Value-tier red meat and dairy sales soar as other tiers suffer

Tuesday, 26 September 2023

The cost-of-living crisis continues to restrict consumer spending on red meat and dairy as people try and save money.

While we have seen people trade down to cheaper proteins and private-label products from branded as a result, switching between private-label tiers has also been key to this.

Value-tier products* have performed strongly as trading down continues since they often represent the cheapest products in supermarkets. But which proteins and products have seen value-tier growth?

Private-label products are a huge part of total sales, contributing 88% (£10.6bn) to total red meat (Kantar, 52 w/e 06 August 2023) and 64.4% (£5.6 bn) to total dairy sales (Nielsen, 52 w/e 12 August 2023).

While value-tier products are only a small part of red meat volumes (7.7%), value-tier volumes have grown massively, up by 35.6% year-on-year (YoY). Similarly, for dairy, just 2.4% of all volumes are made up of private-label value-tier products, although we’ve seen a 47.9% rise in value-tier volumes over the last year.

This YoY growth comes from consumers looking to cut back on spending due to price rises. Price has become more important to over three-quarters of consumers when buying meat, and this is now at its highest level when buying dairy (59%) (AHDB/You Gov August 2023).

Red meat

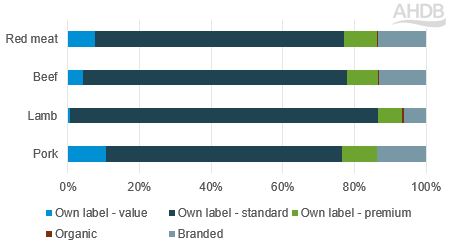

Red meat volumes have declined by 2.7% YoY, driven mainly by declines in standard tier volumes for beef (-3.6%), pork (-4.9%) and lamb (-9.9%) (Kantar, 52 w/e 06 August 2023). Yet, this decline in total red meat volumes was partially offset by the value tier, which was the only tier to see YoY growth, continuing trends seen earlier this year.

Increases to value tier volumes over the last year were seen for beef (+59.1%), pork (+30.0%) and lamb (66.1%), in part due to gaining volumes from shoppers switching out of branded, premium and standard tier products, as customers trade down tiers to reduce their spend on food.

While standard tier products still make up the majority of red meat volumes (69.3%), the loss of such large volumes (-12.9m kg) to value tier products over the last year indicates just how much consumers are moderating their spending habits.

Volume percentage by tier

Source: Kantar, 52 w/e 06 August 2023

While the majority of the trends are the same across the three red meat proteins, there are some nuances.

Lamb has a very minimal tiering with smaller value and premium tiers compared to beef and pork, and it is generally seen as a more premium red meat. However, value tier volumes did rise, alongside growth in premium tier largely through a 29.6% rise in premium ready meal volumes.

Beef value tier price rises (+28.6%) were much greater than standard (+10.3%) and premium (+10.8%) (Kantar, 52 w/e 06 August 2023).

This disproportionately impacts shoppers from the lowest income groups as they see their spend on food increase by a greater amount than more affluent groups since they are unable to trade down further. However, the value tier remained cost-effective at nearly £3/kg cheaper than standard.

When looking at the best-performing beef value tier products, mince topped the list, with sales volumes growing by 179.8% YoY (Kantar, 52 w/e 06 August). In general, largest value tier volume gains were seen for cheaper cuts and family favourites.

This indicates consumers do not want to fully remove their favourite products from their diet but instead want to save money by purchasing the value tier versions. This can also be seen as sliced cooked meats also saw a large YoY volume increase of 63.2%.

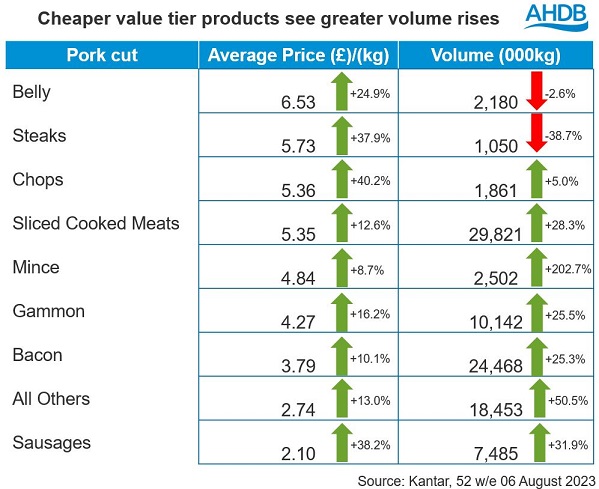

Pork staple products like sliced cooked meats and sausages have seen value-tier growth. Sliced cooked meat value tier saw the largest increase in actual volumes up 28.3% YoY.

Sausages are the cheapest value tier cut at just £2.10/kg and saw value tier volumes grow by 31.9% YOY, gaining share as standard tier growth was only 3.6% YOY (Kantar, 52 w/e 06 August 2023).

Dairy

While dairy volumes saw a 3.2% decrease YoY, value tiers saw growth with milk and cheese as value-tier volumes were up by 56.3% and 56.7%, respectively (Nielsen, 52 w/e 12 August).

This comes as the standard tier for both these products saw YOY declines. However, value tier butter volumes have fallen YoY (-34.7%), perhaps because plant-based spreads and margarines are priced at a much lower rate for each tier.

Opportunities for meat and dairy

Despite the cost of living crisis, consumers are still keen to treat themselves, even if it is less often than before. This can often take the form of trading up product tiers for these occasions or recreating out-of-home meals at home to save money.

Providing meal inspiration and quality reassurances will be key to enticing consumers to buy these higher-tier products.

The standard tier is the most extensive tier in terms of product ranges (IGD), which is part of the reason it accounts for most meat and dairy volumes.

Therefore, by expanding the number of products on offer in the value tier and making sure this offering is tailored towards staples like mince, sausages and cheese, this provides the opportunity to expand retail sales of red meat and dairy.

It’s important to remember that not all retailers offer a value tier range, so expanding tiers in all supermarkets is necessary to attract more customers to buy red meat and dairy.

Adequately advertising value tier ranges in supermarkets and communicating their in-store location to consumers ensures value-tier products can be found easily.

Not all value ranges are of equal quality or source; some use higher quality and some use only British-sourced meat and dairy.

Consumers care about these credentials, so highlighting these will be key to getting customers to buy more British products, even for the value tier ranges. This is because shoppers have shifted from mainly focusing on low prices during the cost of living crisis towards value for money, quality and product satisfaction (IGD).

So targeting products towards these customer desires and highlighting their quality associations are key to growing the number of repeat customers.

*Value-tier products are those within a specific money-saving/value-for-money supermarket-own label range.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: