Key points from the Spring Statement

Thursday, 27 March 2025

The Chancellor of the Exchequer, Rachel Reeves, delivered the Spring Statement on 26 March 2025, updating Parliament and the nation on the economy, public finances and economic objectives.

The accompanying Economic and Fiscal Forecast from the Office for Budget Responsibility (OBR) revealed that lower-than-expected January receipts pushed borrowing further above forecast, intensifying financial pressures. With a £22 billion deficit, Reeves emphasized fiscal discipline, aiming to restore a £10 billion surplus while mitigating risks related to interest rates, productivity and global trade.

Key announcements

- Reeves reaffirmed her commitment to fiscal rules, ruling out borrowing to fund government spending

- Pledged reductions in both spending and overall debt

- Defence spending to increase by £2.2bn next year, reaching 2.36% of GDP in 2026 and 2.5% by 2027

To achieve these objectives

- Welfare cuts will be extended, saving £4.8bn after previous projections fell short

- Foreign aid will be reduced from 0.5% to 0.3% of gross national income by 2027

- Government departmental administrative costs will be reduced by 15% by 2030

- Civil service jobs will be cut by 10,000, affecting HR, policy, communications and office management

Impact on farming

While the Spring Statement focused on macroeconomic indicators, the upcoming June Spending Review will clarify departmental budgets, including Defra's. The October 2024 budget already signalled shifts affecting the farming sector:

- The full 100% relief from inheritance tax will be restricted to the first £1 million of combined agricultural and business property, Above this amount, landowners will pay inheritance tax at a reduced effective rate up to 20%, raising concerns over farm sales to cover tax liabilities

- National Insurance contributions for employers will rise from April 2025, increasing labour costs

- The farming budget remains at £2.4 billion but is eroded by inflation

- Unexpectedly steep reductions in direct payments for 2025 may cause cash flow challenges for farm businesses

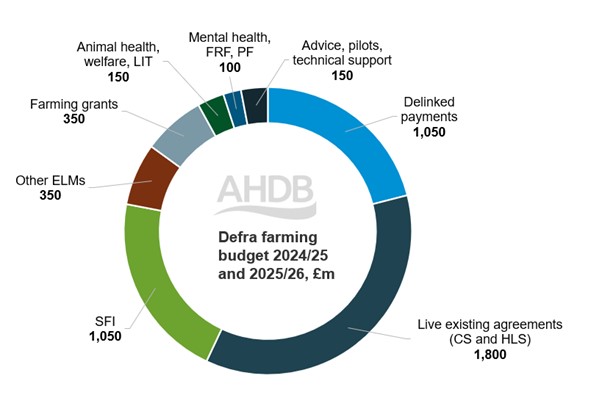

England’s farming budget of £5 billion for 2024/25 and 2025/26 has been allocated across Countryside Stewardship, Higher Level Stewardship, the Sustainable Farming Incentive (SFI) and other schemes.

Figure 1. Defra budget allocation 2024/25 and 2025/26

CS – Countryside Stewardship

ELMs – Environmental Land Management schemes

FRF – Farming Resilience Fund

HLS – Higher Level Stewardship

LIT – Livestock Information Transformation

PF – Prosperity Fund

SFI – Sustainable Farming Incentive

Source: Defra

However, on 11 March 2025, SFI applications were closed after the £1.05 billion funding cap was reached. This could restrict farmers' incomes as direct payments decline.

The Spending Review will determine government allocations until 2030. While Reeves stated that "day-to-day spending would increase in line with inflation," it remains uncertain how much funding will be available for farming beyond 2026. This uncertainty could hinder farmer confidence and investment in the sector, making the coming years financially challenging for many.