Consumers flocked back to lamb in 2024

Thursday, 19 December 2024

With 2024 coming to a close, it is fair to say that consumer demand for lamb has far exceeded the levels AHDB had anticipated at the start of the year following two years of declines.

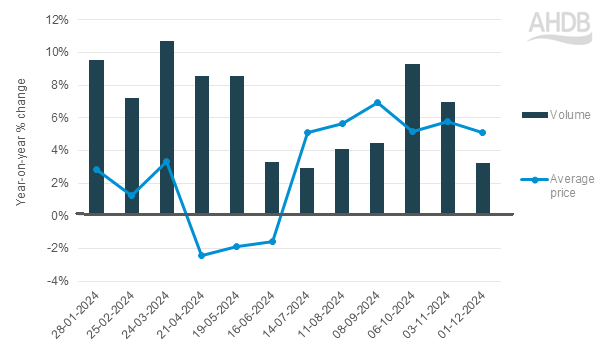

In the last 12 months we have instead seen consistent year-on-year increases in volume sales in retail, with overall volumes purchased up 6% year-on-year (Kantar, 52 w/e 1 December 2024). This is despite seeing almost as consistent price rises during this time (Kantar, 12 w/e 1 December 2024).

Lamb - Volume and average price changes in retail throughout 2024

Source: Kantar, Total lamb, rolling 12 w/e 1 December 2024

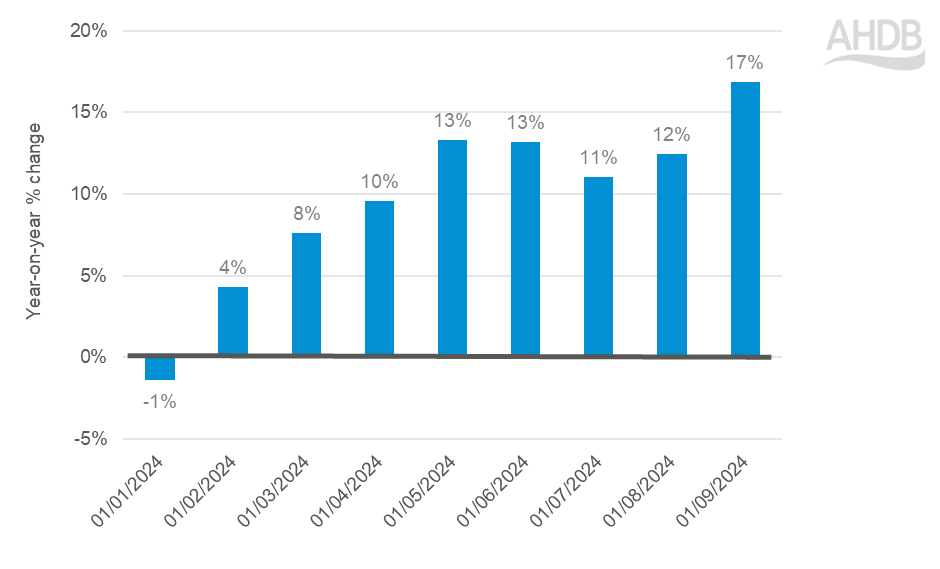

Equally, for the out of home market lamb has also been in growth, up more than 8% year-on-year (AHDB estimates on Kantar Out-of-home data, 52 w/e 1 September 2024).

Year-on-year volume changes for lamb in foodservice

Source: AHDB estimates on Kantar OOH data, rolling 12 w/e 1 September 2024

There are several key factors which have driven the growth in lamb:

- Consumer focus shifting away from price

- The way lamb is used at mealtimes

- Retail promotions at key seasonal events

- Retailer development of lamb ranges

These are explored in more detail below.

Consumer focus starting to shift from price

Consumer confidence has been on a positive trajectory throughout 2024, reaching its highest level since the cost-of-living crisis began at the end of 2021 (Consumer Confidence Monitor, 2024). While price has certainly remained a top consideration for shoppers, we have seen other factors gaining in importance for consumers when purchasing red meat.

