Lamb prices supported into Easter

Friday, 28 April 2023

Liveweight

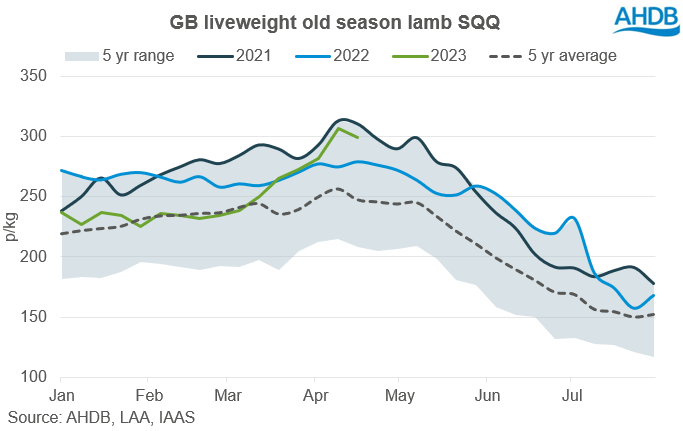

In-line with seasonal trends, the average GB liveweight old season lamb (OSL) price saw month-on-month (MOM) increases, averaging 257.5p/kg, with prices in March up 9.9% (23.2p/kg) on those for February. However, this was 6.0p/kg (-2.3%) lower than the same month last year, driven by the lower prices at the start of March. Prices in the weeks following 18 March saw year-on-year (YOY) rises and peaked at 306.6p/kg (w/e 15 April) following the Easter period, although they slightly declined in the following week (w/e 22 April).

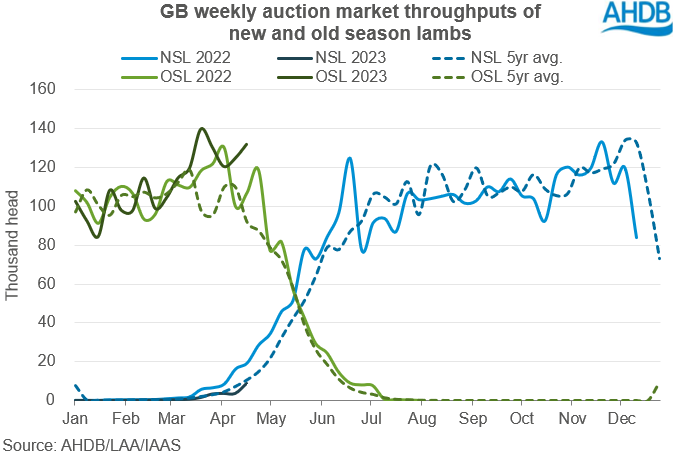

Total throughputs of old and new season lambs (NSLs) came to 511,400 head for March, significantly higher (22.6%, 94,400 head) than February’s total throughputs. March’s throughputs also saw a 9.8% (45,800 head) rise on year-earlier levels. Year-to-date (YTD), total throughputs are up 3.4% (58,800 head) YOY at 1.79 million head (w/e 22 April).

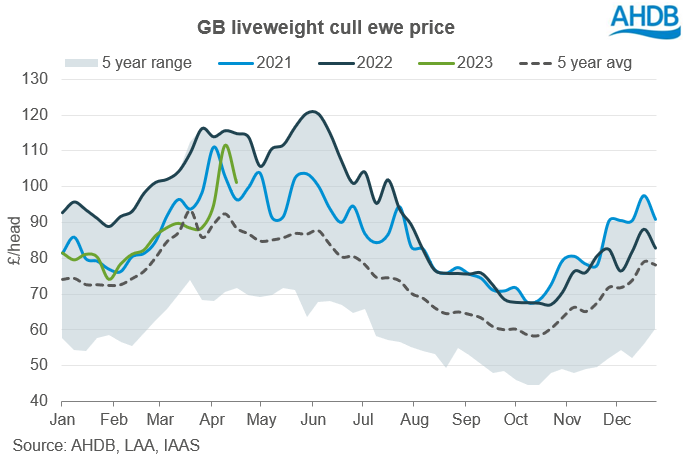

Through March, the average GB liveweight cull ewe price remained relatively steady, ranging by just £1.30/head and averaging £88.81/head for the month, £6.85/head up on February. Since then, we have seen sharp support to prices, reaching a peak at £111.50/head (w/e 15 April) before falling in the following week, roughly in-line with trends seen in 2021.

This sharp week-on-week price decline is likely influenced by the combination of greater supply and the passing of the key Ramadan buying period. Throughputs rose by 35.0% (13,250 head) in the week ending 22 April to 51,200 head, with the average price for the week standing at £101.10/head, down £13.80 on the year. For the YTD, cull ewe throughputs are up 11.8% (62,500 head) on the year at 592,900 head.

Deadweight

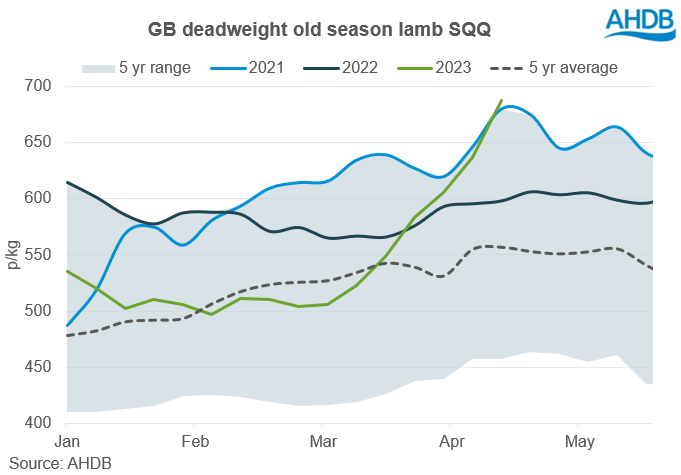

The average GB deadweight OSL price saw large support in March as prices rose by 78.5p/kg, to 583.1p/kg (week ending 01 April).

Prices were 7p/kg higher YOY despite production* rising by 15.2% (3,800 tonnes) YOY in March 2023, and totalling 28,500 tonnes. Production has ramped up in March compared to the first two months of 2023, with YTD production totalling 72,200 tonnes.

Trade has been supported by increased demand in the approach to the key religious festivals of Ramadan and Easter, which both occurred about a week earlier than last year. In the coming weeks, AHDB will be analysing Easter consumption trends, so stay tuned for an article covering this. The current price position of GB lamb on the continent may also be adding support to the market, with market signals suggesting that firm EU prices could continue.

A view to the future

Easter and Ramadan are two key consumption periods for lamb and with these now behind us, it will be important for the industry to capitalise on demand opportunities going forward. With 3 bank holidays in May, we may see demand supported over this period, but weather and promotional activity will likely be key influencers.

Looking at supply for the rest of the year, in our latest market outlook we forecast that the 2023/24 lamb crop could be broadly stable versus a year ago. This assumed fair conditions at lambing and relative stability in the breeding flock. While numbers are still small currently, YTD auction mart throughputs of NSLs are 12.2% (-3,300 head) below the same period a year ago. Meanwhile, prices for spring lambs have rocketed, averaging 356.4p/kg in the week ending 22 April, 25p higher YOY. Supply and quality of these lambs going forwards will be crucial to returns, as will the position of GB prices in the EU market.

*Please note AHDB has queried Defra’s published sheep slaughter numbers and continues to work with industry and Defra to resolve the uncertainties arising from the data set. We imminently await revisions to previous years’ production figures.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.