The new consumer health revolution

Thursday, 1 January 2026

Walk into any supermarket in 2026 and you’ll notice something striking: shoppers are thinking about health. From protein-packed snacks and drinks to more natural product innovations, the aisles are buzzing with products promising better nutrition. Yet, there’s a catch. While health is climbing the priority list, many consumers say they can’t afford to put wellness first in the face of rising living costs.

A growing health challenge

The urgency is clear. The latest evidence for 2023/2024, shows almost two-thirds of adults in in England are overweight and of these, 26.5% are classed obese (GOV.UK Obesity profile, May 2025).

Childhood obesity remains a major concern, with just over one in five children aged 10–11 years (2024/2025 school year) classified as obese (DHSC, National Child Measurement Programme).

These figures underscore why health is no longer just a lifestyle choice but a real concern. Tackling obesity means making healthier options easier, more affordable and more appealing for everyone.

Diet versus fitness for a healthier lifestyle

In the latest YouGov/AHDB Pulse survey, 85% of consumers said that diet is important to their health and 77% of consumers stated that fitness is important to their health.

This highlights that the majority of consumers understand the importance of a healthy diet and fitness, but everyday challenges, such rising costs or time constraints, can hinder their decision to make a change in lifestyle.

The price and convenience of eating well

For many households, the cost of healthy eating is the biggest barrier.

In the latest YouGov/AHDB Pulse survey, of all adults who think diet and/or fitness is important for health, 71% stated it was difficult to buy healthy food and drinks as they are too expensive (November 2025).

Worldpanel by Numerator data reiterates this, as the cost of an average evening meal with a healthy element is £3.65, which is 13% more expensive than a meal without.

Furthermore, with so many health claims on products, in the press and on social media, consumers are understandably confused as to which products are actually healthy or less processed.

In addition, more consumers now desire convenience and easy, simple dishes due to time constraints but also, because of a lack of knowledge in how to cook healthy meals or lack of suitable kitchen facilities.

Regrettably, these are all underlying factors creating barriers to healthier eating.

Which of the following factors make it difficult for you to buy healthy food and drinks products?

Source: YouGov/AHDB Pulse survey, November 2025

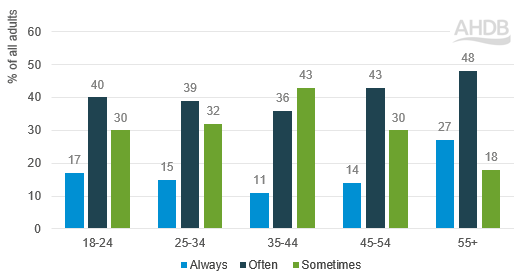

Different ages, different needs

Health goals aren’t universal. Younger consumers are more focused than the total population on short-term wellness benefits, such as boosting energy levels, high protein, improving body image and social media.

In comparison, many families are trying to juggle fitness and diets around busy lifestyles, and older generations are focussing on bone strength, heart health and more natural ways to manage their health.

The over 55s are more likely to be eating a well-balanced diet on a regular basis and have the time and cooking skills to assist them.

The challenge for the food industry? It is key to meet these age-specific needs with natural nutrient-dense products such as lean red meat and dairy which are high in protein, vitamins and minerals such as vitamin B12 and calcium.

How frequently do you eat a well-balanced diet (i.e. including vegetables, fruit, cereals, dairy, and adequate sources of protein such as meat, fish, eggs and beans)?

Source: YouGov/AHDB Pulse survey, November 2025

Diets in the spotlight

With health being an important topic for the food industry in 2025, what trends can we expect to see in 2026?

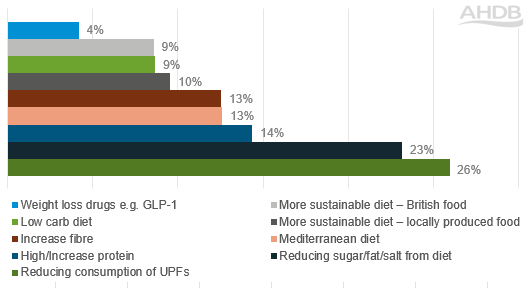

According to the YouGov/AHDB Pulse survey, consumers are keen to eliminate certain elements from their diets – 26% are planning to reduce consumption of ultra processed foods (UPFs) and 23% are planning to reduce sugar, fat and salt (HFSS) from their diet.

This intention was shared across all demographic groups as shoppers are questioning additives and long ingredient lists, and are leaning towards natural, minimally processed options instead.

Transparency has become non-negotiable, with consumers wanting to know more about food products, where they are sourced and how they are made.

