- Home

- News

- Limited continental supply underpins store cattle prices through autumn: Beef market update

Limited continental supply underpins store cattle prices through autumn: Beef market update

Friday, 31 October 2025

A strong start to autumn trading has kept the store market buoyant, with younger cattle showing particular strength against a backdrop of limited supply.

Key points

- The average price for 12–18-month-old native steers in England & Wales (E&W) reached a new record of £1,556/head in the week ending 19 October, following a period of steady growth.

- Most other price points for store cattle peaked in April, however current levels are still markedly higher year-on-year.

- Continental steer and heifer throughput is significantly lower so far this year: -14% for 12-18-month-olds and -13% for 18–24-month-olds (year to week ending 26 October).

- Store cattle price inflation continues to outpace that of finished cattle. Store steer prices currently +40-50% year-on-year, versus the overall deadweight average at +26%, keeping store-to-deadweight pressure firmly in focus.

18–24-month-old stores

Average prices in the 18–24-month-old store category remain back from peaks reached in April, in line with steadier deadweight values since late Q2 where 4-week average prices for store steers stood at £1,730/head and £1,937/head for native and continental steers respectively.

Even so, current store prices remain significantly up on the year across continental and native types. Values are up 44-45% on average compared to the same point last year, reflecting a structurally tighter supply of cattle and ongoing competition for forward stores.

Average prices for 18-24-month-old stores, week ending 26 October:

- £1,732/head for native steers

- £1,495/head for native heifers

- £1,953/head for continental steers

- £1,720/head for continental heifers

Weekly England & Wales average store steer prices 18-24 months

Source: LAA, AHDB

12-18-month-old stores

The 12–18-month-old store market shows a more resilient tone heading into the final quarter of the year. Most categories saw average prices peak in April, but 12-to-18-month-old native steers reached a new high of £1,556/head in the week ending 19 October. This potentially highlights renewed competition for longer-keep cattle as finishers seek to secure 2026 supplies. Continental and native heifer prices also remain firm on the year, averaging 40-50% above where they were a year ago.

Average prices for 12-18-month-old stores, week ending 26 October:

- £1,511/head for native steers

- £1,249/head for native heifers

- £1,734/head for continental steers

- £1,586/head for continental heifers

Weekly England & Wales average store steer prices 12-18 months

Source: LAA, AHDB

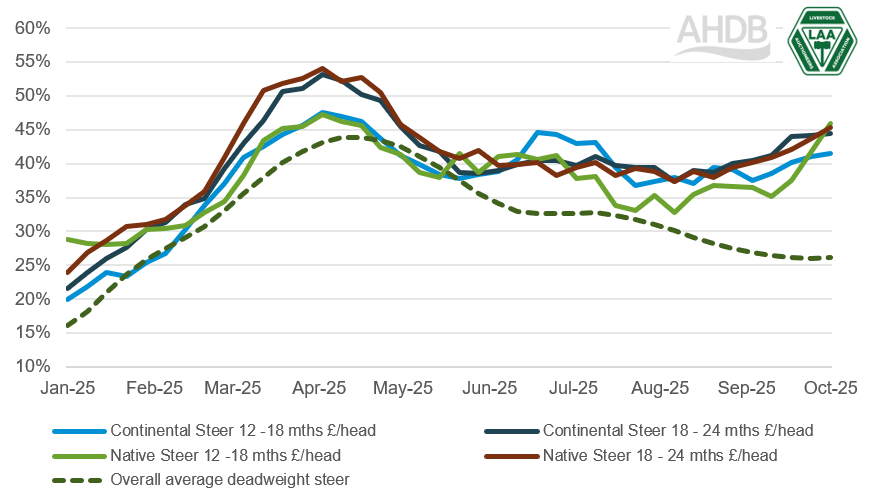

Store versus deadweight price inflation

Relative price inflation continues to be more pronounced in the store market. 4-week average prices up to the week ending 26 October were approximately 40–50% higher year-on-year, compared with 26% for deadweight steers (week ending 25 October). This widening differential highlights ongoing margin pressure for finishers unless counterbalanced by improvements in growth rates, carcase weights, or future price expectations.

The lead-lag relationship seen earlier in the year, where store prices peaked several weeks ahead of finished values, has persisted through the autumn, with store inflation maintaining a stronger trajectory. This pattern reflects a combination of lower availability and a favourable feed price outlook.

Comparing year-on-year price inflation for store and finished cattle; average store steer prices vs overall average deadweight steer price for England & Wales

Source: LAA, AHDB. Prices are 4-week averages.

Throughput

Throughput of continental steers up to the week ending 26 October was around 14% lower for 12–18-month-old animals and 13% lower for 18–24-month-olds compared with the same point in 2024. Native breed throughputs are closer to year-ago levels, with year-to date throughput of 12-18-month-old steers and heifers down 2% and 6% year-on-year respectively.

The reduction in marketings, particularly in continental breeds is likely helping to underpin store prices and reflects trends in calf registrations.

Store throughput figures for the dairy steers are also of note with year-to-date 12-18-month-old and 18-24-month-old stores down 19% and 21% respectively compared to the same point in 2024. This is likely in part reflective of the increased use of sexed semen within the dairy herd.

© Livestock Auctioneers Association Limited 2025. All rights reserved.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: