Agricultural price inflation: conflict drives volatility in key input markets

Friday, 2 February 2024

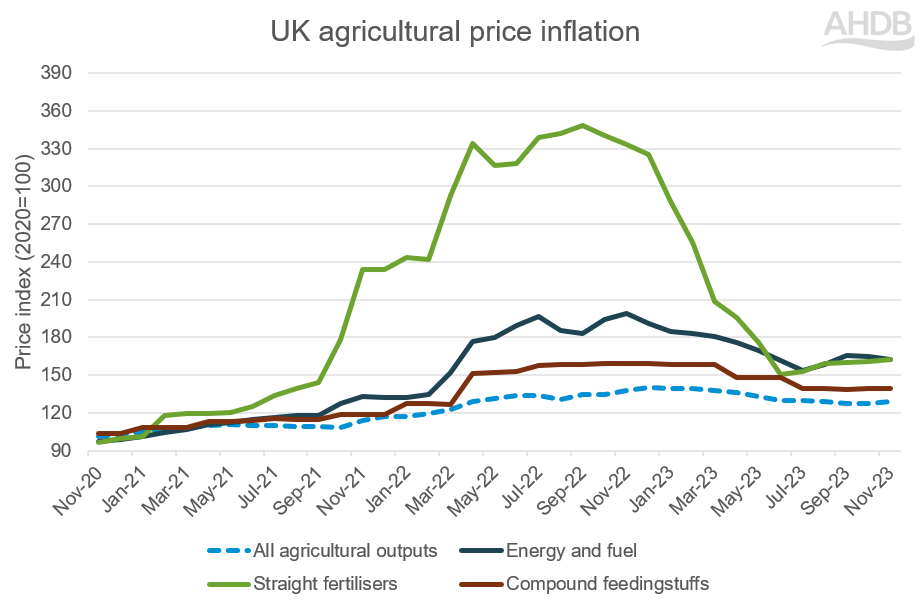

The latest Agricultural Price Index (API) for all agricultural outputs decreased by 6.5% year on year in November 2023, remaining lower than inflation seen in inputs despite all agricultural inputs falling by 10% year-on-year. The Bank of England’s Bank Rate remains unchanged since July, sitting at 5.25%, its highest level for 15 years.

Although there has been some easing in both general inflation and food price inflation, it is likely that agriculture will continue to endure relatively high input costs through 2024, impacting overall farm profitability.

Source: Defra

Fertiliser price inflation saw the largest decline, with a drop of 50% since the start of the year (Dec 22 vs Nov 23) and down 51% from the inflationary peak seen in September 2022. GB fertiliser prices have generally remained stable but have eased slightly since rising to historically high rates in 2022. In November 2023, the average GB fertiliser price for UK-produced ammonium nitrate sat at £384/t, the first figure published since August, rising by £14/t. The imported AN price sat lower, at £359/t for November 2023, almost half of the price it sat at for the same time last year. Supply has been a key driver of the most recent price rises, due to reduced output from some exporting countries. However, with fertiliser price movement closely mimicking the natural gas market, which has seen stability in recent months, it is likely fertiliser will follow suit.

Energy and fuel price inflation has decreased by 17% from the start of 2023 (Dec 22 vs Nov 23), and 18% from the peak seen in November 2022. Despite a small peak, due to increased energy demand going to the colder months, the rate of inflation has fallen marginally. Year-on-year red diesel prices have been easing, closely following the crude oil market. The red diesel fuel price for November 2023 was 90.74ppl, a fall of 21% from November 2022. Additionally, the recent disruption in the Middle East has the potential to result in short term variation in energy prices.

The disruption in the Middle East has led to shipping delays, caused by combined disputes including the Israel/Gaza conflict and attacks to commercial shipping in the Red Sea, negatively impacting trade and imports of key inputs such as fertiliser and oil. The scale of the impact is currently under speculation. However, it is likely to influence prices and domestic inflation due to increased transports costs associated with avoidance of key shipping lanes.

The rate of inflation of compound feeds appears to have stabilised since July, with the compound feedingstuffs price index down just 0.1% since July and down 12% since the start of the year (Dec 22 vs Nov 23). Feed wheat futures remain under pressure, with a bearish outlook regarding competition from Black Sea grain supplies, benign global weather and influence from currency movements. With challenging market conditions, lacklustre demand and greater end-of-season supply levels, a downward trend looks likely. Find out more about the cereals and oilseeds markets in our upcoming Agri-market outlooks.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: