Consumer cooking trends: Healthy and convenient meals on the rise

Friday, 28 March 2025

Brits are still consuming most of their food and drinks in the comfort of their own home vs pre-COVID times with, 71% of all meal occasions eaten at home (Kantar Usage 52 w/e 29 December 2024). In the last year, three main trends have evolved: health, cuisine based and convenience, as these have all had a greater influence on consumers’ meal choices.

The need for convenience

Consumers want to spend less time cooking as meal preparation time continues to reduce, following the trend seen over the last five years to an all-time low of just 31 minutes for the evening meal.

Average preparation time for lunch and evening meal from 2020 to 2024

.png)

Source: Kantar Usage 52 w/e 29 December 2024

At the same time, there have been increases in meal servings which are easy to prepare and clean up, involve less cooking or are quick to prepare. This has also been seen at lunch, with average preparation times also reducing over the last five years to less than 15 minutes (Kantar Usage 52 w/e 29 December 2024).

This desire for convenience has caused meals to become simpler, with fewer ingredients being used across all lunch and evening meal occasions – both now having less than five ingredients on average. The number of categories contributing to a meal over the last five years has seen a gradual decline as this provides financial savings when cost is a key consideration (Kantar Usage 52 w/e 29 December 2024). Despite this trend, the top meal choices have remained broadly similar.

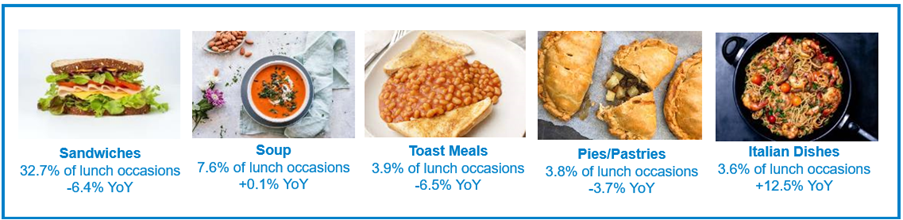

Top five lunch options

(Kantar Usage 52 w/e 29 December 2024)

Sandwiches continue to dominate at lunch due to their ease and simplicity and have a 32.7% share of lunchtime occasions (Kantar Usage 52 w/e 29 December 2024). With an increase in people returning to the office, more convenient lunch options are increasing in popularity year-on-year, such as soup (+0.1%), chicken portions (+4.9%) and pizza (+4.4%), as consumers have less time available for lunch (Kantar Usage 52 w/e 29 December 2024).

Top five evening meal options

(Kantar Usage 52 w/e 29 December 2024)

This trend is also being seen at evening meals. The top choices for evening meal choices show a lean towards more cuisine-based choices such as Italian, Oriental and Indian.

Cuisine-based dishes

As many people continue to work from home, people are drawn to hot, easy-to-prepare lunch options. Options such as pizza and Italian dishes are in growth at lunch – +4.4% and +12.5%, respectively, year-on-year – showing a preference towards more cuisine-based options, potentially influenced by different cooking styles from across the world (Kantar Usage 52 w/e 29 December 2024).

Italian dishes (11.9% share) remain the most popular choices for evening meals (Kantar Usage 52 29 w/e December 2024). Consumers regard Italian dishes as firm family favourites; they predominantly include cheese, which makes a meal more enjoyable and increases taste (Kantar Usage 52 29 w/e December 2024). They also commonly include red meat such as beef or pork mince which deliver on taste but can also be a more cost-effective option for the whole family.

Enjoyment is the main factor contributing to the growth of these dishes, but taste, practicality and indulgence are also all considerable factors (Kantar Usage 52 29 w/e December 2024).

Health

Health is becoming more important to consumers in 2025, which is influencing their decisions on what meals to cook. Consumers are adding red meat and dairy into their diets to be healthier; the dishes which have the greatest share of servings picked for health reasons include salad and stew/casserole (Kantar Usage 52 w/e 29 December 2024). Mexican dishes proved popular for combining both meat and dairy ingredients, while servings with dairy chosen for health reasons increased by +3%pts during 2024. The growing interest in health is predominantly being driven by families. Retired households consume the most meals for health, but this has been declining (Kantar Usage 52 w/e 29 December 2024).

Meat alternatives consumption is in decline and has seen a decrease in the share of food occasions which feature meat alternatives and a plateauing of dairy alternatives (Kantar Usage, 52 w/e 29 December 2024). Instead, consumers are turning to meals that include red meat and dairy for their enjoyment, practicality and natural health benefits.

The health trend has benefited cow’s yogurt as volume has increased 7.9% year-on-year (NIQ, 52 w/e 22 February 2025), as consumers continue to choose it for its health and enjoyment factors (Kantar Usage 52 w/e 29 December 2024). Yogurt has seen a boost in occasions at breakfast time and as a dessert.

Opportunities for meat and dairy

As consumers move towards more convenient and simple meal options, quick, easy recipes that include meat and/or dairy should be highlighted, such as those in our Lets Eat Balanced campaign and This is British Pork. But not as you know it campaign.

Continue to remind consumers that the presence of red meat and dairy makes a meal more enjoyable and can play a key role in providing a healthy, balanced meal for all the family.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: