What the UK Global Tariffs mean for Dairy

Thursday, 11 June 2020

By Kat Jack

In late May the UK government announced the new Most Favoured Nation (MFN) tariff regime – the UK Global Tariff (UKGT). These tariffs are due to come into force on the 1 January 2021, the day after the Brexit transition period ends. These tariffs would apply to all countries not covered by a trade deal or an agreed Tariff Rate Quota (TRQ) with the UK. There is the potential for these tariffs to be reduced in the future, should the need arise.

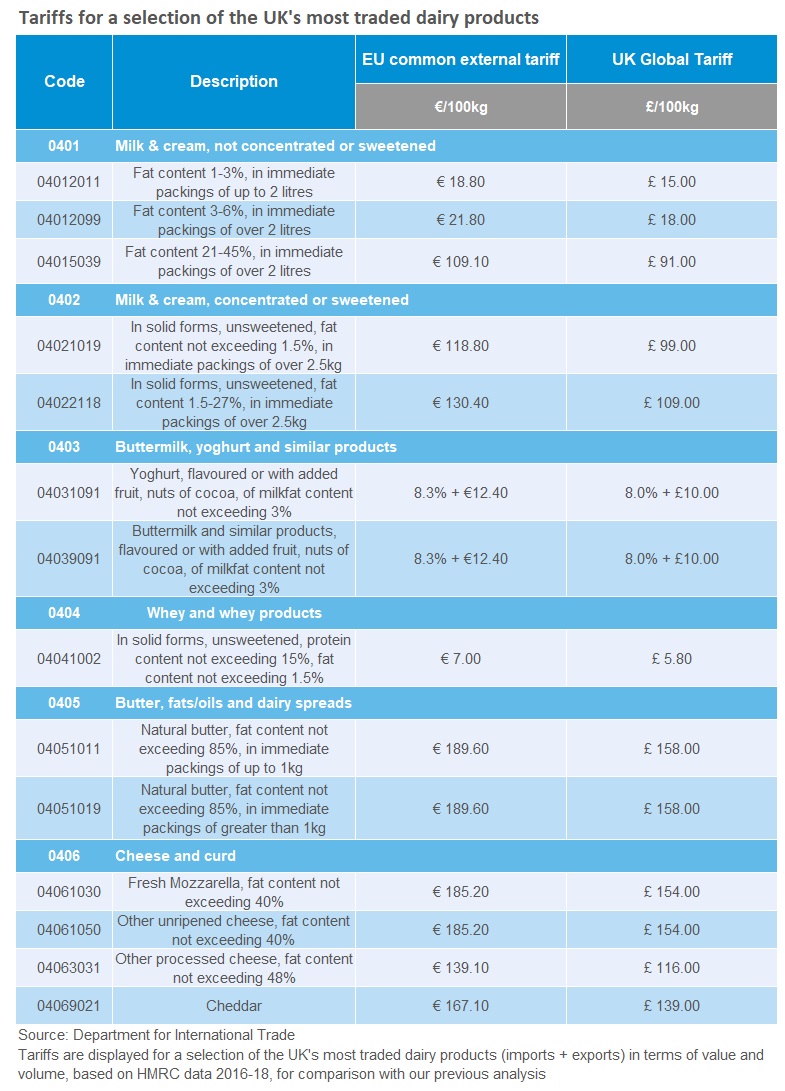

For dairy, nearly all the UKGT tariffs are aligned with the current EU common external tariffs (CET). The tariff rates have been converted from euros to pounds and percentage rates have been rounded. This is a substantial change from the tariffs initially announced in March 2019 and revised in October 2019. Previously, there were tariffs for some cheeses and butter products, but no tariffs for milk, cream, powders or yoghurts. Now all dairy product codes (within HS codes 0401-0406) will be subject to import tariffs, with the exception of one whey code. The new tariff rates will offer more protection for domestic products from imports compared to the previously proposed tariffs.

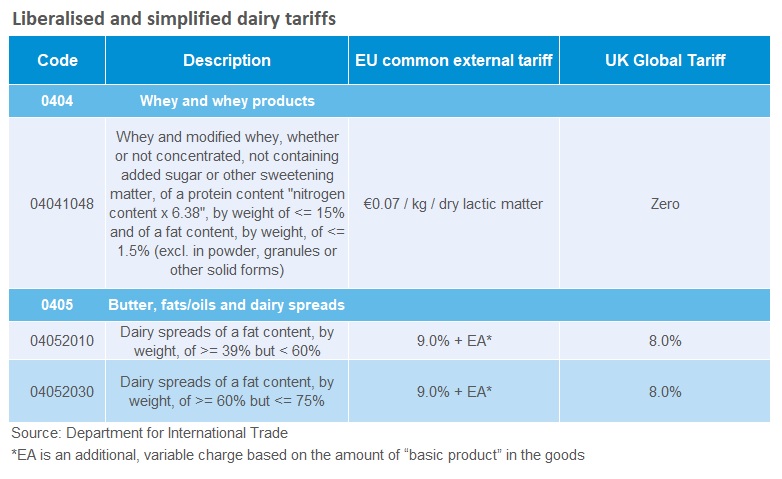

There are three dairy trade codes for which there isn’t a simple currency change to the tariff. This includes two codes covering dairy spreads between 39%-75% fat, for which the tariff has been simplified from 9% + EA* to 8% alone. Additionally, one code has been liberalised, and will have no tariff. This is 04041048, which is for unsweetened liquid whey of <15% protein and <1.5% fat. These products accounted for a relatively small amount of UK imports in 2019, totalling 4,200 tonnes for the two dairy spreads codes combined, and only 50 tonnes for this specific whey code.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.