Takeaways and food delivery under lockdown

Wednesday, 24 June 2020

Restaurants, pubs and cafes have now been closed for 12 weeks, only able to operate for takeaways and deliveries. Despite now making up the majority of the foodservice market, takeaway and delivery sales have declined year-on-year, driven by the temporary loss of big fast food chains. Using new data from Kantar, AHDB estimated the impact on volume sales of AHDB sector products including red meat, cheese and potatoes.

Market performance

Growth in the takeaway and delivery market before COVID-19 restrictions was strong, with the number of items sold up 8% year on year. In the week prior to lockdown, growth accelerated to 27% as diners swapped restaurant visits for socially-distanced dining at home. However, once the lockdown was fully implemented, many big operators closed which caused orders to slump.

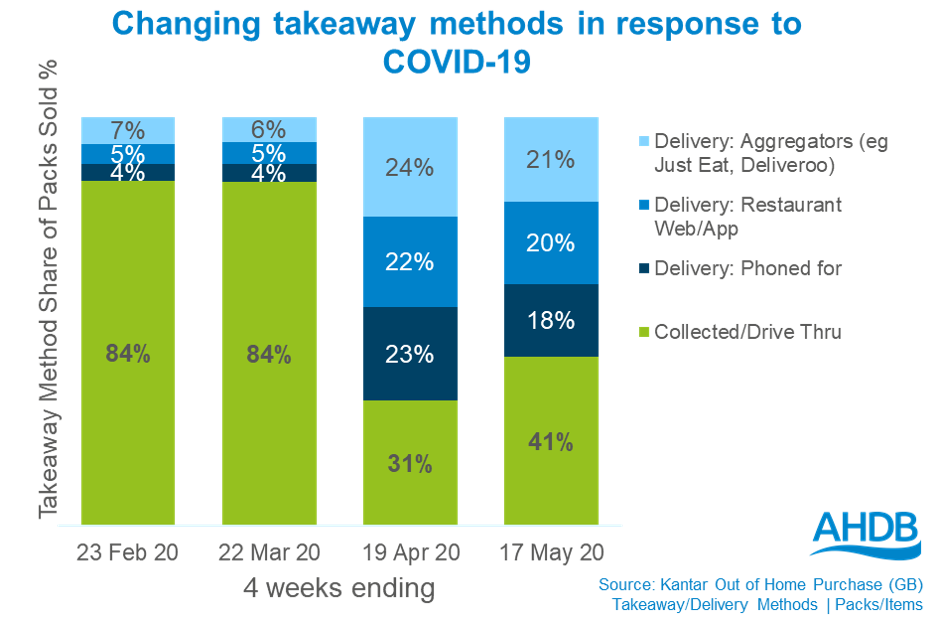

One big shift in the market was in the method of distribution. Takeaway collections and drive-through typically account for over 80% of items sold, but April saw their share collapse to 31% as consumers observed strict social distancing rules and fast food drive-throughs closed. Routes that involve minimal contact, such as delivery, grew by 192%, but this was not enough to offset the losses in collections and drive-through. Overall, the market declined by 41% in the month up to mid-April. Declines slowed in the following month, to -20% year on year, driven by an uplift in collections and drive-throughs.

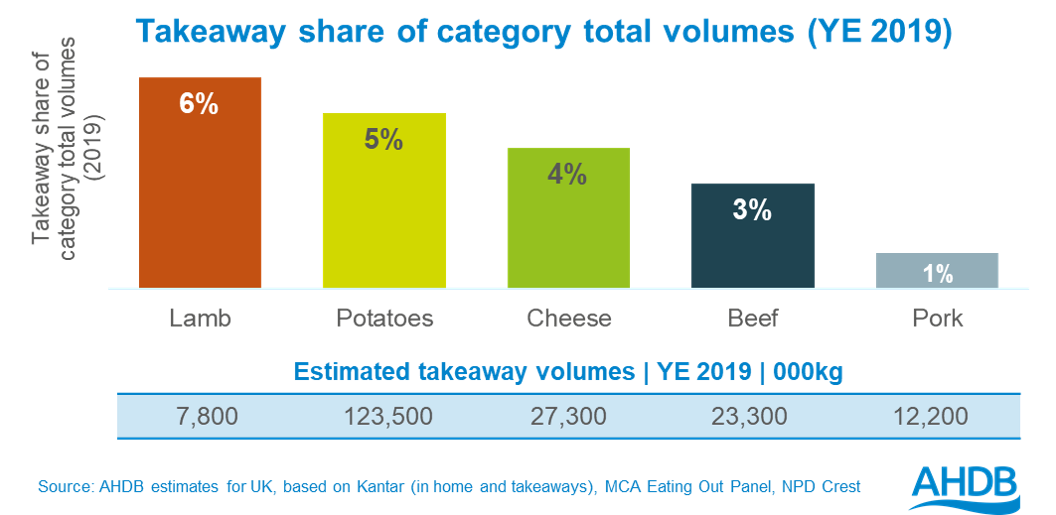

The takeaway and delivery market is more important for some AHDB sectors than others, because of the nature of the dishes popular in this channel.

Of all the lamb sold in 2019 in the UK, AHDB estimates that around 6% was sold in a takeaway or food delivery. Of this, a full 60% was used to produce that staple, the lamb kebab, while a further 27% went into Indian food. Of all the AHDB sectors we analysed, lamb has the biggest dependency on the takeaway and delivery market.

Potatoes and cheese see 5% and 4% of their volumes sold in this channel respectively, due to the popularity of chips and pizzas.. Burgers are the most significant beef dish in this market, as other beef dishes which are popular in the wider foodservice market, like steaks, sandwiches and roasts, don’t lend themselves well to takeaways. Only 1% of pork is sold through the takeaway and delivery market, the majority being bacon on burgers.

Impact on red meat, cheese and potatoes

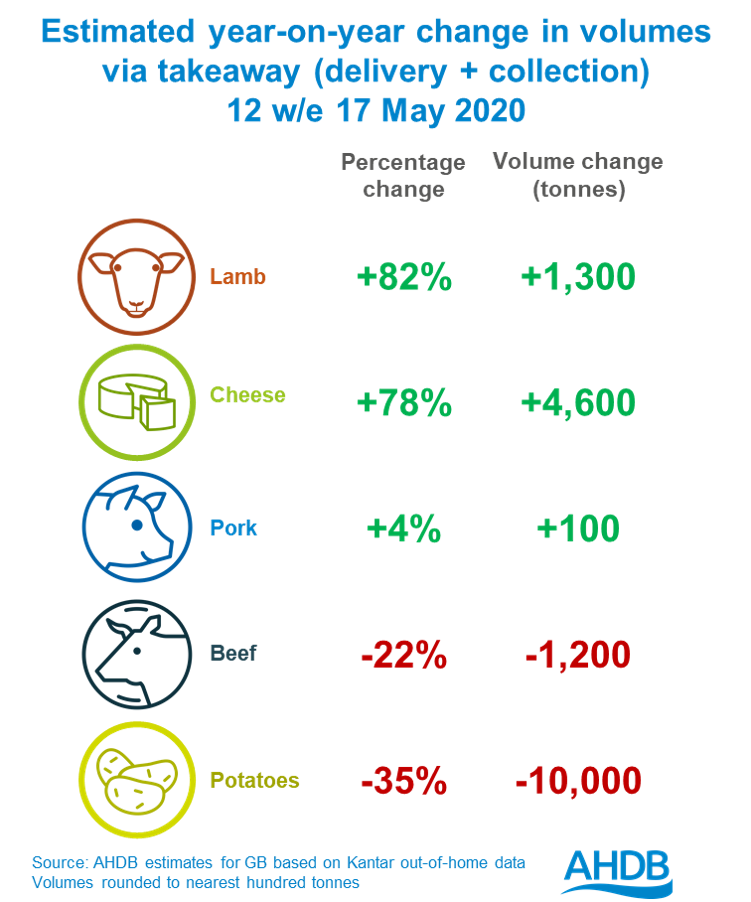

During the COVID-19 lockdown, many large chains closed their doors entirely for a few weeks leaving smaller independents serving the market, although some large pizza delivery chains continued to operate. This benefited some dishes, such as pizza, Chinese cuisine and Indian cuisine, boosting the performance of lamb and cheese. The loss of major burger chains hindered beef and potato performance, with potatoes further affected by a fall in the number of portions of haddock, cod and scampi sold.

Leaving lockdown

The eating-out market is expected to start opening again from 4 July, although it is likely to be operating at a reduced capacity to comply with COVID-19 secure guidelines. In the meantime, many major chains have reopened for takeaway and delivery, including McDonalds and Burger King. This should benefit beef and potato volumes, but may slow the growth of lamb and cheese dishes as they compete for consumers’ orders. We therefore expect the takeaway and delivery market to peak in June but maintain double-digit growth until the eating-out market starts to normalise. If all goes well, this could happen in the latter half of 2020. However, under scenarios which see lockdown measures re-applied or extended, we expect takeaway and delivery growth to slow because of the negative impact on consumer spending.

Related content

Topics:

Sectors:

Tags: