UK-India trade deal: Prospects for agriculture

Thursday, 13 January 2022

The UK and India have now started negotiating a free trade deal. In this article, we consider the implications for agriculture.

An Enhanced Trade Partnership (ETP) between the UK and India was agreed in May 2021 with investment from India creating jobs in the health and technology sectors in the UK, as well as lowering non-tariff barriers of UK fruit and medical device exports. Negotiations for a UK-India Free Trade Deal (FTA) were formally launched on 13 January, with talks due to start te following week.

What’s the current situation?

Metals and machinery are main UK goods that are exported to India, with refined oil and clothing the main UK imports from India. Agriculture accounted for 16% of India’s economy (value added) in 2019, after the industrial sector which makes the highest contribution to India’s GDP at almost 25%. In contrast, agriculture comprises 0.6% of the UK economy (2019) with the services sector the main contributor at over 70%.

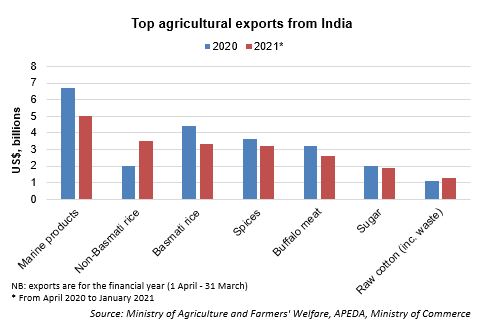

Top Indian food exports are rice, marine products (fish/seafood), spices and buffalo meat.

The table below compares UK and Indian trade in red meat, dairy and cereals.

|

|

Exports, £ millions (2018-2020 average) |

Imports, £ millions (2018-2020 average) |

||

|

UK |

India |

UK |

India |

|

|

Beef |

428 |

2,377 |

1,046 |

|

|

Sheepmeat |

402 |

67 |

333 |

1 |

|

Pork |

368 |

1 |

896 |

2 |

|

Dairy |

1,666 |

188 |

2,845 |

25 |

|

Wheat |

113 |

110 |

373 |

5 |

|

Barley |

222 |

1 |

18 |

27 |

|

Maize |

29 |

222 |

473 |

40 |

Source: IHS Maritime & Trade- Global Trade Atlas®

For most of the products shown, India is a net exporter in value terms and is largely self-sufficient.

A more in-depth look at each of the sectors is available below.

Beef

|

Beef |

2018-20 average |

|

|

UK |

India |

|

|

Production ('000 tonnes) |

915 |

4,090 |

|

Exports (‘000 tonnes) |

121 |

1,051 |

|

Imports (‘000 tonnes) |

262 |

0 |

Source: USDA, IHS Maritime & Trade- Global Trade Atlas®

India was the fifth largest global beef producer, based on the 2018-2020 average, ahead of Australia and Argentina. Despite, the traditional notion that India is mainly a vegetarian country, a recent report by Natarajan and Jacob[1] claims that the extent to which this is true may be exaggerated. The report estimates that only 20% of Indians are vegetarian, with ‘cultural and political pressures’ leading to the under-reporting of eating meat. India’s main religion is Hinduism, which considers the cow to be sacred, but Natrajan and Jacob’s work estimates that 15% of India’s population (or 180 million Indians) consume beef, which is 96% higher than official figures.

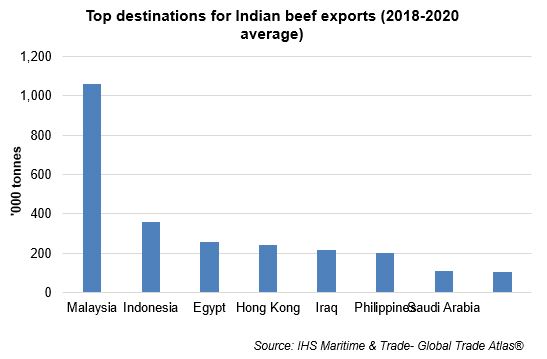

India’s main export destinations for beef are in South-East Asia, the Middle East and Egypt. India’s main competitor for these markets is Australia. Indian cattle are mainly raised on natural feed so costs are lower compared with systems that use antibiotics, growth enhancers and hormones. However, the Indian beef sector has obstacles, such as bans on the sales of live cows for slaughter to contend with, as well as the general preference of Australian beef.

[1] (PDF) 'Provincialising' Vegetarianism Putting Indian Food Habits in Their Place (researchgate.net)

Sheepmeat

|

Sheepmeat |

2018-20 average |

|

|

UK |

India |

|

|

Production ('000 tonnes) |

298 |

268* |

|

Exports (‘000 tonnes) |

89 |

14 |

|

Imports (‘000 tonnes) |

66 |

0 |

*2017-19 average used as that is the latest data available

Source: USDA, FAO, IHS Maritime & Trade- Global Trade Atlas®

India’s sheep meat production is at a similar level to that in the UK, however, consumption per capita is lower. In 2020, Indian sheep meat consumption was estimated at 0.5 Kg per capita, whereas for the UK this figure was 3.9 Kg per capita (OECD).

As the table above shows, India’s exports of sheep meat are only around a sixth of the figure for the UK, although there are negligible Indian sheep meat imports.

India’s main export products are fresh/chilled sheep carcases. It is difficult to source data for Indian sheep meat export destinations, but for sheep and goat meat, the Middle-East is the main market.

Pork

|

Pork |

2018-20 average |

|

|

UK |

India |

|

|

Production ('000 tonnes) |

956 |

372* |

|

Exports (‘000 tonnes) |

241 |

1 |

|

Imports (‘000 tonnes) |

430 |

1 |

*2017-19 average used as that is the latest data available

Source: USDA, FAO, IHS Maritime & Trade- Global Trade Atlas®

India’s average pig meat production from 2018 to 2020 was around 370,000 tonnes, and less than half of UK production over a similar timeframe. Consumption of pig meat in India was 0.2 Kg per capita in 2020 (OECD) compared with 15.8 Kg per capita for the UK. The Indian pig sector has been described as ‘highly unorganised’ and the majority of pigs are reared in small scale settings. The number of semi-commercial pig farms is limited.

Another issue is that India’s pig breeds are unsuitable for high quality pork production. To improve this situation, the state of Maharashtra is planning to import Canadian pigs but it will take time for numbers to develop to make a significant difference to the sector.

Dairy

|

Dairy |

2018-20 average |

|

|

UK |

India |

|

|

Production ('000 tonnes) |

|

|

|

Liquid milk |

6,138 |

194,993 |

|

Butter |

176 |

6,083 |

|

Cheese |

477 |

1 |

|

Exports (‘000 tonnes) |

|

|

|

Whey* |

64 |

0.4 |

|

Butter |

43 |

17 |

|

Cheese |

197 |

18 |

|

Imports (‘000 tonnes) |

|

|

|

Whey* |

57 |

10 |

|

Butter |

70 |

0.4 |

|

Cheese |

519 |

2 |

*includes other products containing natural milk constituents (e.g. lactose)

Source: USDA, IHS Maritime & Trade- Global Trade Atlas®

India is the world’s largest liquid milk producer with average output at over 190 million tonnes. Liquid milk is the most widely consumed dairy product in India and accounted for almost two thirds of the market share (by value) of Indian dairy consumption in 2017.

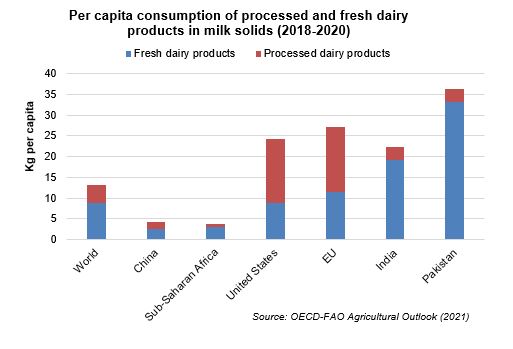

The graph below shows that Indian dairy consumption per capita mainly comprises fresh, rather than processed products. In the past decade, however, there have been signs of a shift towards processed, value added products such as cheese, yogurt and flavoured milk.

India is not a major dairy exporter and out of the small dairy products it does export, butter is predominant followed by milk powder. The main export destinations for India’s dairy products are Bhutan, Bangladesh and the United Arab Emirates.

Lactose and whey powder are the main Indian dairy imports. Lactose is used in the food and pharmaceutical sectors, including the production of baby milk formula. The main import origins are France, Turkey, Norway and Germany.

India has high tariffs on dairy imports and in 2019 had the second highest average final bound tariffs on dairy products in the world (after Pakistan).

Cereals

|

Cereals |

2018-20 average |

|

|

UK |

India |

|

|

Production ('000 tonnes) |

|

|

|

Wheat |

13,146 |

103,777 |

|

Barley |

7,558 |

1,711 |

|

Maize |

25 |

29,330 |

|

Exports (‘000 tonnes) |

|

|

|

Wheat |

663 |

530 |

|

Barley |

1,405 |

3 |

|

Maize |

165 |

1,170 |

|

Imports (‘000 tonnes) |

|

|

|

Wheat |

1,952 |

29 |

|

Barley |

88 |

139 |

|

Maize |

2,743 |

192 |

Source: Defra, USDA, IHS Maritime & Trade- Global Trade Atlas®

In terms of grains, India’s main product is rice and the country is the world’s second largest producer of rice after China. India is also the world’s second largest wheat producer after China but, like China, is not a key exporter as most of the crop is domestically consumed.

Nepal, Bangladesh and Afghanistan are the main export destinations for the India’s relatively small exportable surplus of wheat.

Barley is grown at a much smaller scale compared to wheat and maize in India Around 80% is used for animal feed and 20% is used for human consumption, including malting and brewing. The state of Rajastan, which has a strong livestock industry, is the main barley producing state in India. There is potential for higher malting barley demand in India from the emerging middle class which could lead to opportunities for the main global barley exporters. Argentina and France are the main origins for Indian barley imports.

After rice and wheat, maize is the third largest crop that is grown in India. The majority of domestic consumption is for animal feed. Ethanol production is also likely to become an increasing source of demand for maize as India’s 2025 Ethanol Roadmap seems to favour food crops such as maize for ethanol production rather than second generation waste products. The use of grains such as maize in ethanol production is predicted to increase four-fold by 2025, although this is considered to be rather optimistic. India is a net exporter of maize, with Bangladesh and Nepal the main export destinations.

What’s the potential for agri-food trade between UK and India?

For the sectors shown above, there is not much, if hardly any trade between the UK and India. The current tariff rates will be a key factor here with India’s average tariff rates on most products, including food, higher than those for the UK. India also has a higher number of non-tariff measures, such as sanitary and phytosanitary conditions (SPS), quantitative restrictions and safeguards compared to the UK and so an FTA between the UK and India could provide beneficial for the UK if there is some relaxation on this front from India. Sanitary and phytosanitary standards are complex and challenging for agri-food firms wishing to export to India. The FTA will seek to enhance access for agri-food by increasing transparency of SPS standards in order to help UK firms trade more easily.

From a UK perspective, there is certainly potential in the Indian market for value added dairy products such as cheese. As mentioned above, although fresh dairy products are more widely consumed in India, there has been growth in demand for value added dairy products. While demand for higher value dairy products is at a relatively low base, the growing middle class and huge population in India provides opportunities.

There may also be some potential for UK sheepmeat exports to India. At the end of 2018, India gave access to British sheep meat imports for the first time. As with value added dairy products, although Indian sheep meat consumption is relatively low, there is opportunity for this market to grow.

Topics:

Sectors:

Tags: