume change year-on-year

Source: Kantar 4 w/e 29 December 2024

In the run up to Christmas, 34% of consumers claimed they were going to avoid the supermarket chaos and utilise online retailers more for their Christmas food (IGD Shopper Vista 17 November 2024), and this translated into a +1.3% year-on year volume grown for this channel, with online grocery spend reaching a record £1.6bn, covering 5.6m households this Christmas (Kantar 4w/e 29 December 2024).

From a cooking perspective, prior to Christmas 26% of consumers claimed that meat that was easy to cook was important to them for their Christmas day purchases (You Gov/AHDB Pulse November 2024). This need for convenient cooking is illustrated by a +7.1% volume growth year-on-year for pre-prepared Pigs-in-Blankets, outperforming their individual components which declined in volume growth (Sausages -0.4%, Bacon -6.3%, Kantar 4 w/e 29 December 2024). Ready to cook beef steaks and ready to cook pork joints also saw positive year-on-year volume growth this Christmas (+72.9%, 17.5% respectively, Kantar 4 w/e 29 December 2024), suggesting that easy to cook solutions for the main event and meals in the run up to Christmas are key to consumers.

The trend for convenience is likely to continue through to Christmas 2025, with consumers attracted to meat offerings that are easy and quick to cook.

Value for money

Prior to Christmas, 38% of consumers claimed that good value for money was important to their Christmas meat purchases (You Gov/AHDB Pulse November 2024). Promotions are one means to deliver good value for money to consumers and this Christmas promotions have been instrumental in the growth or decline of different meat offerings.

Total pork volumes declined this Christmas by 2.1% year-on-year, driven by consumers primarily switching out of pork to chicken. This decline has been seen throughout 2024 and retailers increased share of pork volumes on promotion this Christmas by 2.1% in an attempt to stem this decline. This resulted in a +4.5% volume growth year-on-year for pork offerings on promotion (Kantar 4 w/e 29 December 2024), highlighting that promotions are one lever to pull in the effort to counteract switching to chicken.

Total beef volumes grew +0.8% year-on-year this Christmas. Promotions for beef were particularly important for lower social class consumers, with a +6.4% year-on-year growth in volumes sold on promotion for this group. Here promotions helped consumers manage their budgets through the Christmas period (Kantar 4 w/e 29 December 2024).

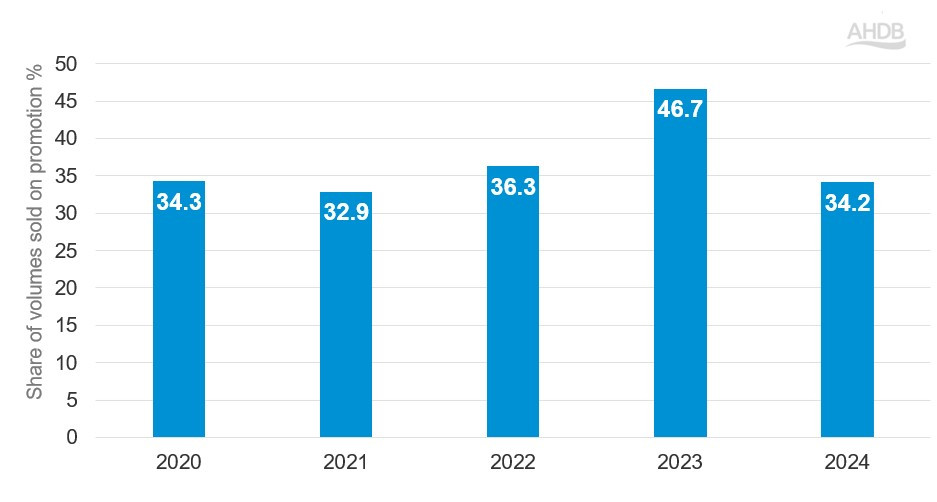

For lamb, Christmas 2023 was driven by promotions, with 46.7% of volumes sold on promotion. This Christmas, the share of volumes sold on promotion dropped to 34.2%, in line with earlier years, resulting in lamb volumes declining -2.8%. Despite this, lamb showed a strong performance versus 2022 (+8.2% volumes year-on-year Christmas 2024 vs Christmas 2022).

Percentage of lamb volumes sold on promotion at Christmas

Source: Kantar 4 w/e 3 January 2021, 2 January 2022, 1 January 2023, 31 December 2023, 29 December 2024.

Savvy shopping is likely to continue into 2025 and careful consideration of promotions will be key for Christmas 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.