Retail and foodservice – what we know so far

Friday, 20 March 2020

The coronavirus (COVID-19) pandemic is a worrying time for consumers and will impact behaviour both in and out of home. As we are still in the early stages of the pandemic, we are yet to have sight of actual demand data and therefore the purpose of this article is to highlight what we do know now (as of 20 March 2020). We will continue to track and report insights going forward.

It is important to look at both the retail and foodservice environment, with both contributing billions to the UK economy on a yearly basis. As many people begin to isolate, the impact on both of these channels differs greatly.

As the impact becomes more apparent, it will be key for us to look at the total domestic market to see how demand has been affected overall.

Retail

- We are strongly expecting grocery sales in retail to have grown in March. In addition to observed stockpiling behaviour, many meals which would normally be eaten in foodservice have transferred to the home.

According to a study by MCA/HIM, one-third of consumers are claiming to stockpile food in preparation and 67% are concerned about retailers running out

- Long-life categories are currently preferred: tinned, frozen and dried goods. This has the potential to positively impact categories such as long-life milk, powdered milk, frozen meat and frozen chips. It may also benefit meat cuts that lend themselves to bulk cooking or freezing, such as mince, diced, etc.

- Although this peak in retail sales will subside, it is likely that retail demand will remain higher than usual, as people increasingly work from home and make fewer visits to foodservice

- Dependency on online delivery has increased, with retailers reporting that delivery slots are being booked weeks in advance. Ocado has temporarily suspended its website to help it cope with demand. Meal-kit companies are also reporting an upturn in sales.

According to a study by MCA/HIM, 23% of shoppers plan to increase their use of online grocery shopping

- The surge in demand has seen action from retailers. Many have introduced product limits, priority access for elderly customers and cutting back on the range of products offered to improve efficiencies. Morrisons plans to create 3,500 new jobs to work in delivery and distribution centres, utilising new resource to launch food parcels, more delivery slots and a call centre for phone orders. Sainsbury’s has announced it will take staff off meat, fish and bakery counters to be utilised elsewhere in store. We will publish analysis of this impact as data is collected

Foodservice

As of midnight on the 20th March all bars, pubs, cafes and restaurants have been ordered to close. They are able to provide takeaways.

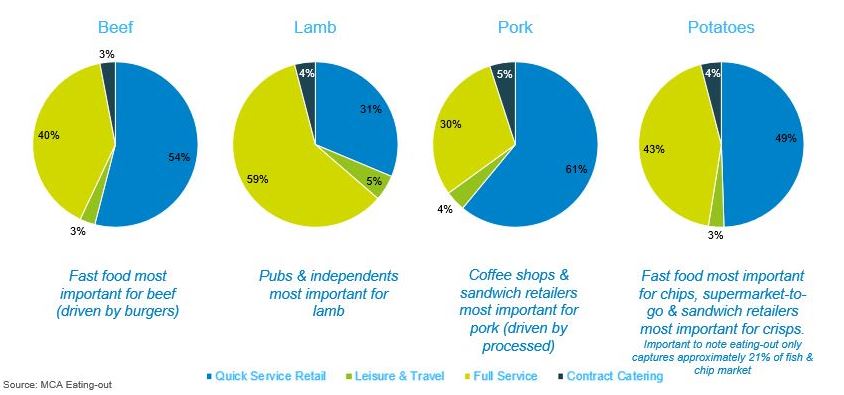

The majority of foodservice revenue (AHDB estimates 80%) comes from the eating-out market. What we know about this channel is:

-

Before this announcement, eating-out sales were declining as footfall decreased dramatically. According to Wireless Social, in the seven days to 20 March there was a 50% fall compared with the same seven days last year

- Early signs show that certain eating-out channels may be worst hit:

- London, city centres, travel hubs and universities

- Pubs, local independents and supermarket/department stores, as these are venues most popular with the over-70s

- Coffee shops, supermarket-to-go and sandwich retailers, as more people work from home

- Catering companies, due to event and conference cancellations

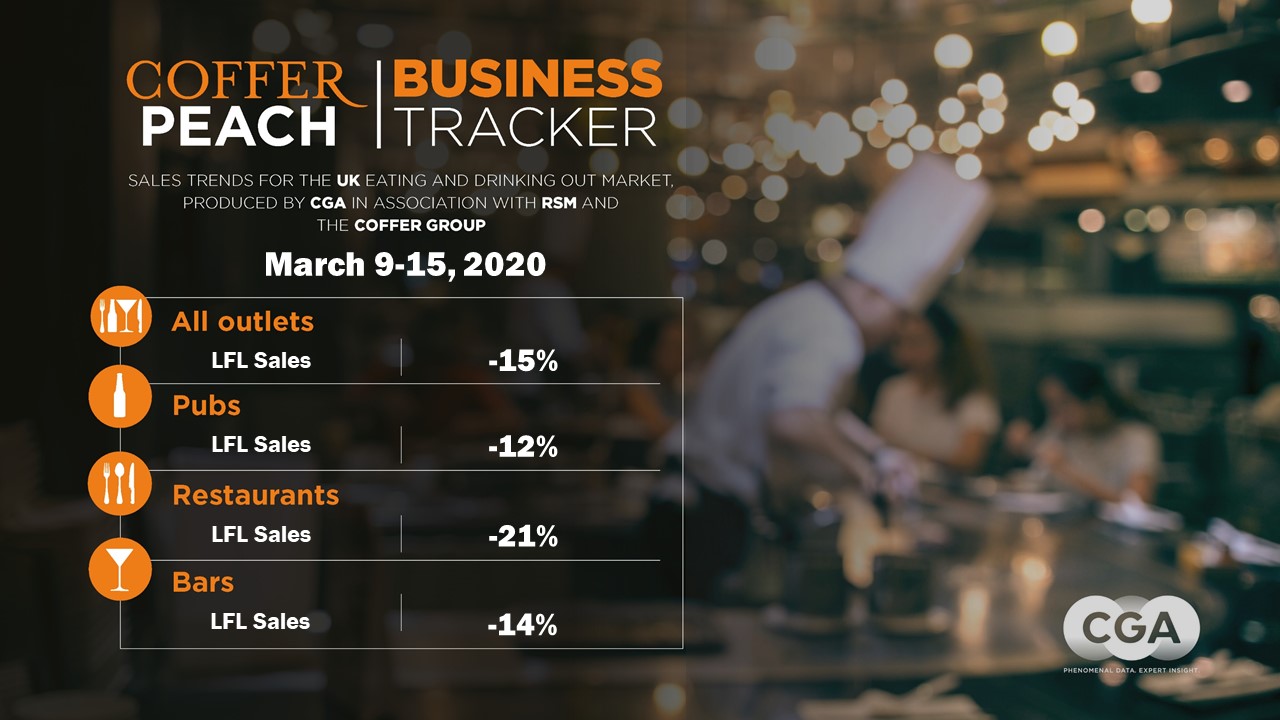

Coffer Peach Business Tracker, week ending March 15, 2020, trading figures for pub, bar and restaurant groups.

- Eating-out channels have responded to the new socially distant environment by offering food to go, meal kits or home-delivery options. Planning rules were relaxed to allow all pubs, restaurants and cafes to offer takeaway or food delivery, without prior permission. This is still the case following the announcement on the 19th. Fast-food outlets are well placed to service the off-premises market

- A survey of Chinese consumers by Kantar found that, once they were free from lockdown, the first activity they wanted to do was go to a restaurant, cited by 63% of respondents

A smaller but integral part of the market (currently at 8% share of foodservice) is delivery. What we know here is:

- Food delivery was already in double-digit growth (+18% spend in 2019). With people having to stay at home, coupled with the initiatives mentioned above from restaurants, this growth will inevitably accelerate

- Delivery companies, such as Deliveroo and Just Eat, quickly reacted by launching contactless delivery, initiatives to support grocery shopping and reassurance about hygiene levels, as well as extra precautions. Restaurant take-up of these delivery services has increased

- Food delivery lends itself to certain dishes and food categories: beef, due to burgers (a Five Guys’ burger is the number one Deliveroo order in the UK), dairy, due to pizzas, and potatoes, due to fish and chips

- While a gain in food delivery is positive for the foodservice market because of its overall size, gains here are not likely to compensate for losses seen in the eating-out market