February 2024 Dairy market review

Thursday, 21 March 2024

Milk production

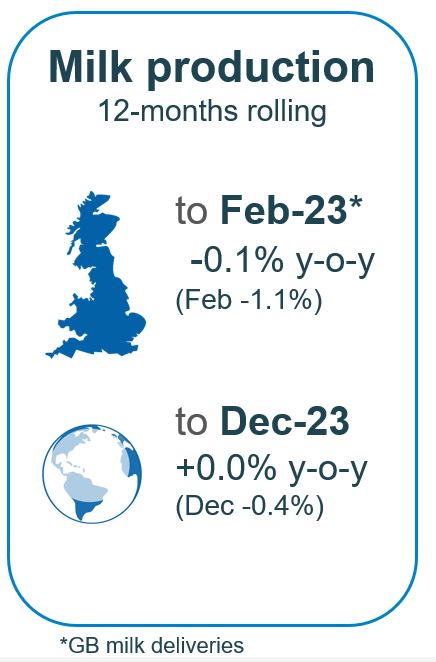

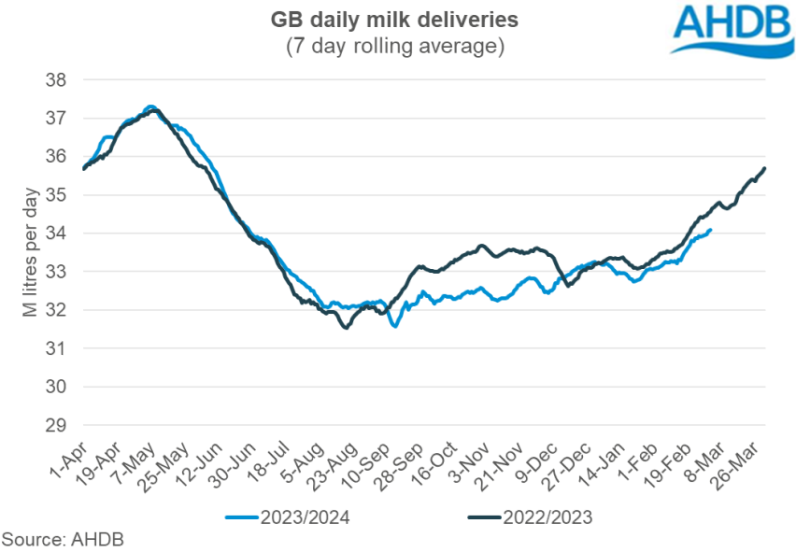

GB milk deliveries are estimated to have totalled 973 million litres in the 29 days of February 2024 with an average of 33.6 million litres per day. This would mean a decline of 1.1% year on year.

Production for the milk season to date (April to January) totals 11.23 billion litres, slightly behind (-0.6%) the same point in 2023. This is currently running ahead of the latest forecast revision, which is due to be revised in March ahead of the flush. This is the lowest milk volume recorded since the 2016/17 milk season.

The decline in volume is most likely to be driven by reduced yields as the GB dairy herd recorded only marginal change year on year in the latest BCMS data. Although farmgate milk prices have seen some improvement in the most recent months, many producers are still struggling with high input costs and interest rates eroding farm margins and working capital. This is providing little incentive to push cows. An extremely wet start to the year will not help in allowing cows to get out on the grass either.

Latest analysis point towards a stable herd size for 2024, in spite of a bump in calf registrations for Q4. BCMS data shows that the average age of the herd is continuing to trend lower.

You can read more about expectations and drivers for the milk year ahead in the Dairy market outlook.

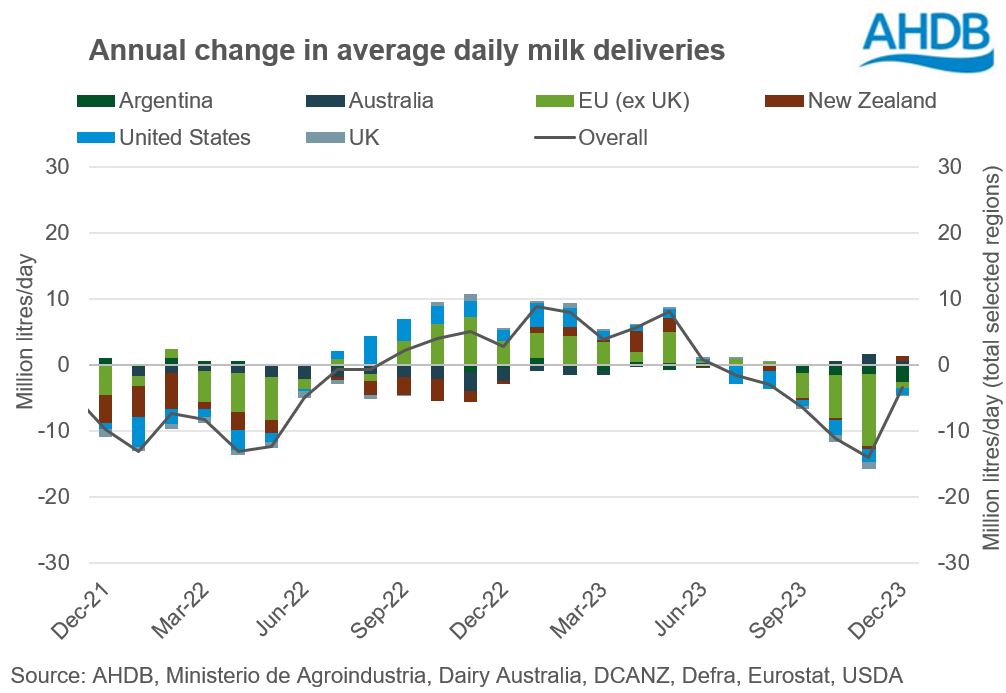

Global milk deliveries in the latest period (December) averaged 804.5 million litres per day in December, a decline of 3.4 million litres per day, or -0.4%), across the selected regions, compared to the same period last year. All regions except Australia and New Zealand recorded year on year volume decline.

Milk deliveries in the EU averaged 358.8 million litres per day in December, a slight decline of 1.0 million litres per day (0.3%) compared to the same point last year.

The decrease in EU total milk deliveries was mostly driven by a significant year-on-year production decline in Ireland, down 76.6 million litres (27%). Slight declines were also seen in France (6.4 million litres or -0.4%) and Germany (11.5 million litres or -0.4%). On the contrary, Italy and Poland recorded production increases in December, up 37.9 million litres and 25.6 million litres year on year, respectively.

According to latest forecast estimates, global milk production across the key producing regions is expected to grow modestly by 0.25% in 2024. This is slightly higher than the 0.05% increase recorded in 2023. Although production is likely to increase, there is expected to be variability across key regions with growth expected in USA, EU and Australia, but decline in UK, Argentina and New Zealand.

Available supplies and trade

Estimates of available supplies are mixed but don’t point towards an over-supply of dairy products currently. In the fourth quarter of 2023 milk powders registered a small growth in supplies year-on-year while cheese and butter saw a drop. Lower milk production during the period contributed to production declines for butter and cheese, although relatively higher prices put a brake on exports (apart from cheese exports which saw some growth).

2023 overall saw an increased balance of dairy trade with export volumes overall up by 2.2%. This growth was supported by the notable increase in trade in powders with SMP exports up by 26.4%. Despite Brexit the EU continues to be the key partner for dairy trade.

Much has been written about the importance of China as the engine for world trade but Chinese demand for dairy products remains disappointing. Imports of dairy products to China totalled 2.6 million tonnes in 2023, down 12% compared to the previous year. Imports of milk powders and liquid milk and cream were both down year on year, while yogurts and whey products increased. The decrease in powder was driven by a significant reduction in WMP volume, down 38% year on year. In contrast, SMP imports saw mild growth, with volumes up by 3% in 2023 compared to 2022.

