Christmas opportunities for red meat as turkey tradition fades

Tuesday, 7 February 2023

In the run up to Christmas, 53% of Brits expected to spend less for Christmas 2022 (IGD), and we saw this materialise in the sales data. Inflation was the driving force behind significant market growth, as households actually scaled back the amount of volume they purchased. The value of the biggest shop increased by nearly £5, to reach £78.55 (Kantar).

Please note this article was updated on 1 March due to a revision to Kantar's gammon data following previous publication.

Roasting joint summary

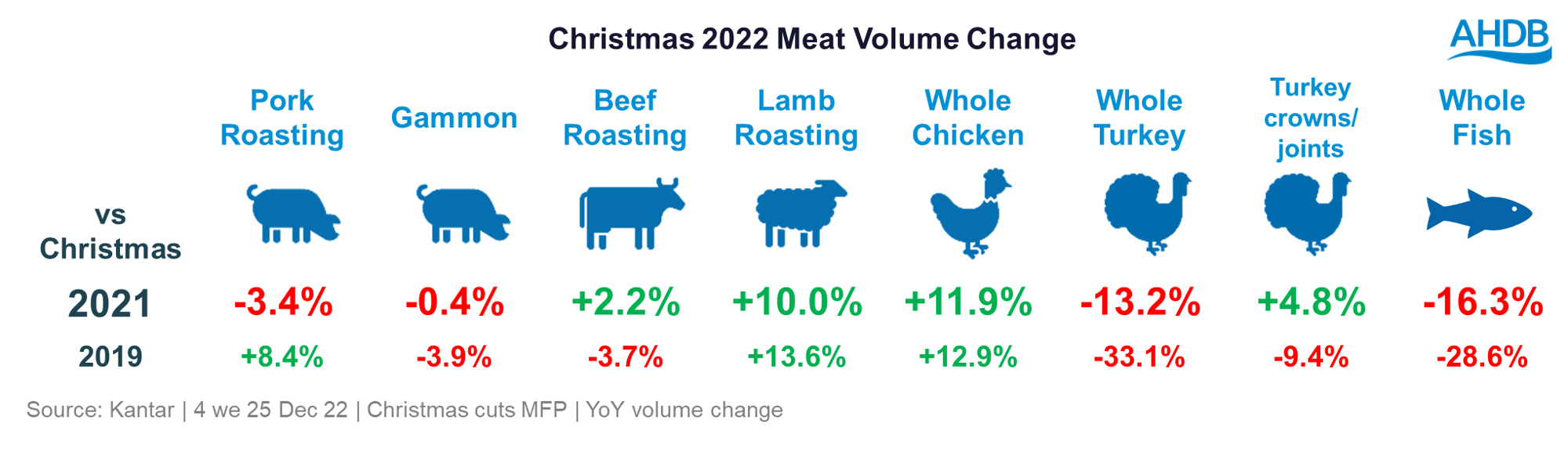

As detailed in our first look at meat retail sales in December, it was a positive month for beef and lamb roasting joints, which were both in year-on-year volume growth.

There were direct switching gains from turkey into lamb, gammon and chicken, while lamb also made some gains from beef, likely linked to promotional activity.