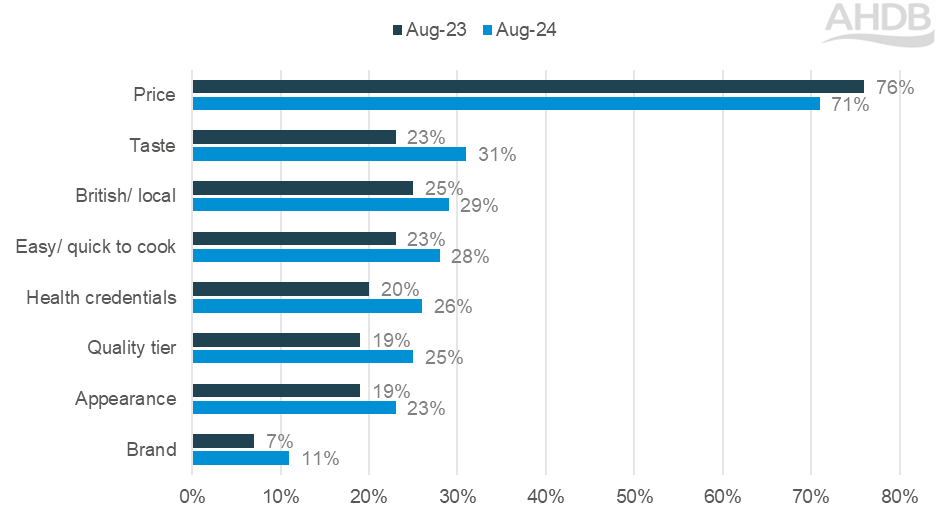

Factors that have become more important to consumers when buying meat

Source: AHDB/YouGov, August 2024 vs August 2023

Although price remains the highest importance for 71% of consumers, this has decreased (-5%pts) compared to last year. Instead, consumers are putting increasing importance on factors which are usually associated with a higher price point, such as quality tier (+6%pts), being easy or quick to cook (+5%pts), health credentials (+6%pts) and British sourcing (+4%pts) (AHDB/YouGov, August 2024).

This is good news for lamb, as one of the highest average price points of the meat, fish and poultry category (MFP). Consumers are now open to looking beyond the price paid at the till to determine the value of a product, which has previously benefitted cheaper proteins.

Average price per kilo of key MFP proteins

|

Protein |

Fish |

Lamb |

Beef |

Pigmeat |

Chicken |

|

Average price/ KG |

£11.93 |

£10.88 |

£8.80 |

£7.28 |

£6.14 |

Source: Kantar, 52 w/e 1 December 2024

Research has shown that lamb is more than twice as likely to be chosen for treat reasons compared to other food and drink, as well as for taste (105 index) and enjoyment (108 index) (Kantar Usage, 52 w/e 1 September 2024).

We also see that meals containing lamb are likely to over index for practicality reasons, such as being easy to prepare or cook (Kantar Usage, 52 w/e 1 September 2024). It is therefore unsurprising that this is being clearly reflected in how well the lamb added value category is performing.

Added value products provide convenience and allow shoppers to try lamb dishes in ways they may not have felt confident in being able to cook, frequently with shorter cook times than if creating the same meal using primary cuts. This fits well with consumer desire for spending less time cooking and increased need for convenience at meal times, and less pressure on consumer budgets has meant that they have felt able to incorporate these lamb dishes into the meal repertoires.

Who’s buying lamb?

The shift in priorities around price is impacting the shopper demographics who purchase lamb. Typically, the average lamb shopper tends to be older and more affluent.

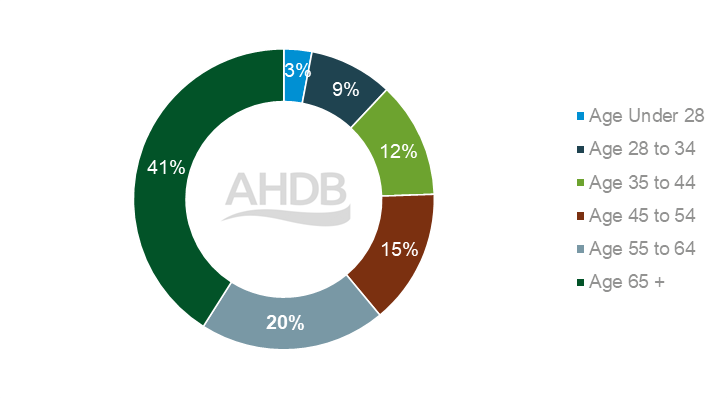

Share of lamb volumes purchased by shoppers by age

Source: Kantar, 52 w/e 1 December 2024

While this is still the case, with 61% of lamb purchased in retail by consumers aged 55 plus, and just over 50% class ABC1 (Kantar), we are now starting to see an increase in younger demographics as well as less affluent consumers purchasing lamb products.

