Cull ewe prices continue to fly: sheep market update

Thursday, 10 July 2025

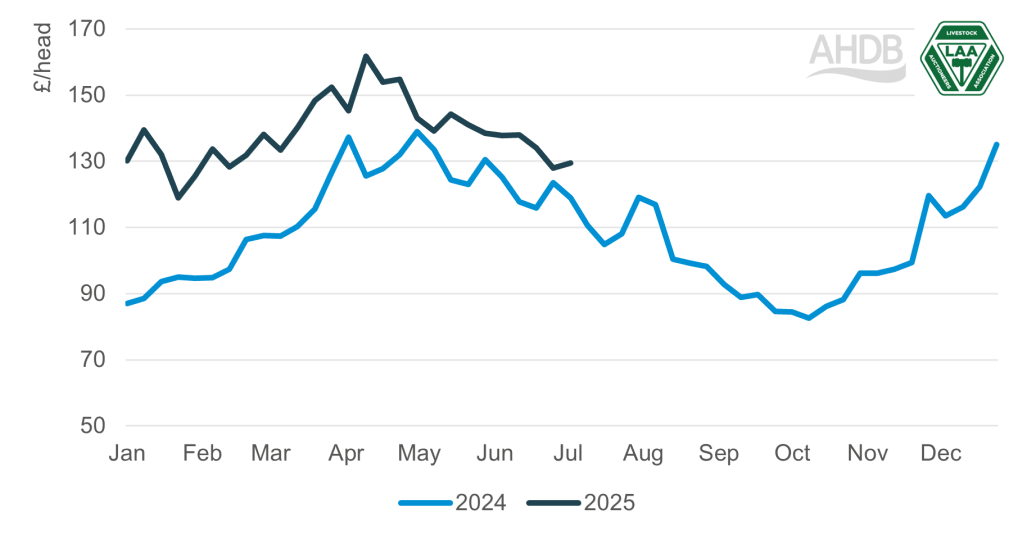

Unlike both old season and new season lamb, cull ewe prices have consistently remained above 2024 prices so far this year. This article explores the supply and demand factors behind the strong cull ewe trade.

Key points:

- LAA data shows that average cull ewe prices in England & Wales stood at £129.40/head for the week ending 6 July, up £11 year-on-year.

- Defra report adult sheep slaughter to be just under 530 thousand head for the year-to-date (Jan-May), down 7% on the year.

- The majority of product from adult sheep (mutton) is sold to specialist markets, such as Halal butchery or into foodservice – both of which experienced growth in 2024.

- For the first half of 2025, lamb consumption in the foodservice sector has shown steady performance year-on-year.

Whilst the lamb price has not experienced the same peaks that were seen last year, the cull ewe trade has remained exceptionally strong throughout 2025. The average England & Wales liveweight cull ewe price was £11/head up year-on-year for the week ending 6 July, standing at £129.40/head.

England & Wales liveweight cull ewe price (£/head)

Source: LAA

© Livestock Auctioneers Association Limited 2025. All rights reserved.

Supply

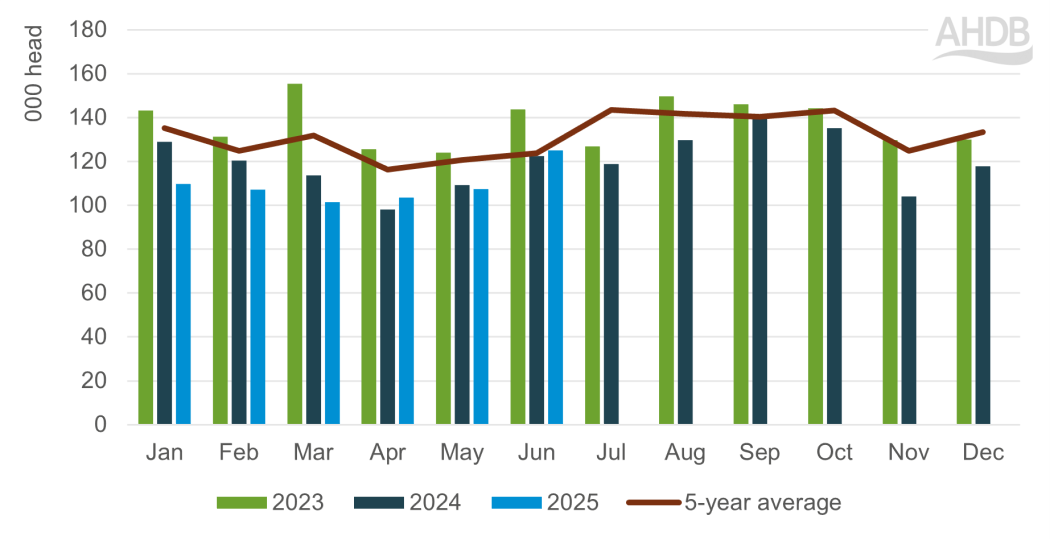

One of the main drivers for this strength in cull ewe prices has been on the supply side, as ewe throughputs have declined so far in 2025. Figures from the LAA show that cull ewe auction throughputs in England & Wales were down 12% year-on-year up to the week ending 6 July. Numbers appeared to peak in early July ahead of Qurbani festival but were still substantially lower year-on-year. More widely, Defra report that UK adult sheep slaughter (ewes and rams) stood at just under 654,000 head for the first six months of the year, down 6% annually and down 13% from the five-year average for the period.

Monthly UK adult sheep slaughter patterns

Source: Defra

Some of this supply tightness was to be anticipated as sheep populations have contracted across the UK. Indeed, according to Defra census figures, the UK breeding ewe population stood at 13.1 million head on 1 December 2024, down by 5% from the year before.

However, for the first quarter of the year adult sheep slaughter was below forecasts even when considering these lower populations, with Q1 adult sheep slaughter down by 12% on the year. Slaughter numbers have picked up in the past couple of months, rising 2% from March to April, and a further 5% from April to May, as per seasonal trends.

Demand

Another factor behind strong cull ewe prices is robust demand. The majority of product from adult sheep (mutton) is sold to specialist markets, such as halal butchery or into foodservice.

Sheep meat volume sales in foodservice saw significant growth in 2024, increasing by 12.6% on the year (52 weeks ending 29 December, AHDB estimates using Kantar out of home). An extra 1.4 million tonnes of sheep meat was sold as kebabs and an additional 0.5 million tonnes was sold through Indian restaurants compared to 2023.

Kantar data shows that demand for lamb in foodservice is persisting at this elevated level, with overall volumes steady versus 2024 for the first six months of the year and adding support to the market.

Despite only being a small fraction of the British population, the halal market is incredibly dynamic, making up 30% of lamb volume sales in 2024.

AHDB research has found that 57% of consumers purchasing halal meat prefer to do so from a specialist butcher and the average halal consumer purchased 2.9 cuts of mutton a week in 2024 compared to 3.7 cuts of lamb, indicating that mutton is still a significant part of the diet – and going some way to explaining the seemingly strong demand for cull sheep.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.