Economic outlook – February 2026

Tuesday, 27 January 2026

As economic growth continues to be subdued amid a climate of ongoing global uncertainty, what could 2026 look like for the UK economy?

Overview

- UK economic growth continues to be subdued, with persistent geopolitical uncertainty an ongoing challenge

- Inflation is expected to ease gradually in 2026 and interest rates are expected to continue a downward trajectory

- Household incomes are expected to remain tight, with low levels of shopper confidence expected to impact on food and grocery consumption

- The wider economy will also impact decision-making by farmers and other businesses in the supply chain. Here, low levels of farm business confidence are expected to limit investment

The 2026 economic outlook sets the context for the sectoral outlooks. It draws on evidence from the Office for Budget Responsibility (OBR) and other sources, and focuses on the implications for agriculture.

Economic growth and sector impact

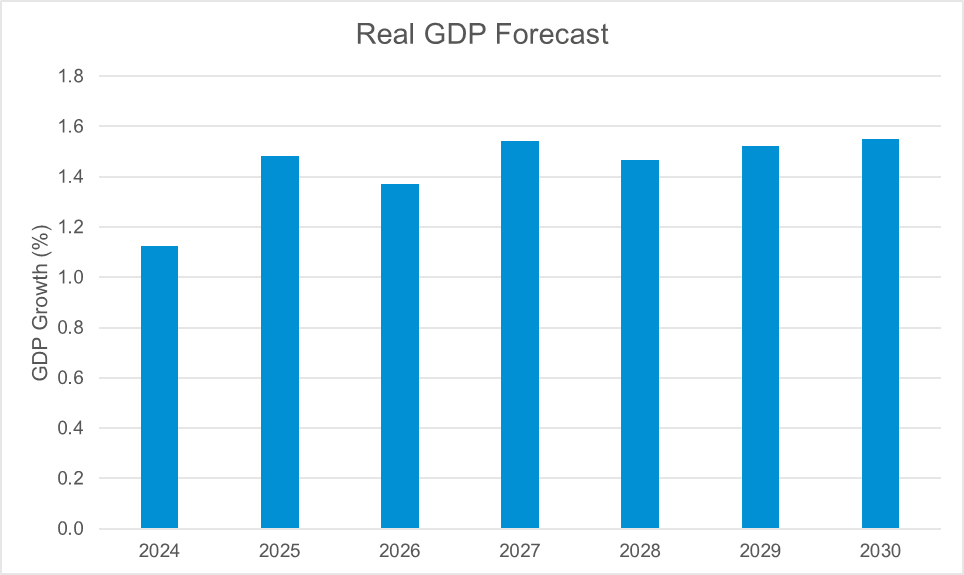

UK Gross Domestic Product (GDP) growth is estimated at 1.5% for 2025, with only modest improvement expected in the near term. Persistent geopolitical uncertainty and subdued business confidence will weigh on investment decisions across the economy. For agriculture, this means slower demand growth domestically and continued pressure on margins.

GDP growth is expected to remain around 1.4% for 2026, a downward revision from earlier OBR forecasts, signaling a tougher environment for farm businesses reliant on consumer spending and export markets.

Higher food inflation and frozen tax thresholds will further squeeze household budgets, influencing purchasing patterns for food and drink.