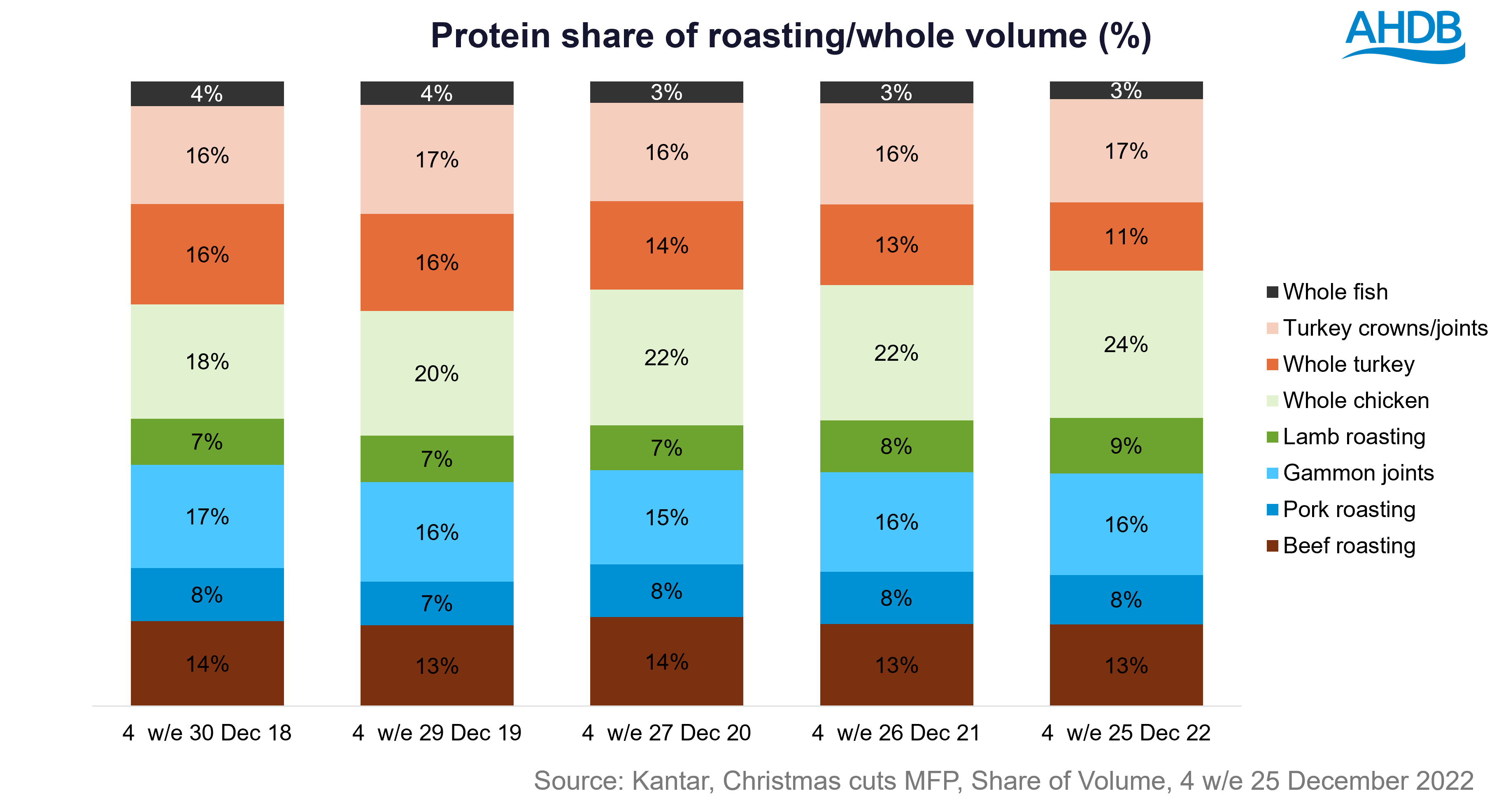

Turkey remains a staple of the Christmas meal occasion, but this tradition is losing relevance over time. Data from IGD shows that 56% of UK shoppers who celebrated Christmas had turkey as part of the Christmas meal – down from 60% in 2021 and declining each year.

This is reflected in the grocery sales data for roasting joints, where whole turkey accounted for 11% of volume in 2022, compared to 16% in 2018. Chicken is the main protein to benefit over time, with consumers generally seeing this protein as more versatile and therefore likely to be used across a range of meal occasions in the run-up to Christmas. Inspiring the use of beef, lamb and pork throughout the festive season, and not just at the main Christmas meal occasion, is therefore key to retain future sales.

In December, Meat Free volumes experienced a slight decline from last year, of -1.1%. Volume gains have slowed dramatically since 2020, however the meat free market remains much larger (+51%) than it did five years ago.

Fresh vs frozen

Within turkey, both fresh and frozen saw an overall decline, with whole birds driving this across both chiller and freezer. Smaller crowns and joints increased volume when compared to 2021 but were down on 2019 volumes.

For lamb, fresh had been outperforming frozen throughout most of 2022. This remained the case in the four weeks to Christmas, with fresh up 1.3% and frozen volumes down by -1.9%. This gap in volume performance had been narrowing and is therefore an area to monitor in 2023.

Value tier gains

At a total grocery level, the premium tier took a bigger share of the year, as usual, but sales growth was behind that of the value tier. This was a trend also seen in MFP, where volumes of the value tier rose by 54.7%. The value tier made particular gains in primary chicken and processed pigmeat.

Switching to discounters

Total grocery spend at the discounters outpaced the rest of the market, up 21% versus the market backdrop of 9%. Supermarkets still see the most spend passing through their doors.

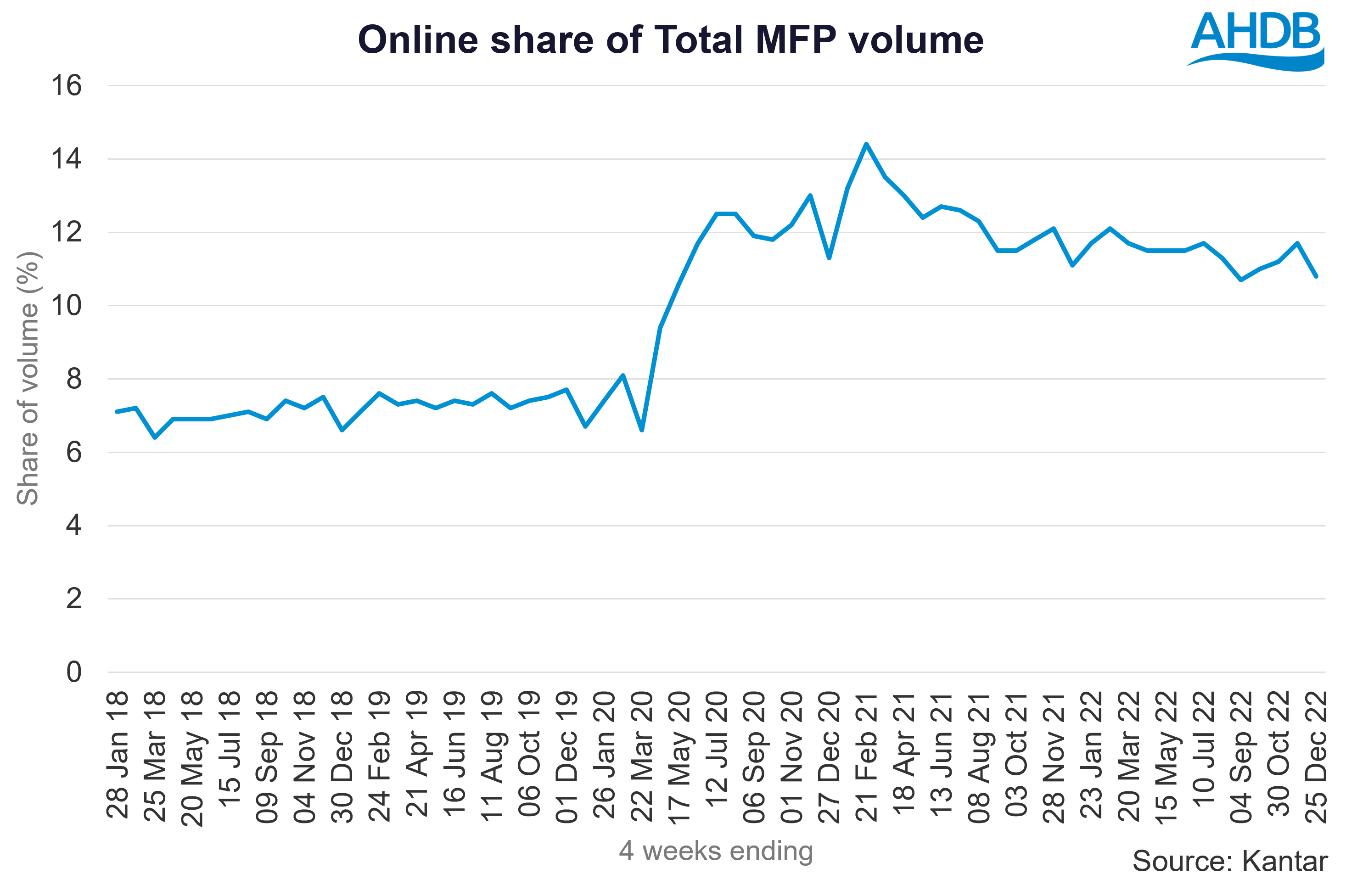

Across Kantar’s definition of ‘Christmas categories’, online value sales rose by 3.5% (against a total market backdrop of +9.0%). While this is therefore behind the market year-on-year, online still has the biggest share increase when compared to 2019.

For meat, online sales accounted for 10.8% of MFP volumes. While this is significantly higher than pre-pandemic, it does represent a reduction of 0.3 percentage points. This is due to the fact that online MFP volumes declined by -2.8%, with turkey experiencing the steepest online decline (-32.1%) and lamb seeing the greatest uplift (+6.6%).

It may be that online shoppers were more concerned about the risk of their main meat being substituted as a result of shortages (linked to avian flu). Indeed, based on IGD’s post-Christmas research, there were 20% of shoppers who were impacted by product shortages (across all channels). Of those shoppers who used online, 25% stated they were impacted by product shortages. This was the highest of the ‘main’ channels used for Christmas.

While butchers still see an uplift in trade at Christmas, shopper numbers have been dwindling over time. In the four weeks ending 25 December 22, 5.3% of shoppers bought red meat from a butcher, down from 6.2% in 2019. This reduction in household penetration is reflected in total sales, where year-on-year volumes of red meat were down 4% and 17% vs 2019. Butchers therefore need to focus on building shopper loyalty throughout 2023.

Reducing basket size

2023 could be another year of hesitant volumes from shoppers. Basket size scaled back in December and many planned to cut back on periphery items, according to IGD. Despite this, chilled party food volumes experienced just a marginal decline (-0.2%), while the volume of pigs-in-blankets rose by 3.5%. In addition to this, volumes of sausages both increased by 5.1% year-on-year, in the month to Christmas, and the retailers that performed the best overall within MFP saw sausages be a key part of this.

The balance between Out-of-Home and In-Home

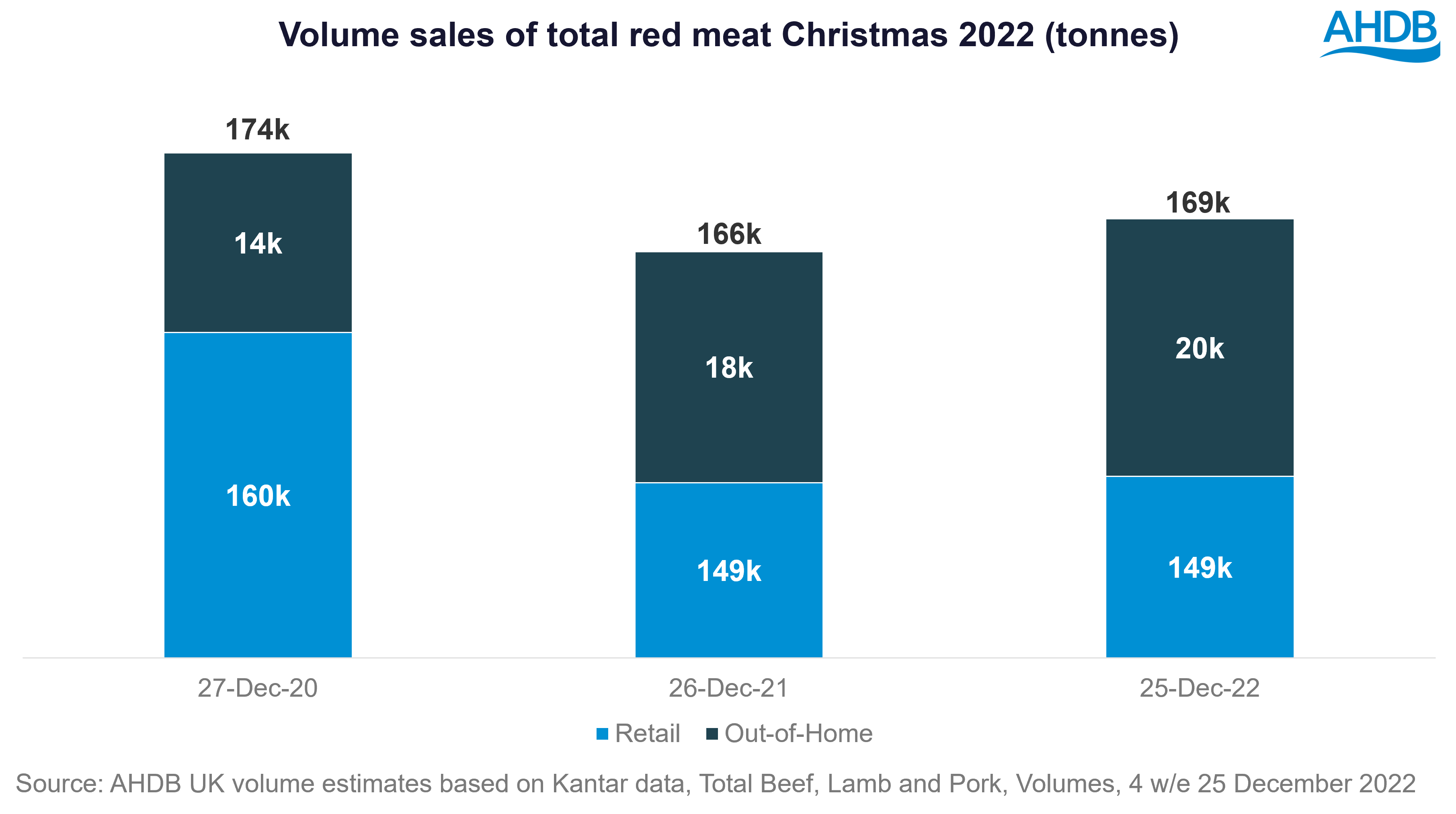

This was the first year since 2019 that consumers could fully access the out of home (OOH) market without restrictions. This resulted in a 21.2% increase in spend on food and non-alcoholic drink, when compared to 2021 and puts the value of the OOH market ahead of 2019. However, inflation is the driver here and the volume uplift was more muted, at 12.1%.

For beef, lamb and pork, AHDB UK volume estimates suggest an 11.6% increase in OOH volume. This means that, when combined with retail volumes, we estimate total beef, lamb and pork volumes to have risen by 1.5% in December.

In 2023 we expect further trading down to in-home meal occasions; of those who claim their finances have worsened recently, 60% plan to reduce spend on eating out (AHDB/YouGov Consumer Tracker). Read our full forecasts for 2023 performance of beef, lamb and pork in our Agri-Market Outlooks.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: