An update on red meat markets in China

Wednesday, 21 June 2023

Pork

Production

The latest figures from the Chinese Bureau of National Statistics show that total pork production sat at 55.41 Mt in 2022, a 4.6% increase year-on-year (YOY). Predictions from the USDA suggest there will be a marginal increase to 55.5 Mt for 2023.

The USDA reports that the Chinese pig slaughter is expected to rise to 701.5 million head through 2023, as production capabilities return back to levels seen prior to the major outbreaks of African swine fever (ASF). However, industry growth is expected to be limited by low prices hampering economic returns from production.

Prices

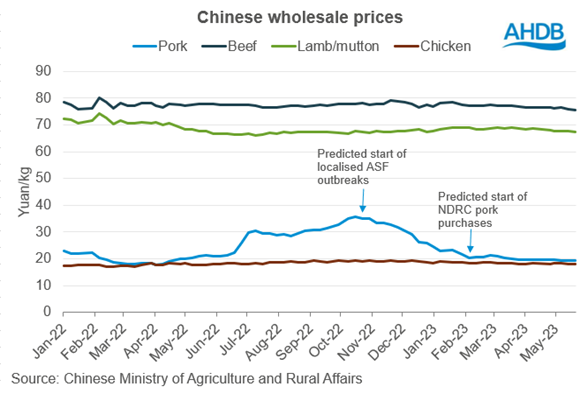

Pig prices have been fluctuating throughout the past 12 months, beginning to rise from May 2022 as prices reached a high of just under 36 yuan per kg in October 2022.

Since this peak, prices have begun to decline, down to 20 yuan per kg in February 2023.

Industry sources suggest that the localised outbreaks of ASF in winter 2022 led to the mass slaughter of pigs, driving up available supplies and reducing prices.

The USDA notes that the National Development Reform Commission (NDRC) in China began to bulk buy frozen pork from early 2023 to support pork prices and maintain an even supply. As a result, prices stabilised from February onwards.

Trade

Global pork imports including offal to China have reached 663,200 t in the year-to-date (Jan–Apr), a 20% increase on the same time period in 2022. Nevertheless, imports to China were much higher in 2021 for this time period, at 1.56 Mt when its production capabilities were severely reduced from ASF.

Therefore, pork imports (Jan–Apr) have dropped off over the last couple of years.

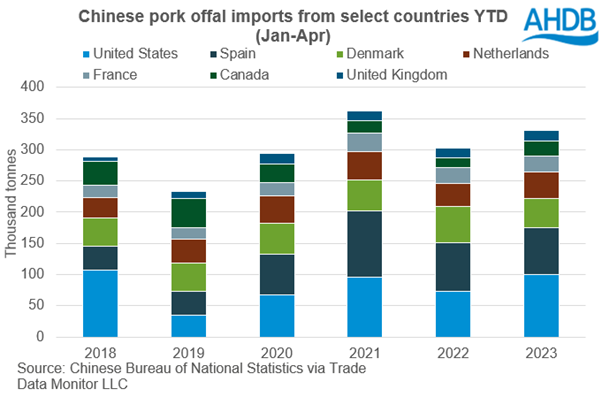

Offal imports have been maintained at similar levels year-on-year, totalling 362,900 t in 2023, this makes up 55% of total import volume.

With disposable incomes remaining tight post-Covid, industry insight suggests we may be seeing greater demand for more affordable cuts of meat as foodservice demand recovers, keeping offal imports maintained.

Looking at specific countries, Brazil saw the most notable increase with imports year to date (Jan–Apr) reaching 154,100 t, up 42% from 2022 levels. This has resulted in Brazil becoming the second largest exporter to China behind Spain (Jan–Apr 167,900 t), making up 23% and 25% of China’s total pork import volumes respectively.

Year-to-date (Jan–Apr) imports to China from the UK totalled 27,350 t, showing little change (+2%) on the year and five-year average. The majority of this volume consisted of offal, which totalled 17,200 t, a 4% increase year-onyear, and up 3,500 t (26%) on the five-year average.

It remains to be seen if the demand for offal continues and how the UK can potentially increase its exports to China.

Beef & Lamb

Chinese beef and sheep meat imports (Jan–Apr) are up year-on-year by 6.7% (37,200 t) and 21.1% (20,100 t), at 588,500 t and 115,300 t respectively. However, this is partly due to COVID restrictions last year limiting the red meat trade, so we have seen imports increase on the year from a small base.

For beef, Brazil, Argentina and Uruguay remain the key exporters to China. For sheep meat, Australia and New Zealand make up 96% of China’s imports, while also remaining key exporters for beef.

With demand for beef and lamb in out of home (OOH) and retail settings set to increase in 2023, domestic beef production is set to grow 3% to 7.18 Mt (USDA) to meet this.

For beef specifically, this is in part due to the large herd size and cattle finished in 2022 being carried over into this year. It will be interesting to see whether the large inventories alongside the growth in domestic production will restrict imports.

Beef and lamb prices are marginally lower year-on-year at 76 yuan per kg and 67 yuan per kg respectively (as of 29 May 2023). With exports of beef from China limited, as most is produced for domestic consumption, the price decline could reflect increased supplies from production and imports alongside slow demand growth.

For sheep meat, we could see the easing prices maintained as growth in demand is slow and unlikely to grow further during the summer months with inventories running high.

Conclusion

As China is a key global consumer of red meat, especially pork as it is estimated that China produces and consumes around 40% of the world’s pork, it will be key to watch how demand and production develop in the coming months. Foodservice demand makes up a large part of domestic red meat consumption, and this market was heavily hit by the slowing economy during the pandemic. Whilst Covid restrictions were lifted at the end of 2022, and the pork industry is recovering from African Swine Fever (ASF), demand for red meat has not seen the resurgence that was expected. Market insights suggests cashflow remains tight, although OOH consumption is slowly recovering as the appetite for red meat increases.

Overall, the predictions for China’s beef and pork market see that production is set to increase slightly, as we see a rebound in consumption and demand following ASF and Covid. Prices are set to remain supported throughout the year, but from a low base, which may discourage regrowth in herd sizes, while the threat of ASF still looms. However, for sheep meat, high inventories and limited demand are likely to limit sheep meat imports.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.