Economic outlook – February 2025

Tuesday, 28 January 2025

With global unrest continuing and Trump’s return to the Oval Office, what are the implications for the UK economy in 2025?

Overview

At the time of writing, global headwinds coming from the USA are threatening to fuel inflation via increased tariffs imposed by the USA. These headwinds are affecting bond markets across Europe, but here in the UK, they have hit harder. There were already concerns that inflation was not dropping as fast as had been envisaged and growth was stagnant and below forecast in the UK. With bond yields rising, this drives up the cost of borrowing for the Government and has all but removed any fiscal headroom for the Chancellor and her spending plans, thus raising the possibility of spending cuts and/or tax rises for the UK.

This does not help the prospects for economic growth in the UK. It also further damages business confidence, which was already low due to rises in National Insurance and workers’ rights, driving up the cost of doing business.

The Government feels that most of the issues have been caused by the fiscal black hole left by the outgoing administration. Economic growth was identified as the number-one focus for the new government as this would increase tax income and help stabilise the economy, but with growth faltering, the outlook for 2025 is looking less positive.

Economic growth

Economic growth is the stated number-one objective for the Government, which is focused on economic growth in order to help it manage the increasing cost of its borrowing, made worse at the time of writing by recent rises in bond yields.

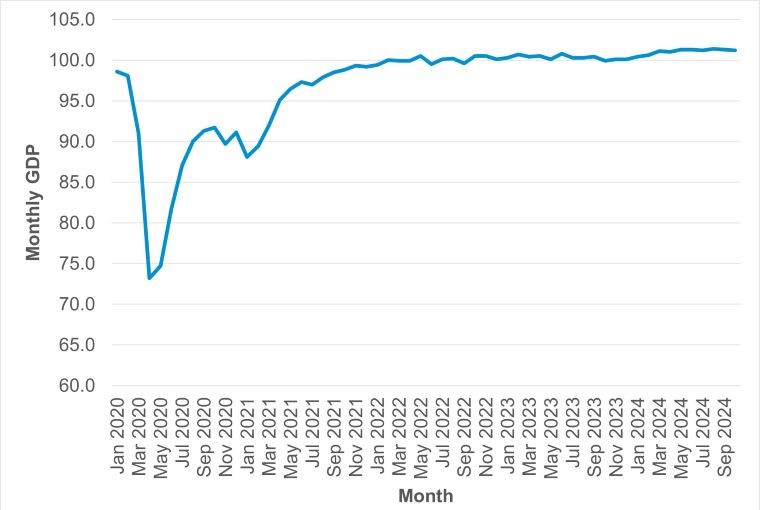

Figure 1 shows that Gross Domestic Product (GDP) growth is currently lacklustre, around 1% per annum, which is below the long-term trend. Monthly real GDP is estimated to have fallen by 0.1% in October 2024, largely because of a decline in production output; this follows a fall of 0.1% in September 2024.

Real GDP is estimated to have grown by 0.1% in the three months leading up to October 2024, compared with the three months preceding July 2024, with growth in the services and construction sectors in this period.

Figure 1. Monthly GDP growth (%)

Source: The Office of National Statistics (ONS)

Inflation

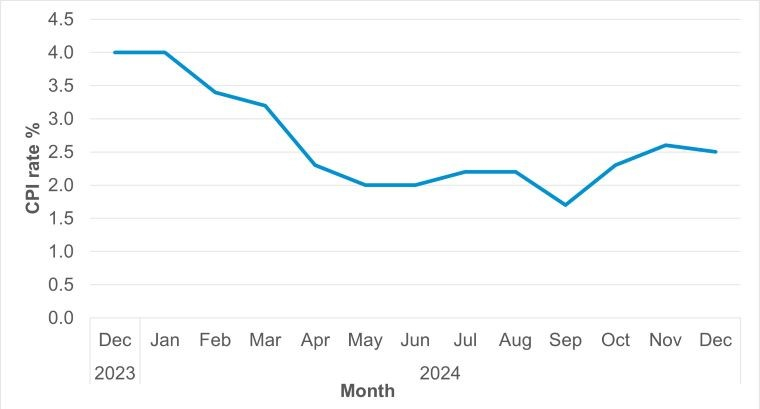

Inflation had a major influence on the UK economy in 2023 and 2024, driven by the war in Ukraine, supply chain issues and housing costs. It is now falling, but not as fast as some forecasters had envisaged. The Consumer Prices Index (CPI) rose by 2.5% in the 12 months to December 2024, down from 2.6% in the 12 months to November. On a monthly basis, CPI rose by 0.3% in December 2024, down from 0.4% in December 2023.

A fall in inflation does not mean prices are falling back to their pre-2023 level, just that the rate of increase is slowing. Prices are still high for consumers, and food prices were one of the sectors most affected during 2023 and 2024. The cost of living is still an issue for consumers and is likely to remain so throughout 2025.

With inflation gradually returning to more normal levels, and closer to the Bank of England’s 2% target, it increases the possibility of an interest rate cut in spring 2025. This would give the economy a much-needed boost by lowering borrowing costs and encouraging spending and investment.

Figure 2. CPI inflation (%) Dec 2023 to Dec 2024

Source: ONS

Exchange rates

Sterling is currently dropping in value against both the dollar and the euro, driven by concerns about the UK’s economy as the cost of government borrowing in the UK continues to rise.

Sterling is currently at its lowest level since November 2023.

The surge in bond yields originated from the USA due to concerns about rising inflation and lower chances of rate cuts from the Federal Reserve. If interest rates remain high in the USA, in contrast to an anticipated reduction in interest rates in the UK, the dollar will stay relatively strong going forward. However, the markets are extremely volatile at the moment.

Weaker sterling does have advantages for UK exports, making them cheaper on global markets.

Employment

Employment rate

In August to October 2024, the employment rate for people aged 16 to 64 was 74.9%. This is similar to the previous year but higher than the previous quarter. The unemployment rate for people aged 16 and over was 4.3% in August to October 2024. This is higher than the previous year and higher than the previous quarter.

In August to October 2024, average earnings increased by 5.2% for both regular and total earnings.

The cost to employers of employing staff is increasing, with National Insurance rates rising in April 2025.

Rising wages and the rising cost of employing workers will increase the cost of production for businesses. This is of concern as it means businesses either have to raise prices, thus driving inflation, or reduce profits, which is a disincentive to produce and dampens economic growth.

In addition to this, there is an increasing number of workers on long-term sickness benefit. Many commentators feel this is an after-effect of Covid, with Long Covid and long-term health issues playing a part. Others feel that generous sickness benefits may incentivise sick leave. Whatever the driver for this phenomenon, the effect is a drag on the economy with the additional tax burden of supporting those unable to work.

Summary

At the time of writing, Trump has completed his first week back in the Oval Office and a fragile peace has emerged in Gaza. Here in the UK, the Chancellor has reiterated the focus on economic growth for the UK.

The outlook for the UK economy is for slow growth, a gradual reduction in interest rates, dependent on inflation rates and a slightly less volatile look to the economy than the past few years. However, much depends on the actions of the new US administration and the knock-on effects they may have on the UK economy.

The situation will be monitored and reported on at AHDB throughout 2025, in particular, the trade aspects for our key sectors.