Compared with the previous year, there has been a 23% increase in volumes purchased by those aged 35 – 44 years old, the largest increase of any age group (Kantar, 52 w/e 1 December 2024). There was also a 14% increase in purchased made by those class C2DE, with primary and added value products driving growth for these demographics (Kantar, 52 w/e 1 December 2024).

This change in shopper has meant that lamb cut performance is also changing. While lamb roasting joints still account for the greatest volume of lamb sales as well as the greatest year-on-year growth; sous vide, marinades and burgers have also seen some of the largest year-on-year increases in volumes sold of the lamb category (Kantar, 52 w/e 1 December 2024).

Break in tradition

Lamb is traditionally a highly seasonal meat, seeing huge increases in demand at Easter and Christmas, then more muted interest throughout the rest of the year. And while this was still the case in 2024, lamb saw improved performance at both seasonal events, as well as during it’s ‘off season’ throughout the summer and autumn (Kantar, 52 w/e 1 December 2024).

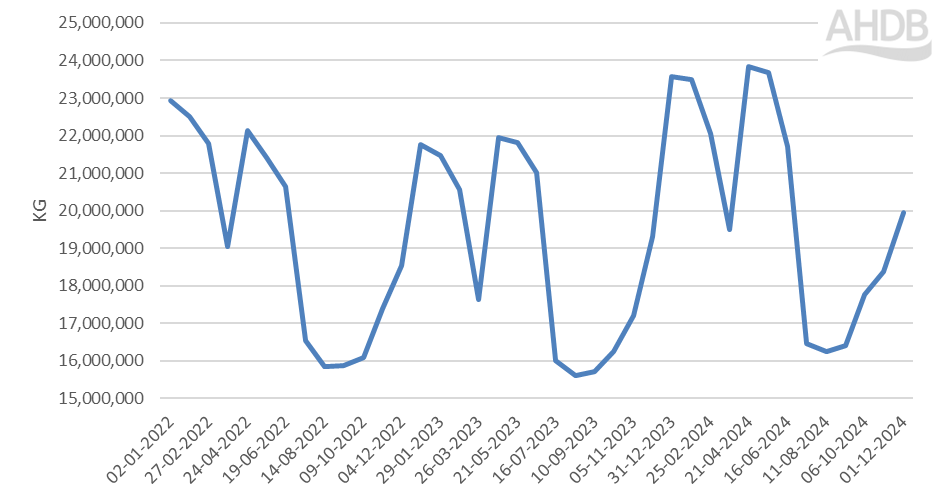

Lamb rolling 12-week retail performance January 2022 – December 2024

Source: Kantar, Total lamb, rolling 12 w/e 1 December 2024

Increased retailer support with promotional activity throughout the year, and not just at Christmas and Easter, helped increase demand for both traditional cuts such as roasting joints, but also for less traditional ones such as burgers and marinades (Kantar, 52 w/e 1 December 2024).

These less traditional cuts benefitted from retailer development of ranges, and inclusion in meal deal promotions at seasonal events such as Valentine’s Day, and has meant that added value products have seen a more than 21% increase in volumes sold year-on-year (Kantar, 52 w/e 1 December 2024).

The future for lamb

We can learn from 2024 that for lamb to continue its positive momentum into 2025 and beyond, it will need to continue to evolve to meet consumer needs. This is particularly important around areas of growing importance to consumers, such as the health credentials of their food, convenience at mealtimes, and the value which food can provide above that of the price paid at retailers.

AHDB will be releasing a 2025 outlook for lamb in early February.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: