Defra cut UK harvest 2020 wheat production estimate: Feed market report

Wednesday, 6 January 2021

By Thomma Shepherd

Grains

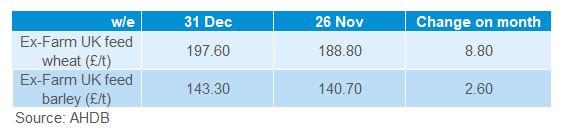

UK ex-farm grain prices gained throughout December. With spot feed wheat quoted at £197.60/t and feed barley at £143.30/t, on 31 December. This has increased the discount of feed barley to feed wheat even further, now at £54.30/t. UK wheat has been following global grain prices up due to a very tight domestic supply, this has been supporting feed barley prices.

On 22 December, Defra released their final estimates for the 2020 UK crop. Reductions were seen for both wheat and barley production. The largest decline was for wheat, with production now estimated at 9.66Mt, down 475Kt from the October estimates. This is a 40.5% decrease from harvest 2019 and the lowest production since 1981.

This change was led by cuts to both area and yield estimates. Wheat area is now estimated at 1.387Mha, 28Kha lower than in October. UK wheat yields were pegged at 7.0t/ha, down from 7.2t/ha in the previous estimate, and well below the 5-year average of 8.4t/ha.

The regional breakdowns in the AHDB Early Bird Survey of planting intentions for harvest 2021, were published on 23 December. Total wheat area is forecast to increase by 28% year on year to 1,776Kha with increases seen in every region of the UK. Winter barley is also forecast to be 25% higher than last year at 389Kha, however spring barley is pegged at 756Kha, down 30% year-on-year.

Global wheat markets were also supported towards the end of December, as Russia announced a €25/t tax on wheat exports from 15 February until the end of June. This has been introduced in an effort to stabilise domestic food prices. As a result, we have seen cuts to Russian grain export forecasts. Argentina have also announced a ban of any maize exports until 28 February, also in an attempt to stabilise food prices.

December’s USDA world supply and demand estimates (WASDE) forecast tighter world grain stocks. World wheat ending stocks were cut by 3.95Mt from November’s report to 316.50Mt. Global maize stocks were also cut month-on–month, by 2.47Mt, to 288.96Mt. Increased Chinese feed demand was a key driver of reduced stocks for both grains.

Global maize production could fall further on the back of prolonged dryness and low soil moisture in South America. While it is only the first crop feeling these impacts at present, this issue could become a problem for the safrina (second) maize crop.

Proteins

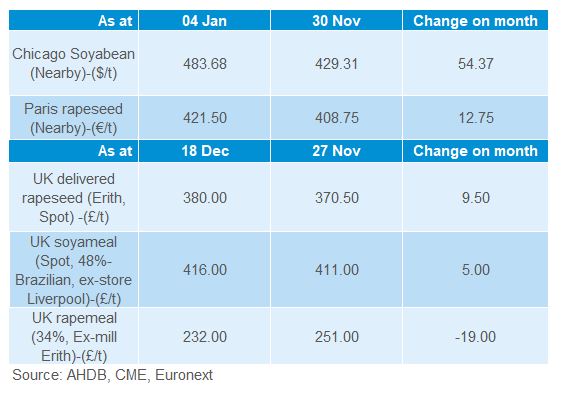

Nearby Chicago soyabean futures rallied throughout December reaching $483.68/t, on 4 January. The nearby contract firmed by $42.34/t, from 17 December to 4 January. Nearby Paris rapeseed futures also found some support over the same period, up €8.50/t to close at €421.50/t on 4 January.

UK spot oilseed rape prices (delivered Erith) tracked Paris rapeseed futures, with the price on 18 December at £380/t, up £9.50/t from 27 November. UK 48% Brazilian soyameal (spot, ex-store Liverpool) increased by £5.00/t over the same time period and was reported at £416.00/t on 18 December.

In the December WASDE release, US 2020/21 soyabean ending stocks were cut by 710Kt to 4.76Mt, the lowest level since 2013/14. The cut was driven by increases in US soyabean crushing.

The WASDE also knocked 1.60Mt off global oilseed production from the previous estimate, with production pegged at 595.68Mt. Argentinian soyabean production was cut by a further 1.0Mt to 50.0Mt, this outweighed increases in production of Canadian and Uruguayan soyabeans. Global oilseed ending stocks are now forecast at 97.76Mt, a cut of 810Kt on November’s estimate.

According to the AHDB Early Bird Survey, UK rapeseed plantings for harvest 2021 are expected to decline for the third year in a row. The intended area is now just 312Kha, 18.1% down on harvest 2020. That said, in the AHDB crop conditions report, the domestic rapeseed crop is in very good condition with 77% of winter rapeseed rated ‘good’ or ‘excellent’ condition at the end of November, compared with just 30% at the same time last year.

Currency

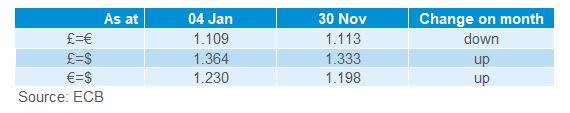

From 30 November to 31 December there has been much volatility in sterling. Especially against the euro as EU exit negotiations came to a close with a deal agreed on 24 December 2020. Despite these large fluctuations, sterling ended up just 0.07% up against the euro over this time period. While there has been some volatility against the US dollar the general trend has been a firming of the sterling, up 2.36% throughout December.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.