Processed meats boosted by premiumisation

Wednesday, 1 December 2021

Processed red meat is a hugely important category for meat in retail. Processed accounts for 39% of red meat value sales and 37% of red meat volume sales for the 12 weeks ending 31 October 2021 with 96% of households buying a processed meat product in the last year. Out of home, processed meat is also dominant with 83% of meat meals containing processed meat.

We define processed as burgers and grills, sausages, sliced cooked meats, bacon and gammon.

Key opportunities for processed meat are:

- To play on consumers need for enjoyment by communicating tasty and filling qualities

- Premier tier is particularly important online, so making sure the offering is right here and quality clearly communicated

- Increased need for value for money is likely to be a factor in the future and processed meat has a great offering here

Retail

According to Kantar, 141k tonnes of processed red meat, worth £963m, was sold in the 12 w/e 31 Oct 21. Volume sales were down 5.4% on the same period last year but up 1.3% on 2019 – which is growing at the same pace as total MFP.

Pig meat makes up the lion’s share of processed red meat with 85% of volume share, followed by 14% for beef (12 w/e 31 Oct 21). Lamb remains a very small part of the market with only 1% of volume sales. Processed beef takes a larger share of processed red meat during the summer and BBQ season with share peaking at 19% in June in both 2021 and 2020.

Processed meat is often not considered particularly healthy by consumers with only 9.6% of processed meat meals chosen for health reasons, compared to 26.5% for primary meat (Kantar, 12 w/e 8 Aug 2021). However, this has been an area of growth for processed meat, driven by processed pig meat with sliced cooked meat and bacon increasingly being chosen for health. Shoppers are also turning to more healthy pork sausages, with volume sales up 25.7% year-on-year compared to declines for total pork sausages (Kantar, 12 w/e 31 October 2021).

Beef burgers

Beef burgers were the most popular beef meal over the summer of 2021, beating even spaghetti bolognese. Positioning burgers as an easy meal for families or a fakeaway for couples pulls them away from being dependent on the BBQ and the summer period.

During the summer, beef burgers over index in convenience stores showing BBQ meats are generally still an impulse purchase. Despite most growth coming from the online channel, burgers still under index. Therefore, we need to remind shoppers when they are buying online to prepare for BBQs and encourage shoppers to add burgers to their shopping lists.

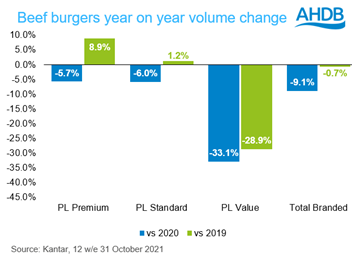

Growth on 2019 is coming from standard and premium tier burgers at the expense of value and branded.

Over time we have seen premium growing its share of burger volumes. Part of the reason for this could be the switch to more online shopping. Previous AHDB online shopper journey research shows tiers are more important online as shoppers use these as an indication of quality. Shoppers can’t see the product in real life, so are more likely to trade up online.

Sliced cooked meats (SCMs)

Pork sliced cooked meats are currently the largest area within processed pork accounting for 32% of volume sales in the last 12 weeks to 31 October 2021. Pork SCMs saw growth on 2020, one of the only cuts to see growth year-on-year, gaining share from bacon and over taking sausages as the biggest category. The return to school and work has meant carried out lunches and ham sandwiches remain one of the most popular options for lunchboxes. Our recent continental meats article has more detail on this area of the market.

SCMs are the area of largest growth for processed beef, up 4.0% compared to 2019 (Kantar, 12 w/e 31 Oct 2021). Much of this is eaten by older consumers for in-home lunches. Lunchboxes are hugely important to sliced cooked meats but beef SCMs under index in this area. There are opportunities to communicate the variety of beef SCM.

Sausages and bacon

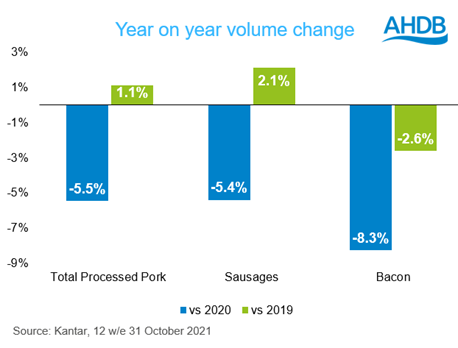

Sausages account for 31% of processed pork and bacon is also a large part of the market at 28%. Both bacon and sausage volumes declined compared to 2020 but sausages were in growth compared to 2019 (Kantar, 12 w/e 31 October 2021)

As with beef burgers, we have seen growth in pork sausages and bacon coming from premium tier products via the online channel. This may be driven by promotions as within processed pig meat, premium products are more than twice as likely to be sold on promotion. Despite these extra sales on promotion, it still represents a trade up in value. For sausages, the average price of on-promotion premium products is £1.27 per kilo higher than standard products without promotion.

Over half of sausage consumption is at the evening meal (Kantar, 12 w/e 8 Aug 2021) so focus should be on family favourite dinners such as sausage and mash and toad in the hole. Sausage consumption is driven by taste and filling needs, so communicating these will be important. They are also more likely to be chosen as a treat, compared to other processed products.

Sausage purchases are driven by affordability and practicality. As sausages are seen as a good value product, they perform well when shoppers are price sensitive and therefore there are opportunities for sausages going forward.

Breakfast is the most important meal occasion for bacon, accounting for 40% of bacon meals, with bacon sandwiches being the favourite at breakfast followed by a fry up. As some of us spend more time at home, there are opportunities for bacon to win more share of the in-home lunch.

Lamb

Processed lamb is by far the smallest area of processed, accounting for less than 1% of processed red meat, bought by only 11% of households in the last year and with less than 100 products (SKUs) in the major supermarkets compared to over a thousand for beef and chicken and five thousand for pig meat. This huge under-trade for lamb poses a big opportunity for the industry. Consumers are becoming more adventurous with their BBQs and having lamb could appeal to shoppers if the ease of cooking is communicated. Kebabs/koftas and burgers/grills are the most popular formats for processed lamb.

Lamb is viewed as a favourite by many and 54% agree lamb is a tasty meat (AHDB/YouGov Aug 2021). However, many are being priced out of buying in to the protein with 64% saying lamb is too expensive to buy on a regular basis (AHDB/YouGov Feb 2020) with roasting joints being the viewed as the most expensive. Processed lamb is, on average, £3.62 per kilogram cheaper than primary lamb. There is opportunity to engage new lamb shoppers, who may be price sensitive, to buy in to these cheaper processed cuts.

Foodservice

In the out of home market, there were 932 million meals with processed meat in the 12 w/e 5 Sep 21. This is every person eating processed meat 16 times over the 3 months. This is a very high frequency of purchase, showing that as shoppers return to eating out, processed products are one of the meals they’re gravitating towards. We have also seen shoppers sending more per meal on processed food at £4.24, up 60p (+16.5%) on 2019.

Beef burgers are the most popular meal out of home for processed meat, with an 11% share of processed meat meals.

Bacon or sausage rolls/baps and pastry sausage rolls are also in the top 4 processed meat dishes out of home. However, their recovery has been slower than other processed meals as they are more reliant on food to go consumption. Whereas burgers have continued to grow through deliveries.

English breakfasts have also been impacted as there are less dine in occasions and evening meals have become more important as we return to dining out. All day breakfast options or encouraging takeaway or delivery breakfasts boost this meal.