Positive reopening for restaurants but not back to pre-pandemic levels

Friday, 30 July 2021

With lockdown restrictions easing, we are starting to see more people returning to the eating out market – delivering an increase in sales for the total foodservice sector (eating out, food to go, takeaways and deliveries). However, it’s important to note that the market is not yet back to pre-pandemic levels.

According to Kantar Out of Home, the foodservice market was worth £9.4bn in the last quarter, up 116% on last year, but still 23% down on 2019 (12 w/e 13 June 2021). Hesitancy by some consumers to return to eating out, remaining social distancing measures and industry closures are all contributing to the slower return to pre-pandemic levels. However, those consumers who are eating out, are spending more than they did previously, with spend per trip up 6.7% versus 2019. And as consumers start to return to the office, we have seen a shift in share from evening meals to breakfast and lunch.

New regular foodservice data from AHDB

Additional data on the performance of red meat sectors can now be found on our new foodservice dashboards.

Unique to AHDB, the new dashboards will provide levy payers with foodservice data not available anywhere else. Investment from the red meat sectors has enabled us to purchase occasion data from Kantar Out of Home. AHDB then apply volume estimates providing a complete picture of the red meat market in Britain when used alongside our retail dashboards. We have delivered the data in dashboard format for ease of use, which will be updated 4 times per year after key periods like Christmas.

If you would like more detail or support in this market, then please contact strategic.insight@ahdb.org.uk

Key finding from the latest data

Channels

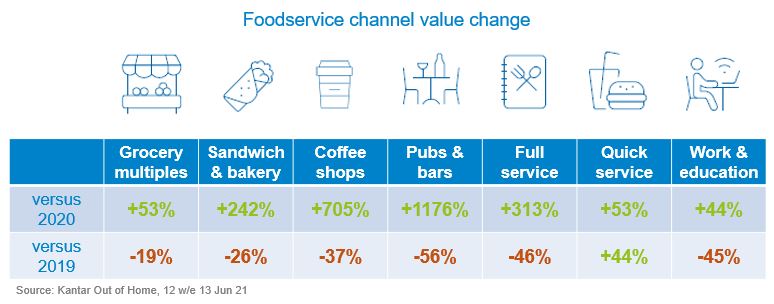

Quick service restaurants were the most valuable channel in foodservice for the 12 weeks ending 13 June 2021 (Kantar Out of home), worth £3.7bn – an increase of more than 53.2% year-on-year and up 44.4% compared to 2019. The only channel to see growth on 2019 levels.

Pubs and bars saw the fastest recovery with value reaching £748.4m in the 12 weeks to 13 June 2021, up over 1000% year-on-year, but still less than half the value seen in 2019.

While delivery can originate from any of the other channels listed, it is an area that has seen value growth on 2019 levels, much of which was delivered from QSRs. Delivery has seen a huge uplift in popularity because of the pandemic with 40% of households purchasing a food delivery in the last 12 weeks compared to only 17% in 2019.

Red meat

AHDB estimates, using Kantar Out of Home data, suggests that total red meat through foodservice has seen strong growth for the 12 weeks ending 13 June 2021, with volumes up 145% compared to 2020. However, this is still behind pre-pandemic levels with volumes down 28% on the same period in 2019.

Volume sales of beef through foodservice has risen 179%, with growth coming from takeaways and eating out, but beef struggled to return to 2019 levels, down 28%. Burgers remain the most popular meal for beef, accounting for 57% of estimated beef volume in foodservice over the last year.

Lamb volumes in foodservice were up 7% compared to 2020 and 9% versus 2019 – the only protein to see a return to pre-pandemic levels. Kebabs are the biggest dish for lamb in the foodservice market, accounting for over 60% of estimated lamb volume over the last year.

Pork is also enjoying strong growth, with volumes up 173% this quarter. In the last year, pork savoury pastries, including sausage rolls were the which make up 33% of estimated pork volume. This is closely followed by pork sandwiches were the most popular meal, accounting for 27% of pork volumes.

AHDB does not expect the foodservice market to fully recover to pre-pandemic levels this year. For more information, please see our July 2021 Agri Market Outlooks.