Cattle and sheep propping up GB feed demand: Grain market daily

Friday, 4 October 2024

Market commentary

- Nov-24 UK feed wheat futures gained a further £0.30/t yesterday to settle at £190.45/t, with the May-25 contract up £0.15/t to £205.00/t. The gains in UK futures came despite Chicago and Paris wheat futures edging lower after rising sharply on Wednesday. A drop in the strength of sterling against the euro and US dollar, offset the wider market dip.

- Sterling fell sharply yesterday after the Bank of England governor suggested they could be a “bit more aggressive” in cutting interest rates if inflation continues to decline in an interview. Sterling fell 1% against the euro to £1 = €1.1897 and 1.1% against the US dollar to $1.3124 (LSEG).

- Paris rapeseed futures for Nov-24 added €3.75/t to close at €481.00/t (approx. £405/t), while the May-25 contract rose €4.75/t to €492.50/t (approx. £415/t).

- Paris rapeseed futures gained along with Winnipeg canola futures, which were supported by technical buying and short covering by speculative traders. In contrast, Chiago soyabean futures fell due to forecasts of rain in Brazil.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Cattle and sheep propping up GB feed demand

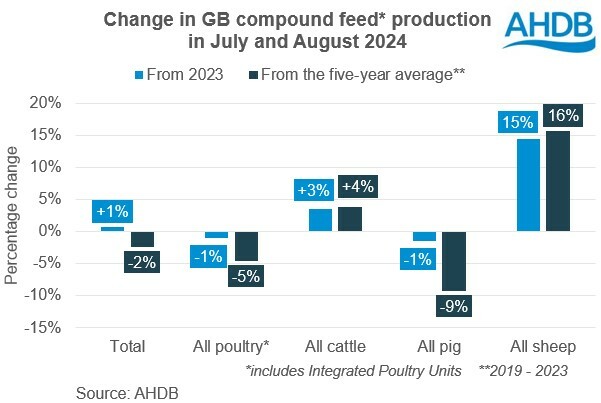

Stronger demand for cattle and sheep feed helped limit the decline in overall GB compound feed production in August in the latest data from AHDB.

Total feed produced by GB feed compounders and integrated poultry units (IPUs) combined in August dipped (-0.4%) below last year’s level. For the season to date (July and August) feed production is now up 1%, but 2% below the five-year average.

The dip in output in August was driven by poultry feed, down 1.5% year-on-year, particularly feed for broilers and turkeys, reflecting lower chick and poult placings. This more than outweighed a rise in feed for laying hens. All poultry feed produced in the first two months of the season totalled 972 Kt, down 1% on 2023/24 and some 5% below the five-year average.

Pig feed production also dropped back below year earlier levels in August by 4%.

In contrast, cattle feed production rose 2% year-on-year in August, with sheep feed up 20%. Deadweight prices for prime cattle rose steadily through August, giving stronger incentive to use bought-in feed to finish cattle. Combined dairy blends and compound production was broadly static year on year in August, with slightly less cows on the ground but poor grass growth.

Deadweight sheep prices were generally stable in August and down from the peak earlier in the year, but still above August 2023 levels. Prices for those lambs meeting better specifications are stronger, giving more incentive to offer compound feed.

Looking ahead

There’s a lot of uncertainty over the outlook for UK animal feed demand, with challenges ongoing around energy and labour costs (and availability) in several sectors. There’s also contrasting trends in prices. Milk prices have been edging up, and beef prices remain strong, but lamb prices are softening slightly. Pig prices also have the potential to ease slightly if available supplies edge up or retail demand softens. Although some consumers are feeling better off, others are still struggling financially and some further shifts (though more gradual than in recent years) in meat demand are expected. Poultry meat purchases in shops could benefit, with pork, beef and lamb more likely to lose out due to their relative price.

The weather will also be important e.g. for cattle, if the weather stays wet cattle could need to come inside sooner, which would increase the need to feed compounds. The availability of forage is also a concern as grass growth has been variable this year and quality of forage even more so. Both of which could increase compound demand, though cost compared to livestock prices will be important as to whether farmers decide to feed for output or not. Forage maize supplies will also impact, with harvests getting underway.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.