- Home

- News

- Forecast update: How many prime cattle and lambs are available to kill in the coming months?

Forecast update: How many prime cattle and lambs are available to kill in the coming months?

Thursday, 2 April 2020

By Rebecca Wright

In December AHDB released its forecasts for cattle and sheep production. Since then the market has changed dramatically with much of Europe now in ‘lockdown’ due to coronavirus. Sheep prices have come under pressure with a lack of demand both domestically and in Europe, and the cattle industry is struggling with carcase balance.

Prime cattle

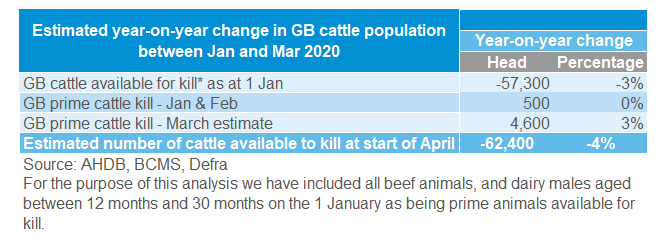

At 1 January 2020 the GB prime cattle population was smaller year-on-year, with the number of animals available for kill in the short term* lower than year earlier levels by around 57,300 head (-3%). Looking at supplies further ahead, the number of calves was also down.

Three months on, how might cattle population numbers look, and what might that mean for the kill in the coming months?

For January and February, Defra kill data is available. This tells us that during those months just over 274,000 prime cattle came forwards, slightly more than during those same months in 2019. March kill data from Defra is not yet available, however we can use AHDB estimated slaughter as a guide, and that indicates that the kill in March was also higher year-on-year.

This now means that numbers on the ground are estimated to be just over 62,000 head lower year-on-year. All other things being equal, this one would imply a drop in prime kill, and a tightening of supply in the coming months. However, it is not quite as straightforward as that. We don’t know the age of the cattle on the ground now nor can we be sure of their level of finish. Any changes in the size of the suckler herd will also have an impact on the forecast kill figure; if more replacements are taken this would put kill numbers under further pressure. If the herd contracts, then kill numbers could be supported.

*For the purpose of this analysis we have included all beef animals, and dairy males aged between 12 months and 30 months on the 1 January as being prime animals available for kill.

Lambs

There is a lot less data available on lambs. Using the AHDB forecast model, there were an estimated 12.9 million lambs available for kill from the 2019 lamb crop. Up until the end of Feb, 10.8 million of those lambs had already came forward, according to Defra data. In March, again using the AHDB estimated slaughter, just shy of 900,000 head came forward, of which the vast majority were hoggets from the 2019 lamb crop. If the original estimate of lambs available for kill is correct, this leaves 1.2 million hoggets to come forward in April and May. This would be in-line with historic averages for the time of year.

The total kill for April and May will include new season lambs, which are not accounted for in the 1.2 million head above. This number is usually relatively small at around 650,000 head over these two months, with the vast majority of them coming forwards in May.

There are of course risks around these forecast figures. They do not take into account any changes in behaviour due to current price levels. In response to the large drop in price last Monday, some farmers have suggested they will keep some ewe hoggets on-farm and run them with the ram this autumn. This would of course have a knock on impact to the 2021/22 lamb marketing year.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: