A natural opportunity for health

Friday, 5 January 2024

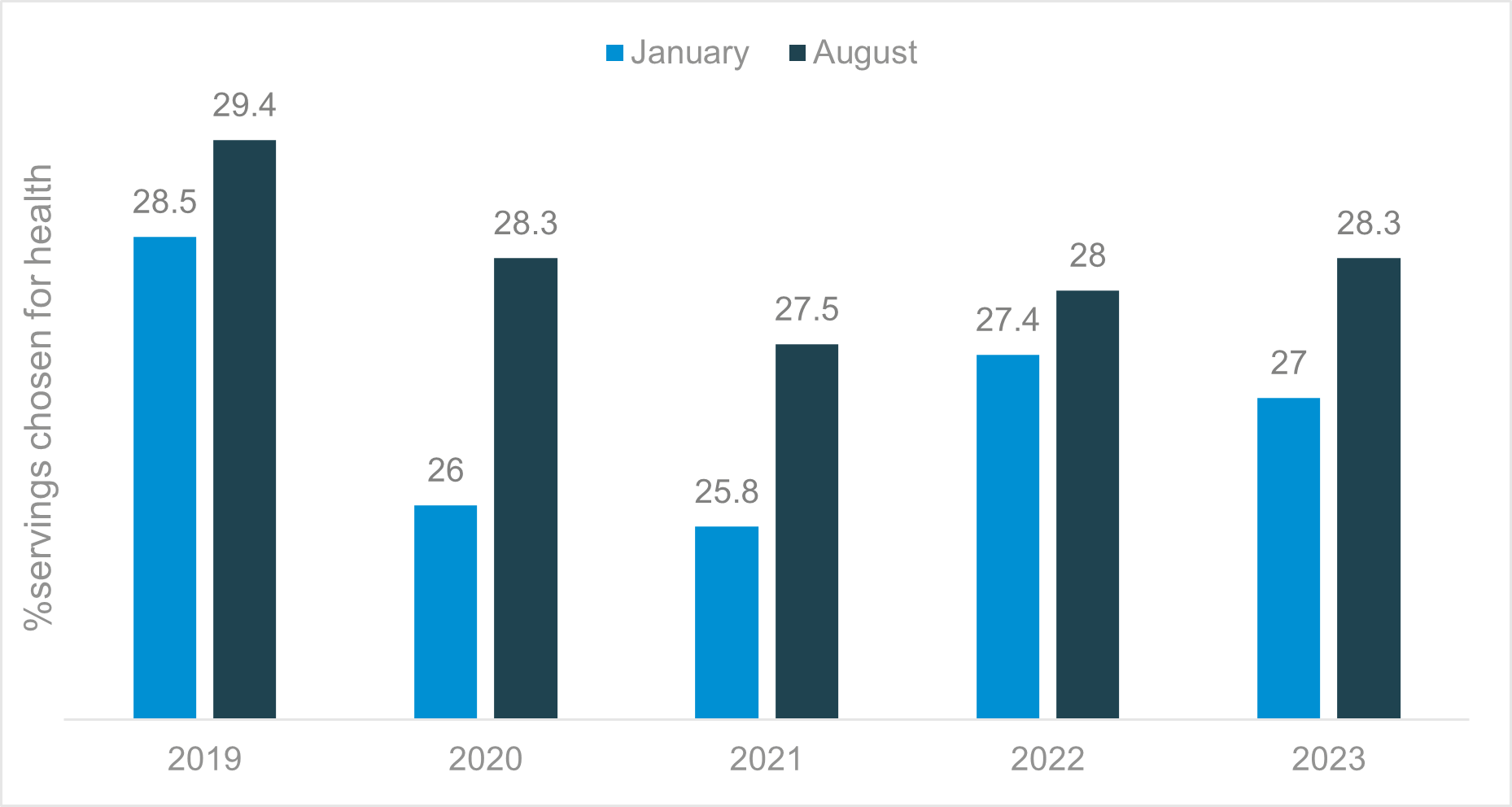

Contrary to popular belief, the proportion of food chosen for health reasons is not typically at its highest in January.

Consumers are actually more likely to stay in during the colder, longer nights and turn towards more comfort food options. It is in the summer months when days are warmer that consumers are more tempted to eat lighter meals and make changes to their diet and seek out healthier alternatives.

Seasonality – % servings chosen for health reasons

Source: Kantar Usage 4 w/e 22 January 2023 vs 4 w/e 06 August 2023, for the past few years

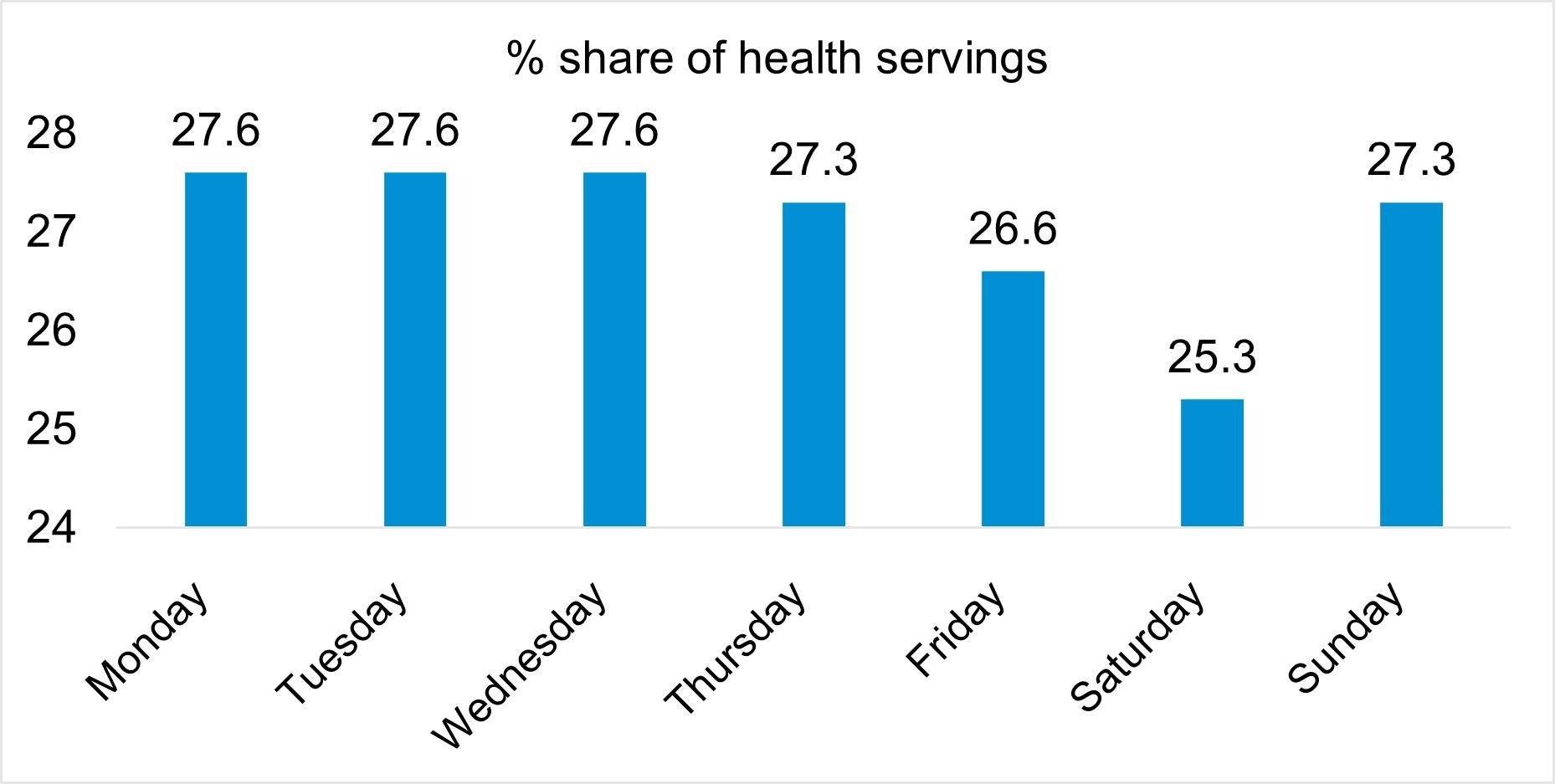

When looking at daily consumption habits, consumers generally eat a healthier diet Monday to Thursday, while at the weekend they are more likely to want a treat, dine out or enjoy a takeaway, so enjoyment and taste become a greater priority.

The day of the week affects our healthy eating decisions

Source: Total food and drink consumption, 52 w/e 03 September 2023, Kantar Usage

Shopping behaviours

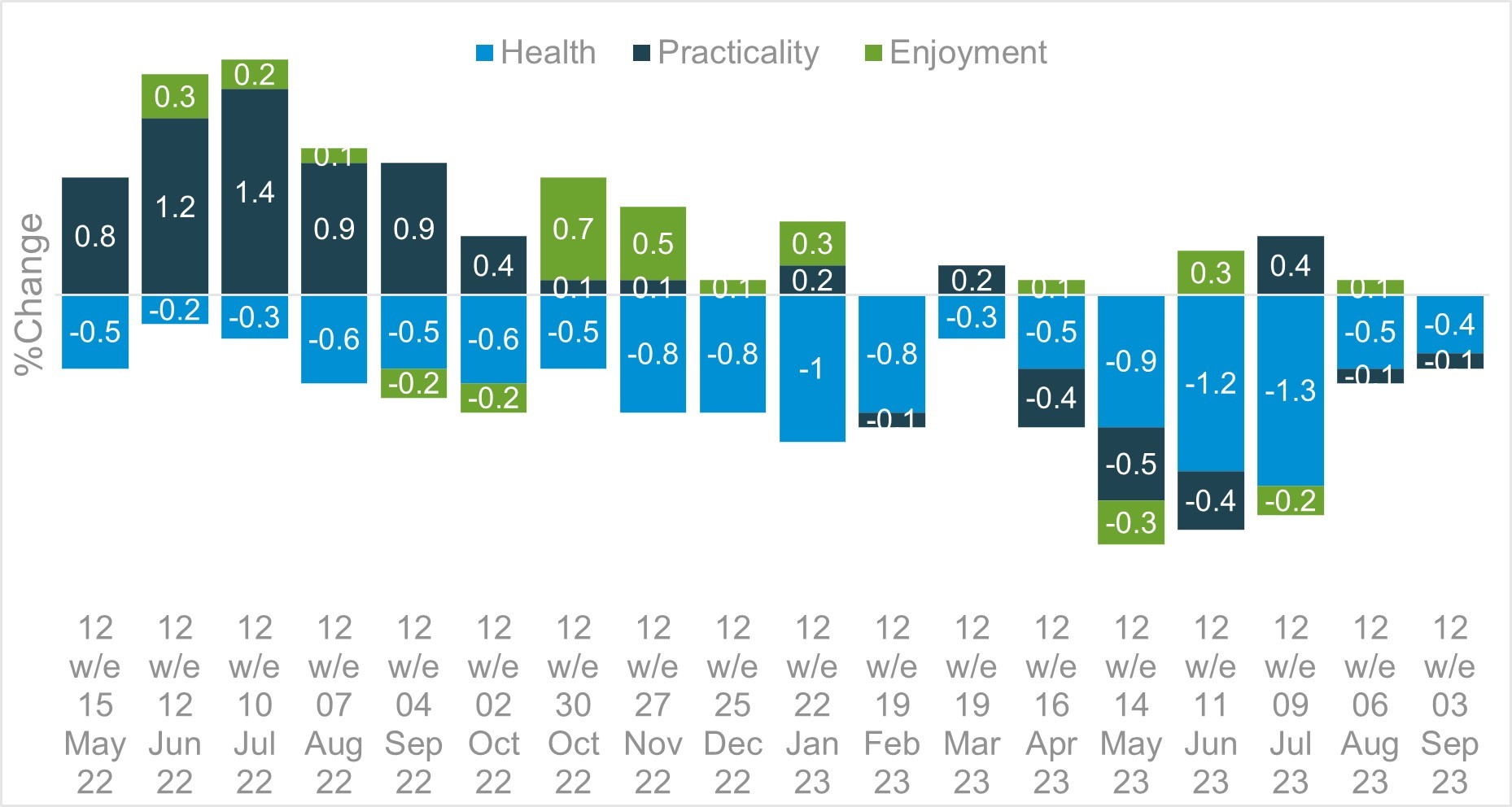

As the economy fluctuates so do consumer preferences. Health is closely aligned to consumer confidence as this declined due to the cost-of-living crisis. Health as a reason for consumption has also experienced consecutive decline since May 2022. As food and living costs have continued to rise, many consumers have had to change their shopping habits and have traded down to value tier products. Within red meat, the value tier has grown by 35.6% (YoY) and within dairy value tier, milk volume has grown by 56.3% and cheese by 56.7% (Nielsen, 52w/e 12 August 2023). To substantiate this trend, in recent research by AHDB/Blue Marble, 40% of consumers expressed their concern for ‘affordable healthy food’.

Year on year servings change in percentage points

Source: Kantar Usage Panel, % servings, 12 w/e vs YA, Total Food and Drink

As consumer habits have changed, one thing has remained consistent; over 78% of consumers choose their food and drink for enjoyment, and this increases to 83.8% for meat, fish and poultry (MFP). Consumers are increasingly choosing meat primarily for taste, then for the recognised natural health benefits and as part in a varied diet. This has increased over the last three years, from 70.1% to 71.7%. Taste and enjoyment are also the primary reasons for buying dairy, with a similar proportion of consumers, (67.3%) buying dairy products for the enjoyable taste, then for health benefits such as low in salt/sugar and being natural (Kantar Usage, 52 w/e 03 September 2023).

For both meat and dairy we need to satisfy the need of taste and enjoyment. Health is an attraction for consumers as the third need with MFP at 20% and dairy at 31.6%. The current situation shows us that consumers are looking for tangiable health benefits across their food purchases. (Kantar usage, 52 w/e 03 September 2023).

So, in difficult economic times, what can we do to encourage consumers to eat red meat and dairy?

As AHDB’s YouGov Consumer Tracker highlights, consumer perceptions around the natural benefits of red meat, particularly around high levels of protein, vitamin B12, and iron, are seen as important as part of a balanced healthy diet. Within dairy, taste holds a real appeal; whether it is milk, yoghurts or cheese, consumers can identify the key health benefits of vitamins and minerals, lower in salt/sugar and the naturalness of a range of products available (YouGov August 2023). To build on this, AHDB’s latest marketing campaign Let’s Eat Balanced showcases British beef, lamb and dairy as part of a healthy and nutritionally balanced diet.

Meat and dairy alternatives

When looking closer at health, consumers are still prioritising positive health benefits. They are choosing foods with added health benefits (fibre/vitamins) and that are more natural. To support this desire for natural foods, Mintel report that 70% of UK consumers say they try to avoid ultra-processed foods (Attitudes towards Healthy Eating UK 2023, Base: 2,000 internet users aged 16+).

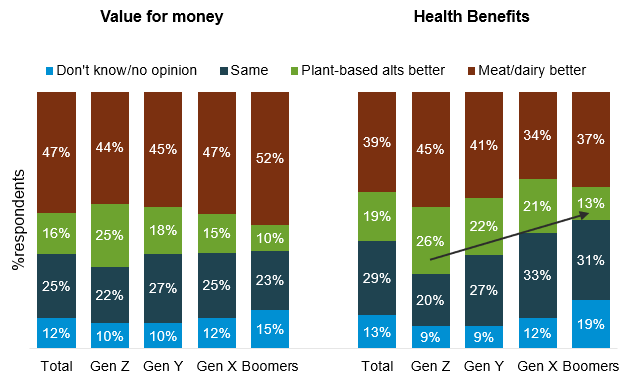

This is also confirmed in AHDB’s recent research by Blue Marble, where a large proportion of consumers see meat and dairy to be preferrable to plant-based products for both health and value across all age ranges. Gen Z are the strongest believers in the health benefits of both meat, dairy and plant-based alternatives, whilst confidence wanes for plant-based alternatives with older generations. As the younger generations age, it will be important for the industry to monitor their views. Over the last four years, meat-free has remained a small part of the market, with just a 2% volume share (Kantar).

Meat/dairy products vs plant-based alternatives

Source: AHDB/Blue Marble 2023, Base: UK Nationally Representative Sample: Total 2085 Gen Z Aged 18-25 (361) Gen Y Aged 26-43 (628) Gen X Aged 44-57 (473) Boomers Aged 58-77 (576)

The importance of health to Gen Z and the potential for meat and dairy

Gen Zs seek health benefits that enhance their lifestyle imminently, not in a week or two. According to Mintel, they are also more likely to consume sports/energy drinks and snack bars more than any other generation (Sports and Energy Drinks - UK, 2023 and Snack Bars and Breakfast Biscuits - UK, 2023).

According to recent research by Mintel, of those consumers aged 16-34, 48% use protein products tailored for sports compared with 27% of all consumers (Attitudes towards Sports Nutrition – UK, 2023). In fact, when asked, of all 16-34s, 63% would find a wider range of natural sports nutrition products to be more appealing, whilst 52% agreed that high-protein sports nutrition products offer poor value for money as a source of protein (Attitudes towards Sports Nutrition – UK, 2024).

With busy lifestyles demanding more from young people, meat and dairy products can position themselves to support their physical and mental wellbeing if they are more actively relevant to these consumers. This provides a real opportunity to communicate that milk and red meat are natural nutritional alternatives and can be their hero products for fuelling sport and exercise. Indeed, 64% of all adults agreed that foods that are naturally high in protein were preferable to ones with added protein (Attitudes towards Sports Nutrition: Inc Impact of COVID-19 – UK, 2020).

Natural role for health

With everyone feeling the pinch with the cost-of-living crisis, it is essential that we all take care of our health, where we can. With taste and enjoyment being key reasons for purchasing meat and dairy, health can really stand out. There is a real opportunity to promote the natural benefits of both red meat and dairy with the wide range of nutrition and health benefits and provide reassurance for all.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: