What is food-to-go and why is the UK market growing?

Friday, 7 July 2017

This article is from 2017 - see our most recent food-to-go article for current trends.

The food-to-go industry is evolving and extending its scope. New ways of reaching consumers have been found and specific consumer needs are increasingly being met. This article describes some of the reasons why sales of food designed to be eaten now have increased.

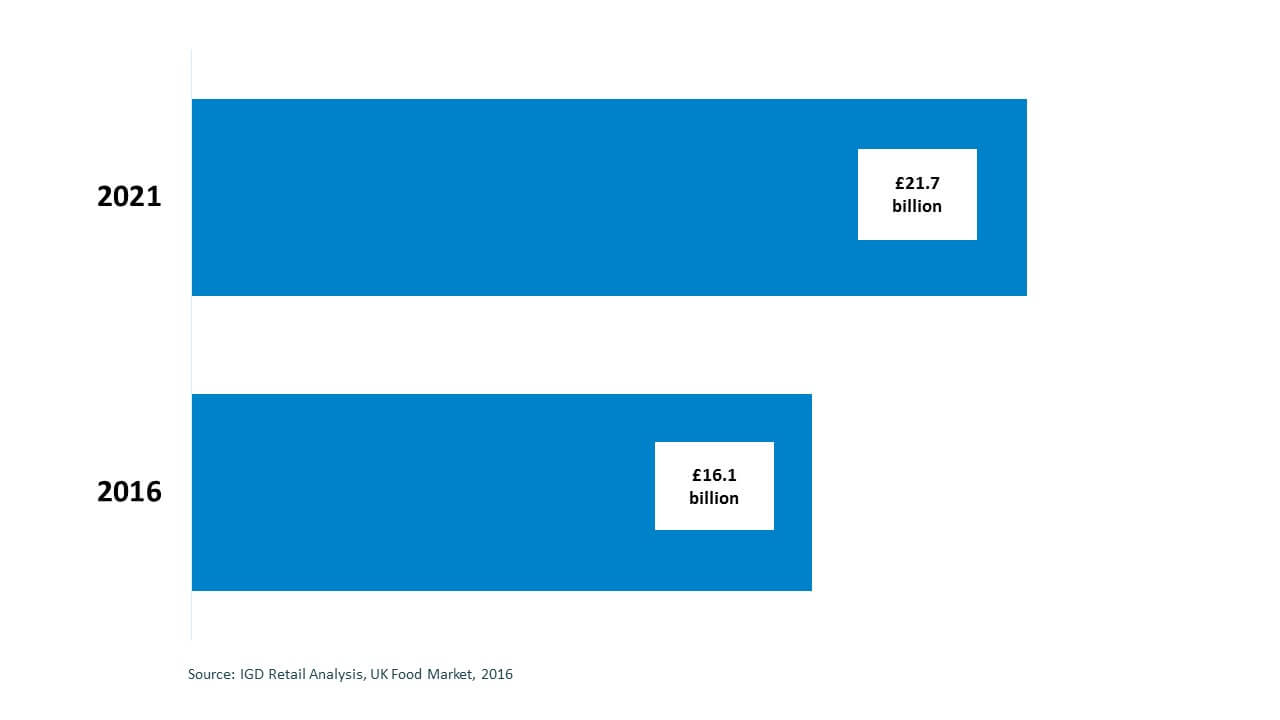

In 2016 the food-to-go market was worth £16.1 billion and retail research organisation IGD forecast this to grow to £21.7 billion by 2021.

What is food-to-go?

Food-to-go is defined as products that are ordered or bought at a counter and delivered with minimum customer service. The product will be a portable single portion, designed for out-of-home consumption and not served on a plate, the packaging will usually be disposable. The food will not require cooking, but may be re-heated or assembled. Food bought in this way is intended to be consumed soon after purchase.

The food-to-go sector includes specialists, for example burger, chicken and pizza take-away shops. Convenience stores and supermarkets are also a big part of this market along with coffee shop chains.

Lifestyle

Research by GlobalData shows UK consumers spending more time commuting to and from work and more time at work, they go on to describe how, for many, time is becoming a scarce resource. IGD has identified a clear desire among Brits to allocate less time to chores and more time to keep-fit, hobbies, socialising and fun. These lifestyle changes are particularly true for younger career-focused consumers who are becoming more reliant on time-saving products, across all sectors.

In food retail, convenient meal solutions directly address this trend. According to Kantar Worldpanel the market is worth more than three billion pounds and growing. The food-to-go industry also appears to have been boosted by this movement.

Availability

Food-to-go is more available than it ever has been. Boundaries between core site activity and food-to-go are becoming blurred, examples include a global sandwich chain and a High St bakery which have expanded into non-traditional locations such as petrol station forecourts, hospitals and colleges. In a slightly different way, coffee shop specialists have extended their food ranges to include a hot snack option and some have formed partnerships with bakers.

For a growing number of retailers, an in-store, food-to-go offering gives shoppers the opportunity to complete a top-up or even a main shop at the same time as buying breakfast or lunch. This helps those who are seeking food that can be obtained conveniently while they are juggling other commitments, lunch for some is a time for running errands and shopping.

Research by IGD has shown that availability of hot drinks is an important factor for consumers when choosing where to obtain quick food and many retail outlets, of all formats and sizes, have introduced this fixture, many even have a limited hot food display.

Healthier

Some consumers may have been encouraged in to the category by the rising number of healthy options that are now available. Consumer trends towards trying to eat more healthily and awareness of the effect that your diet can have on your overall wellbeing have recently been growing. Additional research carried out by Mintel has shown that eating a healthy lunch makes many people actually feel better in the afternoon and that there is a correlation between ‘food and mood’.

The industry response has been to innovate around health in their food-to-go offering. Small independent sandwich shops through to the world’s biggest retail chains and fast food outlets now routinely offer low-fat, low-calorie and free-from products.

Summary

It is important those involved in the supply chain from the farm upwards understand consumer trends and who their final customer is. A wide range of food operators are responding to changes in the way that consumers want to eat. Opportunities to work with those who are involved in the fast growing food-to-go industry to develop products that consumers are increasingly looking for, should therefore be maximised.