- Home

- News

- Beef market update: how have beef breed registrations changed in 2023, and how is this reflected on supermarket shelves?

Beef market update: how have beef breed registrations changed in 2023, and how is this reflected on supermarket shelves?

Thursday, 30 May 2024

Key points:

- Registrations of beef calves were down 1.1% year on year in 2023 to stand at 1.94 million head.

- Combined, Wagyu and Wagyu X registrations increased to 36,000 head in 2023, up 108% from the previous year.

- Beef out of the dairy herd continues to make a significant contribution to the total number of registrations, particularly for AAX and BBX calves.

- In retail, beef breed call-outs on pack have decreased from 2022 to 2023.

Registrations of beef calves in GB totalled 1.94 million head in 2023, back 1.1% on the previous year. This includes all calves registered as “non-dairy” on BCMS, out of both suckler and dairy dams. Looking into the first quarter of 2024, we saw this trend continue, with registrations down 2.3% on the previous year to stand at 513,000 head.

Angus calf registrations continue to grow

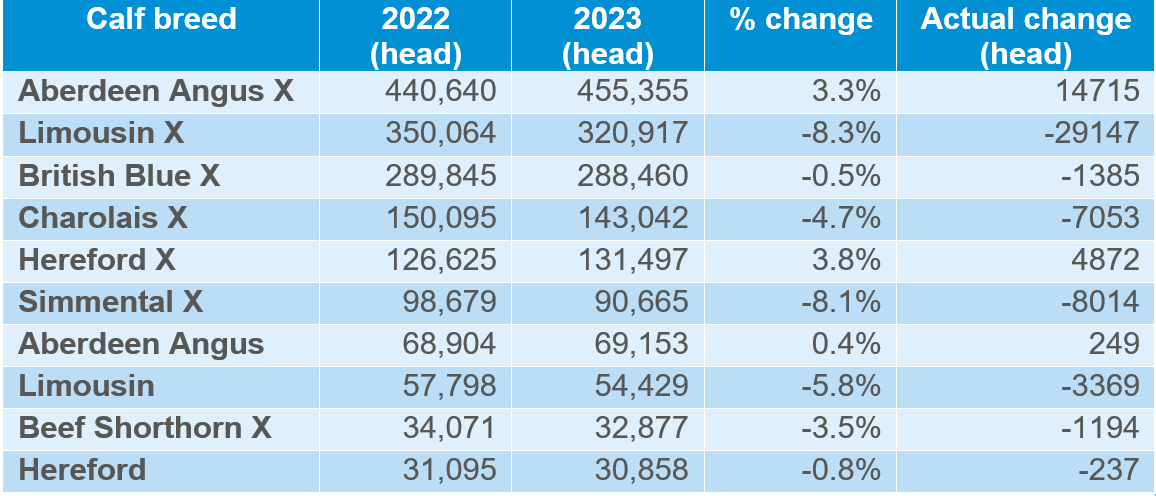

Examining this data by breed, we see year-on-year increases in registrations of Aberdeen Angus X (AAX) and Aberdeen Angus (AA) calves by 3.3% and 0.4%, respectively, from 2022 into 2023. This follows a long-term trend of increasing numbers of AAX and AA calves over the last ten years. Whilst this increase is largely driven by the increased use of beef sires in the dairy herd, we also see steady growth in registrations of AA/AAX calves from suckler dams over the same period.

Continental breed registrations down

On the contrary, registrations of continental breeds were down in 2023 compared to the previous year, contributing to the overall fall in registrations of beef calves. The greatest change was seen in Limousin X, with calf registrations down 8.3% in 2023, compared to the previous year. Significant declines were also noted for Charolais X calves, down 4.7% year-on-year, and Simmental X, down 8.1% year-on-year.

Booming numbers of Wagyu registrations

In 2023, registrations of Wagyu and Wagyu X calves totalled 35,600 head, a 108% increase on 2022. In a similar story to the growth in AA/AAX calves, the dairy herd is the largest contributor of this growth. However, suckler registrations have also increased. This growth has been fostered by the introduction of schemes incentivising Wagyu (X) calves.

GB beef calf registrations, by breed, for the top ten breeds

Source: BCMS

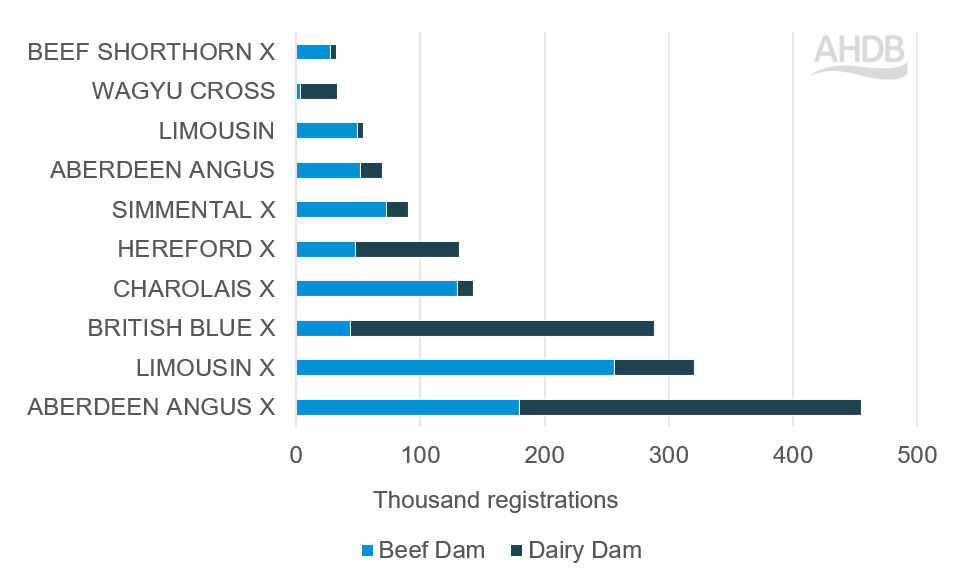

Contributions of the dairy and sucker herd to the beef supply pipeline

AHDB analysis recently showed that just over half of cattle slaughtered for beef in GB currently come from the dairy herd, and the registrations data demonstrates that dairy beef will continue to contribute significantly to the GB beef supply pipeline.

Looking at registrations of different breeds by dam, we can see that for the most popular breed of beef calf - Aberdeen Angus X - 61% of these calves came out of the dairy herd in 2023. Similarly, the majority of British Blue X calf registrations came out of dairy dams, at 85%. In contrast, the suckler herd remains the main contributor of Limousin X and Charolais X calves, producing 80% and 91%, respectively of these breed registrations.

Beef calf registrations to dairy and beef dams in 2023, by breed

Source: BCMS

*Includes the ten most popular breeds as of 2023

How important are breed callouts in retailers?

Beef breed call-outs are used in both lower priced and premium lines and retailers. However, this information on pack remains niche with only 1% of volume sales associated with a breed according to data from Kantar analysed by AHDB* (52 w/e December 2023). Discounters have been building the brand of Aberdeen Angus and Wagyu.

Stock Keeping Unit (SKU) count* has decreased from 2022 to 2023 for individual breed call-outs on-pack in retail, but ‘Angus’ has held a strong position. Hereford appears more in premium retailers, whereas Angus can be seen in lower priced outlets.

Making up an increasing share is Wagyu, where volumes purchased rose by 29.2% from 2022 to 2023.

The majority of Hereford and Angus SKU’s are for steaks, followed by burgers. Whereas Wagyu offerings meanwhile are dominated by mince products such as burgers and meatballs, driving more value into cheaper cuts.

The AHDB tracker with YouGov (November 2023) indicates that a particular breed is important for just 12% consumers, when buying premium beef, with consumers having more of an affinity to British (important to 39% of consumers). Responses indicate that breed call-out is more of a ‘nice to have’ for many. This sentiment also came out in our research on meat labelling, with consumers agreeing a breed call-out would suggest a premium product.

To boost recognition, some may opt for more generic claims such as ‘native breed’. The inclusion of a selection of breeds under this umbrella can reduce supply chain complexity, whilst still boosting retailer authenticity and conveying supply chain traceability.

* A Stock keeping unit (SKU) refers to a distinct type of item for sale. AHDB analysis of volumes associated with SKUs which call out breed information in the product description. If it is called out on pack but not included in the product description, then the data would not have been counted.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: