- Home

- Consumer Insights: The importance of events for lamb

Consumer Insights: The importance of events for lamb

Return to importance of events for red meat and dairy homepage

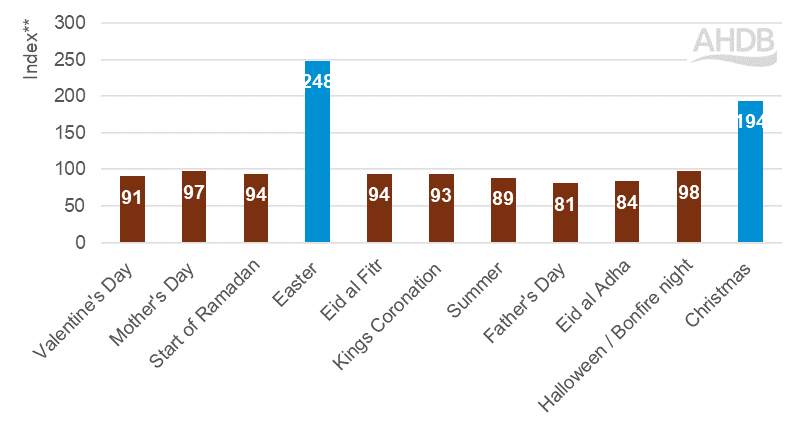

In 2023, there were two key seasonal events which were important in driving lamb sales – Easter and, more surprisingly, Christmas. Both events offered a boost during a year when strains on consumer finances otherwise muted lamb demand.

Lamb retail performance at key seasonal events compared with average two-week period in 2023

Source: AHDB analysis of Kantar data, Volume, Total lamb, index versus average 2 w/e 2023

It is evident from retail sales performance that lamb has stronger ties in the minds of shoppers for Easter and Christmas, where they are seen to significantly over-index (Kantar).

To put this into context, combined volumes purchased in the two weeks leading up to Easter and Christmas accounted for 16% of all lamb sold in retail during 2023, and there were significant uplifts in volumes purchased compared with an average two-week period* for the year (Kantar, 2 w/e 9 April 2023 and 2 w/e 24 December 2023).

So, what can we learn from these celebrations? And how can we use this to boost lamb performance at other seasonal events?

Easter

Easter is synonymous with lamb, so it is not surprising that there are more than twice as many shoppers who purchase it and volumes sold in the two-weeks in the lead up to Easter than in an average two-week period in 2023 (Kantar).

We see that lamb is more likely to be eaten at lunchtime for celebratory occasions, with consumers reporting that a meal containing lamb is more likely to be thought of as a relaxing, special, or treat lunch, rather than an evening meal (Kantar Usage).

Close associations with the classic roast lamb lunch are clearly important for the protein, and on average account for almost a fifth of all lunches containing lamb consumed during 2023; this more than doubles to 42% for the 4 w/e 16 April 2023 (Kantar Usage).

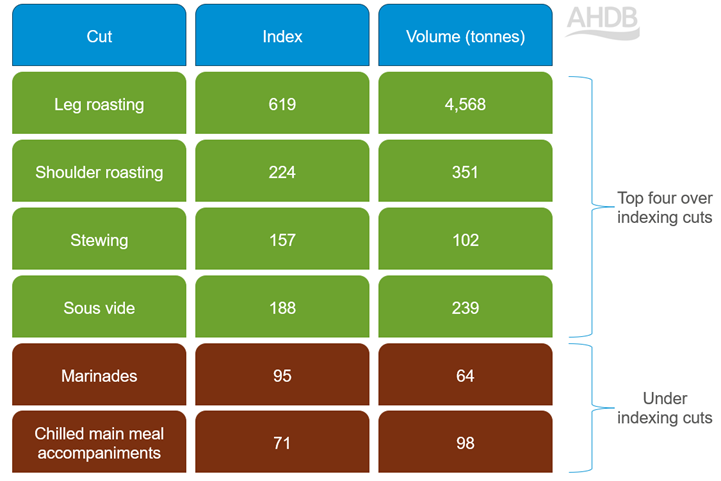

The traditional roast is heavily associated with Easter, and lamb roasting joints see the greatest volumes purchased of any time of the year (Kantar).

While shoulder joints see their best performance in terms of volumes sold at Easter, overwhelmingly, leg roasting joints are favoured by shoppers and accounted for more than 9 out of 10 roasting joints sold (Kantar).

They also drove lamb performance, accounting for almost two thirds of all lamb purchases in the two-week period. This shows how important traditions are for many consumers, who value together time and sit-down meals.

Lamb also saw uplifts in the out-of-home market in the run up to Easter, particularly for roast dinners, as some shoppers decided to skip the washing up for their Easter celebrations, which resulted in an uplift of 2% on average for the year (Kantar Out-of-home, 4w/e 16 April 2023).

But it is not just the traditional roast which performs well at Easter.

Top over- and under-indexing lamb products at Easter 2023

Source: Kantar, Total lamb, Volumes, 2 w/e 9 April 2023

It is also important to remember that while the long Easter weekend is just a few days, shoppers might like to treat themselves to everyday meals but with a seasonal twist, particularly during school Easter holidays.

Pester power of family members requesting dishes is at a five year high, and we see some lamb meals, such as chops, being more likely to be requested than other lamb cuts for this reason (Kantar Usage).

Reminding shoppers of cuts such as mince and stewing and encouraging their use in midweek meals when children are off from school can also help boost retail demand for lamb in the build up to Easter.

The date for Easter changes each year, always falling on the Sunday after the first full moon following the spring equinox (21 March). As a result, there are times when it can coincide with other religious festivals such as Ramadan and Eid, where lamb is central in celebrations.

This was the case in 2023, and as a result, overall lamb performance will have benefitted from the religious festivals coinciding with each other.

Equally, depending on when Easter falls, outdoor dining can be an option, and celebrations can mark the start of BBQ season.

As a result, processed lamb (burgers and sausages) saw uplifts of almost 10% on an average two-week period. Additionally, added value lamb products, chops and steaks, which can work well for indoor or outdoor dining when weather dictates, also saw a strong performance (Kantar).

Particularly when Easter is falling later in the year, encouraging additional lamb focused meals over the long bank holiday weekend for extra celebratory meals outside, alongside the classic Easter Sunday lamb roast, could boost sales.

What does this mean for farmers?

Domestic kill over the springtime period supplies a large proportion of the UK market. However, seasonal kill patterns are at their lowest through the first half of the year. Therefore, the demand side spikes are often managed through imported volumes, which we explore below.

Though various factors affect imports year on year, over the last 3 years we have witnessed an increase in sheep meat from our largest suppliers, Australia and New Zealand through March (TDM average 2021–2023).

Around 6–8 weeks is widely reported for travel from the southern hemisphere, enabling product to arrive for Easter demand and Eid al-Fitr.

However, frozen sheep meat is taking up a considerable (70%) proportion of imports, allowing product to be released from stocks when demand is high, offering more flexibility to the market.

New Zealand lamb slaughter peaks are typically present in Q1, with additional volumes available to supply international markets (Agri HQ). Consequently, New Zealand lamb exports into the UK are often very prominent through the first few months of the year.

Of total world imports of sheep meat, frozen sheep legs are the largest imported product, particularly for the Easter market, with New Zealand being the largest supplier. Determining the destined market is key for hitting the most profitable returns. Refer to the AHDB market specifications booklet for detailed advice.

Ramadan and Eid

While data from Kantar doesn’t show an uplift in retail volumes purchased during Ramadan and Eid al-Fitr, wholesale data and deadweight lamb price movements suggest these events do have significant impacts on the lamb supply chain.

Meat remains central to many Muslim diets, and lamb is particularly culturally important. Despite accounting for just 6.5% of the population, AHDB estimates Muslims account for nearly 20% of lamb volume sales.

Research by AHDB and YouGov indicates that 34% of Muslims report eating lamb weekly; this falls to just 5% for non-Muslims (AHDB/YouGov, March 2024).

Festivals are very important to Muslim culture and lamb is central at many of these events. This means that there is increased demand for halal products which should be catered for.

Peak consumption is reported around three key Islamic events: Ramadan, Eid-al-Fitr and Eid-al-Adha.

Purchases for these events can vary, with some choosing to buy in bulk in the weeks leading up to the festivals and others choosing to spread shopping out across the month.

Equally, as the dates for these festivals change each year based on the Islamic lunar calendar, this can make it difficult to capture true retail demand driven by these events, especially as in 2023 Ramadan and Eid al-Fitr fell around Easter (22 March–20 April 2023 and 21–22 April 2023 respectively) where lamb saw good performance. Eid al-Adha fell on the 28–29 June 2023.

Islamic populations are continuing to grow in the UK, and due to the importance of lamb within their culture in terms of frequency and volumes purchased, this is an area of the market which should not be dismissed.

What does this mean for farmers?

Qurbani is another key Muslim festival where the dates move yearly. Having fallen on 28 June in 2023, the festival was due to fall on 16 June in 2024.

Imports remain elevated during the run-up to celebrations and an estimated 50–70,000 head sheep are processed for the UK’s Qurbani market, with specific requirements.

The Qurbani market specifies lambs to be at least six months old when they are slaughtered, limiting UK production to early lambers born before mid-December; however, a large proportion of the demand will be met with mutton or old season animals.

For details on age and market requirements, see Understanding the Qurbani market.

Demand throughout the celebration period typically experiences a notable uplift, offering support to prices.

Increased seasonal demand as well as low (old season) supplies have further supported the particularly high prices this year (2024).

Christmas

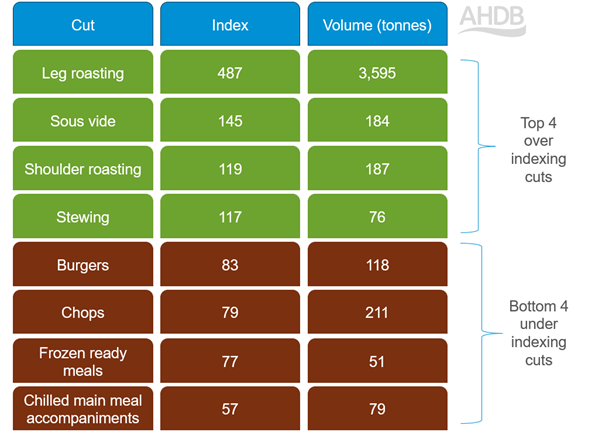

Christmas is the second-biggest calendar event for lamb. In the two w/e 24 December 2023, almost twice as much lamb was sold compared to an average two-week period (Kantar).

Top over- and under-indexing lamb products at Christmas 2023

Source: Kantar, Total lamb, Volumes, 2 w/e 24 December 2023

Similar to Easter, primary lamb drove this strong performance, with nearly five times the volumes of leg roasting joints sold in the lead up to Christmas compared with an average two-week period (Kantar).

Retailers were particularly influential in this, with nearly 70% of all lamb roasting joints sold being on promotion in this time.

This will certainly have helped tempt some shoppers to celebrate the festive period with lamb and proves how influential promotions can be for driving performance of certain cuts.

As family pester power for lamb roasting joints can be influential in meal choices, positioning lamb as either the family favourite treaty centre piece protein for the meal, or as a secondary meat to the traditional turkey could help boost sales.

Aside from roasting joints, sous vide and stewing also saw uplifts (Kantar).

Promotions were less influential in this for stewing, and while new shoppers were attracted into the category at Christmas, those who were purchasing did so in greater volumes, which drove sales.

They were perhaps tempted by the convenience of these products for creating minimal-effort, tasty meals.

Shoppers were not tempted to trade in home meals for out-of-home ones though, and lamb underperformed in foodservice particularly for takeaway classics of Indian and burgers (Kantar Out-of-home).

Consumers are looking to treat themselves in the build up to the festive period when eating out-of-home, so it's important that restaurants include lamb for set Christmas party meals as well as à la carte menus to capture the attention of diners.

What does this mean for farmers?

Within the supply chain, domestic production is higher for sheep meat during the latter half of the year. Increased demand typically encourages gentle price rises for end-of-year kills.

Raised levels of exports were seen in November and December 2023 (TDM), enabling the domestic market to manage the seasonal increase of production.

With a higher proportion of this being offal, this highlights the importance of trade to support carcase balance.

Other event opportunities

While total lamb performance does not see uplifts at some of the smaller seasonal events, there are still opportunities for lamb.

For Valentine’s Day, lamb provides a treaty alternative to the classic beef meal, particularly in the form of sous vide and ready-to-cook products. Including lamb within the selection of meal deal promotions could boost sales for Valentine’s Day.

These products can provide an opportunity for shoppers to try something a little different in an easy-to-cook format, which can be particularly appealing for those who may be less confident in cooking with lamb.

For Mother’s Day, positioning lamb in store and online with inspiration for easy to cook dishes for shoppers to treat their mum to a tasty and indulgent meal at home could help boost sales.

Reminding shoppers that celebrations don’t just have to be in home could also support lamb performance, as lamb in the out-of-home market sees 7% uplifts in the four w/e 19 March, particularly for meat-centred meals such as roasts (Kantar Out-of-home).

One-off celebrations, similar to the King’s Coronation (6 May 2023), offer the potential for lamb to shine. Roast rack of lamb was featured on the coronation menu, and while this didn’t translate into an increase in retail volumes sold, lamb ready meals saw uplifts (Kantar).

For those who wanted to watch the royal events live, ready meals meant that less time was needed in the kitchen and more time could be spent celebrating.

Ready meals should be considered more prominently around one-off celebratory events – whether a royal occasion or a sporting event – meaning that less time is taken away from the action.

While processed lamb over indexes during some of the summer months (Kantar), with increased demand for burgers, koftas and marinades, there are still opportunities for improvement.

Lamb could see a boost at Father’s Day and during summer, both of which already have strong ties with meat-centric celebrations and BBQs.

Lamb chops, steaks and marinades all work well when grilled, so they could be a great treat for outdoor cooking (when the weather allows) or inside dining.

Autumn warmers are popular around Halloween and Bonfire Night, so encouraging use of lamb mince, stewing and roasting joints to create family-friendly meals such as lamb chilli con carne with jacket potatoes or Lancashire hotpot after a cold, damp night out watching fireworks or trick or treating could support lamb sales.

Future opportunities for lamb

- Certain celebratory events are heavily associated by consumers with lamb. Promotions can be highly influential in driving sales. Consider the types of promotions, and the products that are included in them, to boost perceptions and sales of lamb

- Lean into messaging around taste and enjoyment, as these are key drivers for shoppers purchasing and using lamb at mealtimes

- In the out-of-home market, tapping into consumer sentiment around the times of year they associate lamb with, and ensuring that it has an adequate menu share, particularly at these times, could help drive sales

*Average two-week period excludes two weeks to Christmas (24 December 2023)

**Index versus the average two weeks excluding Christmas (over 100 means more likely to be purchased and under 100 means less likely to be purchased)

***Average two-week summer period is defined as the best performing two-week period within the 16 w/e 3 September 2023

The importance of events for beef

How important are seasonal events for beef demand? Is beef just for Valentine's Day or Christmas? We explore the impact seasonal events have on seasonal demand

The importance of events for pork

How important are seasonal events for pork demand? When do consumers like to celebrate with pork? We explore the impact seasonal demands have on pork performance

The importance of events for dairy

How important are seasonal events for dairy demand? Which events see greatest performance for dairy products? We explore the impact seasonal demands have on dairy performance

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.