Wholesale markets

Overall price movements on UK wholesale markets continues the theme of lack of market direction, ahead of the Spring flush, with the market reported to be fairly quiet with the exception of butter which is experiencing increasing demand. Butter continued to record some small price gains of £100/t but SMP, cheddar and bulk cream all eased off by £30/t, £70/t and £25/t respectively. The tone has returned to one of “wait and see” ahead of the Spring flush with trade fairly thin.

The GDT matched this energy over the past two periods, easing 2.8% in the latest, with some moderate declines across most products with the exception of butter.

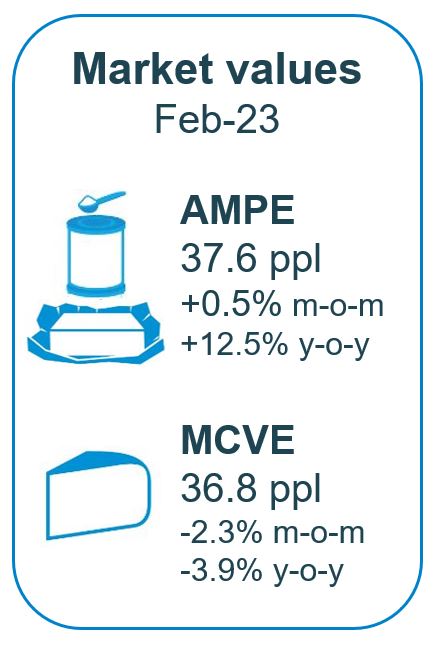

As of February, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) dropped slightly to 35.9ppl. AMPE grew by 0.5%, MCVE lost 2.3%. AMPE is now ahead of a year ago by 12.5%, with MCVE still lagging slightly behind.

Farmgate milk prices

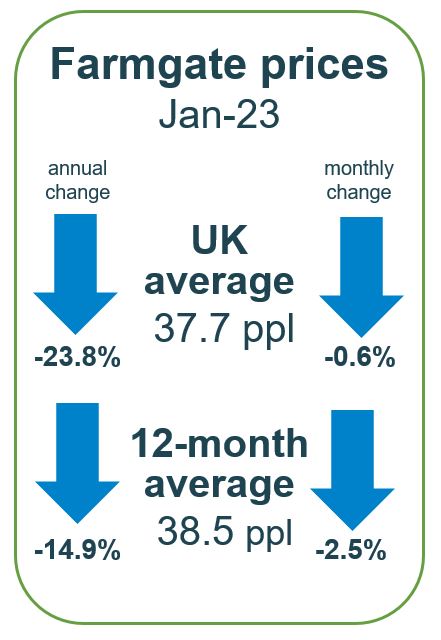

The latest published farmgate price was for January with a UK average of 37.7ppl. Latest announced farmgate prices for March were relatively positive, continue the upward trajectory with processors reacting to the increasing returns from the market during the last few months. For March, announced price increases were generally smaller than those announced for February.

Positive to steady moves on the retail aligned contracts by most of the producers. Sainsbury’s saw an increase of 0.03ppl while M&S hold on to their price from last four months. Co-op Dairy Group and Tesco are holding steady after price increases last month. On non-aligned contracts, prices continue to be steady for another consecutive month except an increase for Payne’s Dairies.

Most of the cheese manufacturers listed on the AHDB league table announced increases for March. The increases in cheese contracts were larger than those on liquid contracts. After having held steady for February, Saputo announced an increase of 1.50ppl. First Milk, Leprino Foods and South Caernarfon Creameries increased their March prices by 1.00ppl each. Lactalis has now moved their milk price up for three consecutive months, increasing by 0.52ppl in March. Barbers and Belton Cheese are holding steady.

Manufacturing contracts remained steady apart from UK Arla Farmers Manufacturing increasing their price by 0.88ppl. Arla Direct Manufacturing are holding after an impressive increase last month. Pattemores Dairy Ingredients have made no change since November.

Input costs

Input costs continue to ease: fuel is back by 15.9%, feed wheat is back by 24.1% and fertiliser costs have halved since last year. Volatility in the inputs market have been a notable challenge for dairy farmers in the past three years and may require new strategies to cope with.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.