Yogurt’s positive performance in-home highlights opportunities to push harder

Thursday, 17 July 2025

While in-home dairy consumption is declining across most categories, yogurt is bucking this trend due to its versatility and appeal to all ages.

In-home meals and moments are integral for dairy, with around 96% of all occasions happening within the home.

However, dairy consumption has seen a longer-term decline, and in the last year it has seen a loss of 779 million occasions (Worldpanel by Numerator, 52 w/e 23 February 2025) – a steeper decline than total food and drink.

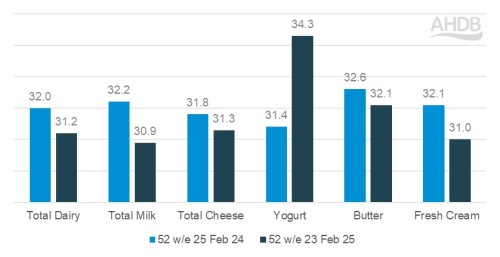

However, this is not the case for yogurt, which features in 34% of in-home occasions, up 3 ppt versus last year.

As supported by Nielsen, the volume growth in retail sales of yogurt, yogurt drinks and fromage frais is being driven by cow’s dairy up +6% versus plant-based at 5% year-on-year.

Cow’s dairy accounts for 97% of all yogurt volume sold (Nielsen, 52 w/e 14 June 2025).

Percentage (%) of occasions year-on-year for dairy and dairy categories

Source: Worldpanel by Numerator, 52 w/e 23 February 2025)

So, what has driven this positive performance for yogurt and what are the opportunities?

Drivers of increased in-home yogurt consumption

The variety of the yogurt category

The yogurt category has a wide range of products, with nearly all types contributing to yogurt’s overall growth within the home in the last year according to Worldpanel by Numerator.

Everyday yogurts are seeing the fastest consumption increase, which is unsurprising due to financial pressures many consumers are under, making it an affordable yogurt option to buy in to.

Also in growth are natural and Greek style, active health, drinks and flavoured, playing into a variety of needs, including taste, naturalness and nutrition.

In comparison, children are consuming less 'kid’s' yogurts; they are instead eating standard 'adult' yogurts, such as everyday and natural.

This could be a shift to more affordable and healthier alternatives as parents reassess their children’s diets.

Appeals to all ages

Encouragingly, all age groups are contributing to yogurt consumption growth, with those aged 16–24 growing the fastest but those aged 65+ consuming the most.

This is because the yogurt category over-indexes versus total dairy in the older age range (35+), whereas it under-indexes in younger (34 and under), highlighting an opportunity to push further with the younger consumer.

Meets a number of consumer needs

According to Worldpanel by Numerator, the more needs a product meets, the more consumers are willing to pay for the product.

For yogurt, 63% of servings are chosen for enjoyment reasons, 32% for the health benefits and 17% to make a meal complete (Worldpanel by Numerator, 52 w/e 23 February 2025).

For these three needs, cow’s dairy has an advantage over plant-based dairy, which should be highlighted.

Positively, Worldpanel by Numerator report that the number of cow dairy yogurt servings chosen for health reasons has increased by 8.6% year-on-year (conversely for plant based, it has declined -4% year-on-year).

Overall, 8 in 10 consumers agree dairy products are an important part of a balanced, healthy diet (AHDB/You Gov Tracker, May 2025).

Therefore, a growing focus on health poses an opportunity for dairy to reassure on its benefits in terms of vitamins, protein and probiotics/gut health, but it is also a potential threat.

Increased noise around processed food has resulted in 62% of consumers claiming that concerns around highly processed foods have caused them to look more closely at ingredients in yogurt products (Mintel, Yogurt and Yogurt Drinks – UK – 2024).

Coupled with this, according to Mintel, 40% of consumers neither agree nor disagree that yogurts are a good choice when looking to avoid processed food, showing some potential confusion here about processing.

There is an opportunity to educate consumers on the natural credentials of plain yogurts.

The number of cow dairy yogurt servings chosen for enjoyment has declined 2% ppt year-on-year and because it "makes a meal complete" by 4% ppt (Worldpanel by Numerator, 52 w/e 23 February 2025).

An opportunity lies in reminding consumers about the great taste of yogurt, whether that be as a stand-alone product or as part of a meal, which we go into in more detail next.

Outside of these top three needs, another opportunity lies in dialling up yogurt’s convenience credentials as this becomes more important to the consumer.

Winning at breakfast

Breakfast is the most popular meal of the day for yogurt, according to Worldpanel by Numerator, accounting for 33% of yogurt occasions, and seeing an increase of 24% year-on-year (Worldpanel by Numerator, 52 w/e 23 February 2025).

While yogurt is becoming more relevant at this time of day, likely driven by the health reasons mentioned above (and in more detail in our analysis of consumers demand for natural, high protein dairy products), there is an opportunity to increase frequency further (currently chosen 3x a week at breakfast on average).

Highlighting pairings such as cereals, fruits and nuts, overnight oats, pancakes and on-the-go pots will showcase versatility.

Conversely, yogurt usage at dinner time (28% of yogurt occasions) has declined over time; 78% of yogurt occasions at the evening meal are for dessert.

As consumer needs for dessert likely differ during the week, i.e. health versus treat, there are a number of ways to position dessert yogurts.

While taste is important for all occasions, when thinking about treating specifically, utilise descriptive words such as think, smooth, delicious and creamy, and communicate yogurt’s synergy with other sweet items such as fruit, cake and honey.

The remainder of yogurt occasions at the evening meal are for mains, with chicken dishes being the primary type of food that yogurt is associated with at this occasion.

An opportunity lies in growing yogurt’s presence as an ingredient; for example, according to Worldpanel by Numerator, when we put yogurt in a curry, we tick more consumer needs than a curry without (it gives extra taste, variety and naturalness benefit). This is even true when we cheat on the prep and use a jar of curry.

Therefore, communicate meal ideas that integrate yogurt more seamlessly into dinner dishes.

Coupled with this, develop yogurt products specifically designed for dinner occasions, such as savoury yogurts or yogurt-based sauces and dressings, to enhance its compatibility alongside evening meals.

Opportunities to accelerate in-home relevance for yogurt:

- Ensure the added value of eating and using yogurt in meals is clear – communicate taste, health and versatility

- Encourage topping varieties and the use of yogurt as an ingredient, as well as a stand-alone dish

- Play on texture communication (thickness) and descriptive words (such as creamy) to encourage dessert consumption

- Educate on the health benefits of yogurt, for example via vitamin, protein and gut health messaging

- Due to the growing focus on processed foods, reassure that yogurt is a natural product with clear and transparent labelling

- Adapt to the rising trend for convenience by communicating yogurt’s advantage here, for example through portable snacks

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.