In terms of additions, 14% of respondents are planning to increase their protein intake and 13% to increase their fibre. This trend is primarily driven by under 34s who are more interested in body image while gaining their inspiration from fitness apps or social media.

Which, if any, of the following are you planning to do as part of your health/ diet plan in 2026?

Source: YouGov/AHDB Pulse survey, November 2025

One of the most talked-about trends is the rise of GLP-1 weight loss drugs.

With 4.1% of GB households reporting current use, these consumers are actively seeking nutrient-dense, lighter meals that are high in protein foods to combat muscle wastage (Worldpanel by Numerator).

As more consumers are expected to try GLP-1 weight loss drugs in the near future, lean primary red meat, natural yoghurt, milk and eggs can all complement these diets with naturally added health benefits.

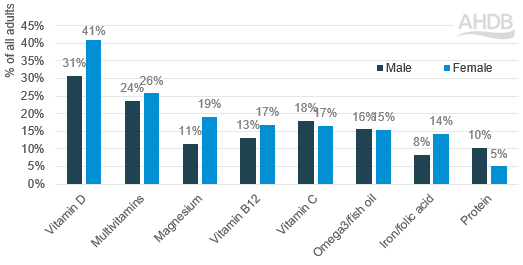

Gender health gap

In the UK, almost half of teenage girls and around a quarter of women consume less iron than recommended, contributing to rising levels of deficiency.

While supplements can provide support, the most effective and sustainable approach is through a healthy well-balanced diet.

As evidenced in our ‘The role of red meat report', haem iron from red meat is absorbed more efficiently than non‑haem iron from plant foods, and it also enhances the body’s ability to absorb non‑haem iron when eaten together – often referred to as the “meat factor.” This makes red meat and iron‑rich plants such as broccoli, kale and beans the perfect pairing, supporting a healthier dietary pattern.

In comparison, men aged under 34, are most likely to be consuming higher levels of protein to build muscle and improve athletic performance.

High-protein diets are heavily promoted online, and it is no surprise that the number of product launches with high/added protein claims in processed protein and dairy rose from 12% in 2020 to 18% for January to November 2025 (Mintel, Attitudes towards Healthy Eating, UK 2025).

As the market for protein-rich foods has expanded rapidly, there is increasing focus on the quality of protein rather than quantity, with products like yogurts, milk, pork, beef, eggs and fish being naturally rich sources of high-quality protein.

Which, if any, of the following vitamin/mineral supplements do you take for your health?

Source: YouGov/AHDB Pulse survey, November 2025

Eating well, living well

Education and skills are key to breaking barriers. The UK’s Eat Well Guide provides evidence based dietary recommendations for a healthy balanced diet.

Our research in collaboration with Worldpanel by Numerator, has also shown that baskets containing primary** red meat cuts are nearly twice as likely to contain fresh vegetables and fruits than the average shopping basket.

For example, of baskets containing primary** red meat, 76% also contain fresh vegetables while only 41% of total shopping baskets contain fresh vegetables.

We are helping shoppers make healthier choices by building their understanding of lean red meat within a balanced diet. Our latest Let’s Eat Balanced marketing campaign provides recipe ideas for quick, simple, nutritious dishes containing beef, lamb and dairy at affordable prices.

The whole industry needs to help consumers learn how to cook simple meals, plan balanced diets and stretch their budgets without sacrificing nutrition.

The message is clear: healthy eating should not feel complicated or expensive.

2026 key health trends*

- Consumers are most likely to start a diet at a suitable point throughout the year (39%) rather than as a New Year’s resolution in January (26%)

- Of those consumers planning to go on a diet or health regime in 2026, 33% state they will stay on it for longer than six months, rising to 44% in over 55s, reflecting a change in long-term eating habits

- 49% of consumers are looking to increase the amount of exercise they do in 2026

- Improved body image (40%) and potential weight loss (36%) are the main inspirations for those starting a diet in 2026

*Source: YouGov/AHDB Pulse survey, November 2025

Looking ahead

As the conversation evolves, meat and dairy are finding new opportunities. Lean cuts of meat are being positioned as an affordable protein source, while dairy is highlighting its nutrient density, probiotics and sustainable farming practices.

In a world where consumers want both health and transparency, the farming and food industry are rebranding themselves as part of the solution.

Health in 2026 is about balance – between cost and quality, convenience and sustainability, personal goals and collective responsibility.

With obesity affecting both adults and children at alarming rates, consumers are demanding more from the food industry.

** Primary red meat includes whole, minimally processed cuts of meat such as steaks, mince and joints

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.