Figure 1. OBR GDP forecast – November 2025

Source: OBR Outlook November 2025

Inflation and input costs

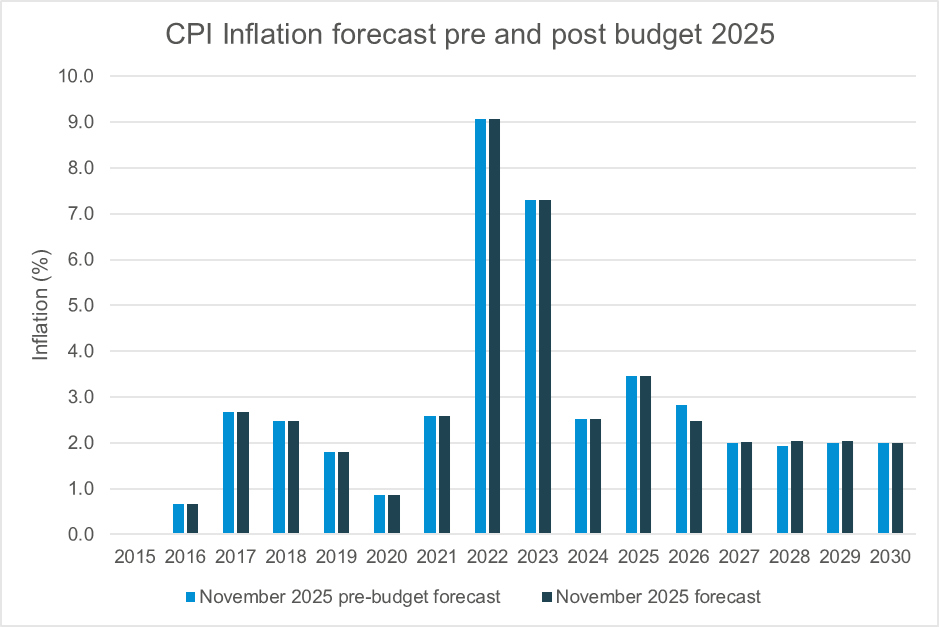

The Consumer Price Index (CPI) inflation is projected at 3.5% in 2025, easing to 2.5% in 2026 before returning to the Bank of England’s 2% target in 2027. If correct, this means that interest rates may be reduced, albeit gradually, which will be helpful for at least some borrowers and will help to support demand.

While headline inflation moderates, agricultural businesses will continue to face elevated input costs, particularly for energy, fertiliser and feed. These pressures will erode profitability even as consumer prices stabilise, creating a lag between cost relief and margin recovery.

Figure 2. Pre- and post-Budget 2025 CPI inflation forecasts

Source: OBR Outlook November 2025

IGD forecasts that retail food inflation will remain above the general level of inflation, but will decline slowly from an average of about 4.3% in 2025 to 3.8% in 2026 and 3.3% in 2027.

They estimate that around 30–40% of inflation pressure in 2026 will be a result of government policy interventions (especially around labour), with the rest coming from market forces.

Key cost pressures include the National Living Wage (NLW) for adults, which will increase from £12.21 to £12.71 per hour, up 4.1%, and the minimum wages for adults under 21, which will also rise sharply.

Real disposable income and food demand

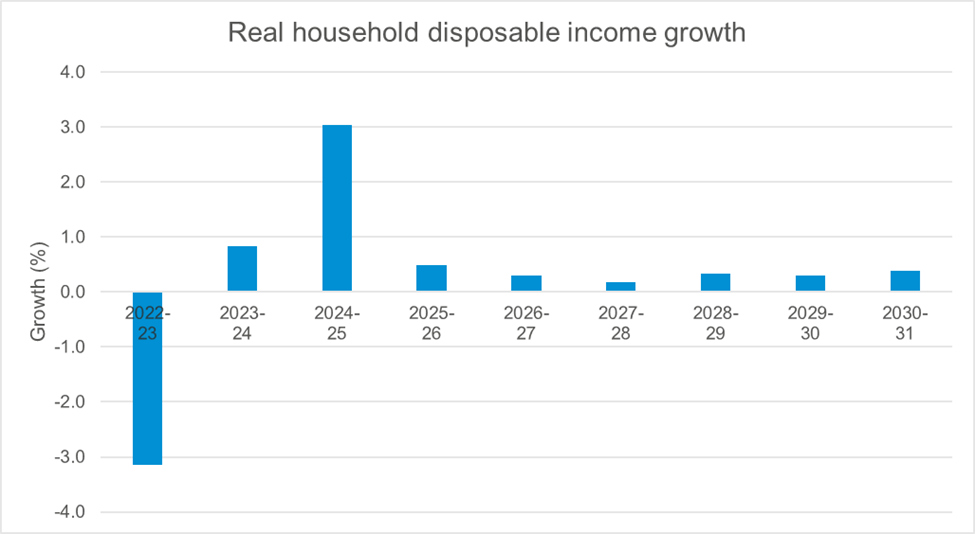

Growth in real household disposable income is expected to fall sharply – from 3% in 2024/25 to just 0.25% per year in 2026. This slowdown, driven by weaker wage growth and higher taxes, will constrain consumer spending on food.

Shoppers are likely to trade down to cheaper products, increase price sensitivity and reduce discretionary purchases such as premium cuts or organic produce.

Figure 3. Real household disposable income growth

Source: OBR Outlook November 2025

While the IGD outlook suggests that inflation will have the biggest impact on consumer sentiment, higher taxes will add further pressure to household incomes in 2026.

Living standards will remain under pressure, with real household disposable income per person expected to stay below pre-pandemic levels. With income tax thresholds frozen until 2031, wage growth will push more people into higher tax brackets, hitting middle- and higher-income groups hardest.

With fiscal tightening set to continue and external shocks ever present, confidence is expected to remain muted as household incomes remain static. Shopper confidence is expected to remain fragile, with more consumers planning to cut back on food and grocery and away-from-home spending in 2026.

Labour market and farm employment

Unemployment is forecast to hover around 5%, falling to 4.1% by 2027, while employment rates remain stable. In the Bank of England's Monetary Policy Report, it anticipates that pay growth is expected to ease in 2026, reflecting continued disinflation and slack in the labour market.

Nominal weekly earnings growth will slow from 5% in 2025 to 3.5% in 2026, limiting wage-driven demand for higher-value food products.

For farm businesses, rising labour costs driven by minimum wage increases and higher National Insurance contributions will continue to challenge profitability, especially in labour-intensive sectors like horticulture.

New obligations in the Employment Rights Bill begin to take effect, while tighter immigration rules will reduce access to labour and skills.

Farm business outlook

Business profits across the wider economy are projected to dip in 2026 before recovering later in the forecast period.

For agriculture, however, the outlook remains more constrained. The Andersons Centre forecasts Total Income from Farming (TIFF) to fall by £1.19 billion to £6.48 billion in 2026, driven by a combination of weak commodity prices, rising fertiliser costs and the erosion of support payments through inflation.

While TIFF would remain close to its long-term average, the prevailing mood in the sector is distinctly cautious. Many farm businesses are prioritising cost control over investment, a response that risks delaying productivity improvements and ultimately undermining long-term competitiveness.

This caution reflects a succession of challenges faced by farmers in recent years. These include the ongoing reduction in Direct Payments, uncertainty around access to environmental schemes, rising employment costs and concerns associated with inheritance tax reforms – despite the subsequent change to original proposals increasing the threshold of allowances before tax is due.

These pressures sit alongside ongoing exposure to volatile markets and increasingly challenging weather conditions, resulting in varied performance outcomes across AHDB sectors. Heightened geopolitical uncertainty, and agriculture’s reliance on global commodity markets, has further weakened business confidence.

In this environment, farm business investment is likely to remain subdued, even as interest rates begin to ease and the cost of borrowing falls.

Owner-occupied farm businesses continue to be viewed relatively favourably by lenders due to the strength of their underlying asset base, meaning credit availability is not expected to tighten uniformly across the sector.

However, lending decisions are increasingly influenced by cashflow performance and confidence in future profitability, rather than asset values alone. While money is becoming cheaper, access to finance is becoming more conditional.

Banks are placing greater emphasis on demonstrable profitability, resilience and, in some cases, sustainability credentials, with preferential lending rates offered to businesses perceived as lower risk over the medium to long term.

For primary producers facing sustained low profitability, this shift in lending criteria risks reinforcing a downward cycle. Weaker margins constrain access to capital, limiting investment in productivity and efficiency improvements.

Alongside these dynamics, sentiment across the agricultural sector remains cautious, reflecting the scale and breadth of policy development underway across multiple areas.

A number of industry strategies, delivery plans and regulatory frameworks are expected to emerge over the coming year, contributing to a period of transition rather than a settled policy environment.

While individual policy objectives are becoming clearer in isolation, the overall direction of travel and how different initiatives will interact at farm level is still evolving.

This has contributed to a more reserved outlook among producers, with business planning and investment decisions shaped by a need to retain flexibility until greater clarity and alignment across policy areas is established.