A nation of cheese lovers

Monday, 15 March 2021

Cheddar remains the ‘big cheese’ in British homes, but throughout 2020 speciality and continental cheese have seen a large uptake as consumers looked for taste and variety during the Covid-19 pandemic.

Retail sales growth of cheese is likely to slow in 2021, as people are able to return to out-of-home dining. However, there are some key areas of opportunity that could help maintain momentum from 2020.

Cheddar was the big winner

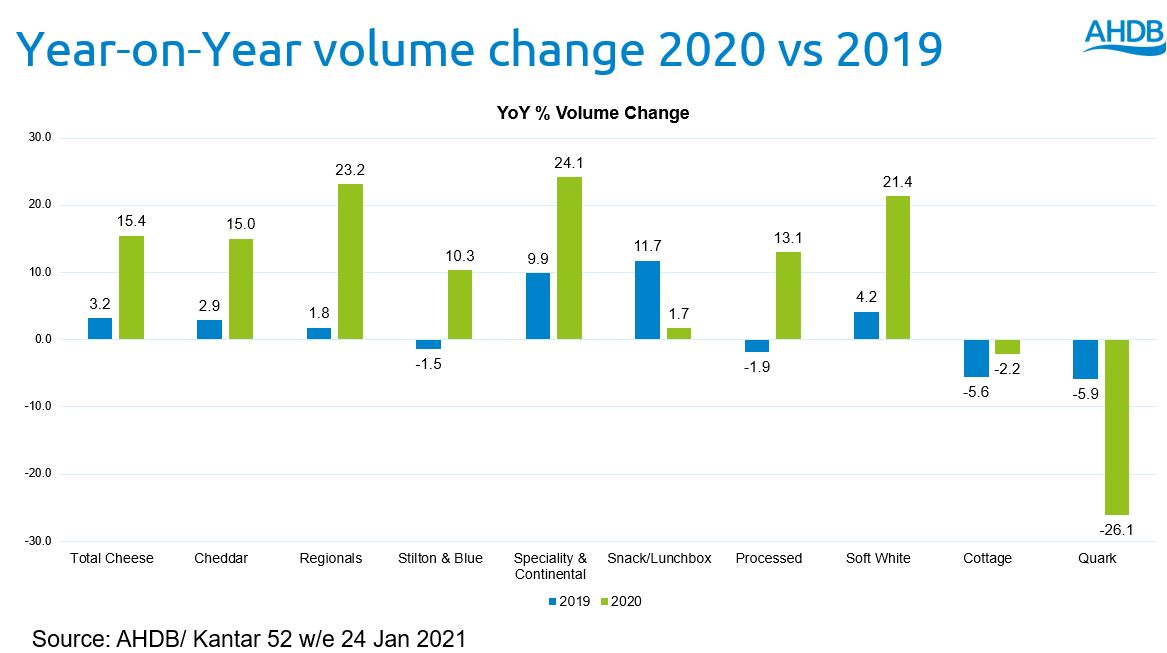

In the 52 w/e 24 Jan 2021 the total retail sales of cheese increased in both volume (+15.4%), and value terms (+16.5%), providing a record year for cheese. Kantar data shows total cheese volumes increased by 72m kg. Although regionals, speciality/continental and soft white cheese experienced volume uplifts of more than +20% YoY, the volume increase of Cheddar was exceptional at +15% YoY. This is because Cheddar represents roughly half of the total cheese market and was therefore responsible for almost 50% of the overall volume increase for cheese (Kantar 52 w/e Jan 2021).

1.2bn more cheese occasions

As a result of the Covid-19 pandemic and governmental restrictions throughout 2020, there were an additional +1.2bn in-home cheese occasions compared to 2019. This is equivalent to a year-on-year uplift of +20%, ahead of total food and drink at +12% (52 w/e 29 Nov 2020).

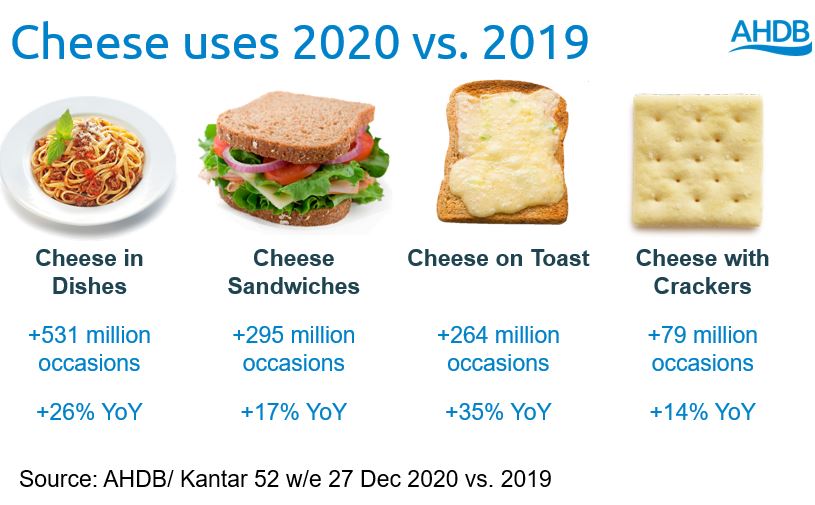

Cheese is renowned for being a highly versatile and tasty ingredient, providing many consumers with a simple yet flavoursome addition to most meal occasions. The top performing meal occasions for cheese can be split into three key categories: cheese in dishes, cheese in sandwiches and cheese snacks. Cheese used within or on top of dishes, for example macaroni cheese and spaghetti bolognese, saw growth of +26% YoY, the equivalent of an additional 531m occasions. Furthermore, savoury snacks such as cheese on toast and cheese with crackers generated +343m occasions.

Opportunities for the future

Following the government’s road map to lifting lockdown, in-home lunch and evening meal occasions are likely to be impacted in the future, with more lunches being carried out of home and a rise seen in evening meals consumed in foodservice outlets.

There are three key opportunities to promote total cheese growth going forward:

Inspire people to use cheese as a regular ingredient at in-home evening meal occasions by promoting the complementary aspect of cheese. For example, grated cheese complements the family favourite meal spaghetti bolognese.

Italian food is the nation’s favourite cuisine and in the 52 w/e 29 Nov 2020, there were 349m spaghetti bolognese meal occasions – a year-on-year increase of 12%. Yet just 23% of these meals were topped with cheese. If this were to increase by an additional 5%, to 28% of occasions, it would generate an extra £3.1m worth of cheese sales (Kantar 52 w/e 29 Nov 2020).

This meal is also less likely to be impacted by the return of the carried-out lunch and re-opening of foodservice outlets, as 85% of spaghetti bolognese meal occasions were consumed as an evening meal (52 w/e 29 Nov 2020).

The in-home lunch occasion has grown by +37% in the 52 w/e 29 Nov 2020, as more people stayed at home due to the nationwide lockdown. As governmental restrictions ease, 54% of consumers expect to only take packed lunches when they return to their place of work. Find out more information on how food-to-go needs have evolved due to the Covid-19 pandemic here (Lumina Intelligence Channel Pulse, wave 23). This provides an opportunity to encourage cheese as a snack within the carried-out lunch, instead of just viewing cheese as a sandwich filling. For instance, if 1% more carried out lunch occasions were to feature cheese, an additional 20m cheese occasions would be generated (Kantar 52 w/e 29 Nov 2020).

In addition, the Covid-19 pandemic has generated economic uncertainty. In previous recessions we have seen the level of snacking increase, as consumers turn to comforting foods. This provides the cheese category with an opportunity to promote cheese as a tasty snack. This does not necessarily mean promoting cheese packaged in snacking formats but actually encouraging people to consume their favourite cheese as a snack.

The Covid-19 pandemic has highlighted the importance of health and it is predicted the trend for healthy eating will eventually make a comeback. In the 52 w/e 29 Nov 2020, an extra 64m cheese servings were chosen for health reasons. Consumers cited the more natural aspect of cheese, as well as it contributing to a varied diet, as key reasons behind this trend. Healthy cheese occasions are more likely to be quick and easy meals and therefore the natural credentials of cheese, such as being a source of calcium and protein, should be showcased and promoted in the future weeks and months.