Food-to-go needs evolve due to pandemic

Wednesday, 3 March 2021

Prior to COVID-19, food-to-go* (FTG) was the hero of the foodservice market. According to Lumina Intelligence it had seen a decade of growth and in 2019 outperformed the wider eating-out market, growing 2.4% in value to £21.2bn. This was driven by expansion, new product development and time poor consumers.

However, this all changed in March 2020 when consumer routines transformed overnight, and the foodservice market was essentially closed. But as we come out the other side of the pandemic how do we see this market recovering and what are the challenges, and opportunities, for operators?

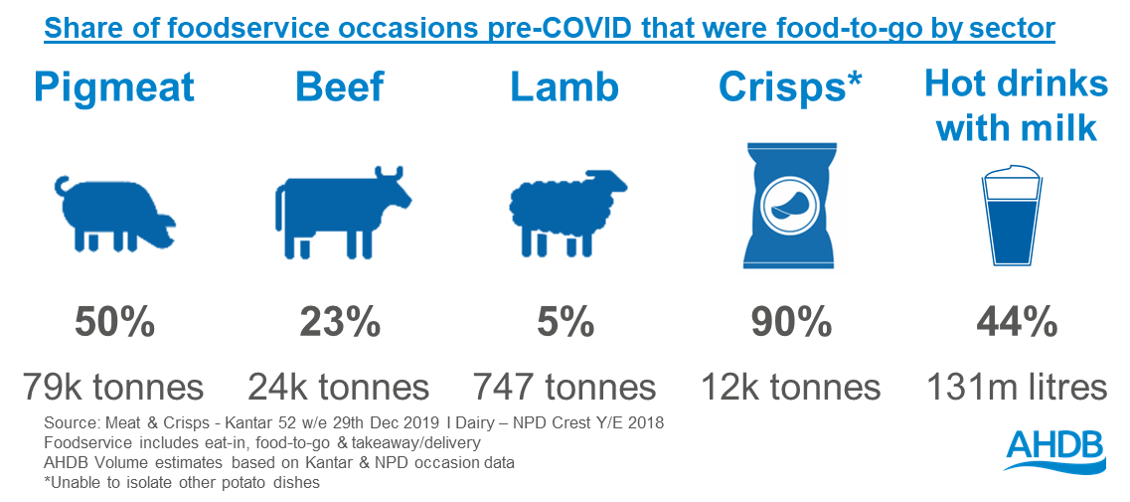

Importance for AHDB sectors

The market plays a role for all AHDB sectors but particularly pork, through sandwiches and sausage rolls, potatoes through crisps and dairy through hot drinks.

FTG market during COVID-19

Undoubtedly, 2020 was a year the foodservice market did not anticipate and the ‘stay at home’ rule switched typical out-of-home food occasions, both work and social, to in-home. It is predicted the FTG market contracted by nearly a third to £15.3bn. However, with operators still able to switch to off-premise consumption, FTG fared better than other parts of the market, still benefitting from key workers and the ‘daily walk’ trade. Dine-in declined at a much faster rate resulting in FTG growing its share of the eating-out market in 2020.

Some operators fared better than others. Quick service retail, particularly fast-food brands, adapted quickly to ramp up safe takeaway offerings, and supermarkets, being the only part of the market to continue to operate normally, provided a viable option to grab food on-the-go. These two channels also benefited from a strong suburban presence, which was key as 39% of UK workers claimed to work more from home (AHDB/YouGov Tracker, Nov 20). Off-premise dining also provided a lifeline for operators who typically didn’t play in this area, resulting in some restaurants and pubs entering the market. FTG operators worst hit by the pandemic were those dominant in city centres and transport hubs, particularly coffee shops and cafes who lost a large majority of the work trade.

FTG market and opportunities post COVID-19

Despite FTG’s more buoyant performance during COVID-19 it is predicted that this part of the market will be one of the slowest to recover to its pre-COVID high. Lumina Intelligence predict it will bounce back over a two-year period to £22.3bn in 2023 as busier lifestyles resume. However, there will be legacy behaviours that will alter how the market looks, meaning FTG operators need new strategies to help regain lost ground during the pandemic.

Click on each of the behaviours below to learn more.

For some consumers, the pandemic has highlighted lifestyle benefits of working from home. This has resulted in over one in four wanting to go in just a few days a week or work from home on a permanent basis post COVID (Lumina Intelligence Channel Pulse, wave 23). Whilst benefitting grocery sales this will challenge foodservice operators, particularly FTG, with reduced footfall in city centres resulting in trade declining overall and dispersing to suburban areas.

What are the opportunities?

- New openings in more rural locations or partnerships with existing rural channels. An example being Greggs opening concessions in local Asda stores

- Ensure presence on food delivery apps and websites

- Target at-home meal fatigue to encourage those working from home to still seek out-of-home breakfast and lunch options

- Don’t forget key industries where working from home is not possible - over a quarter of FTG consumption is in a car/van! Ensure offerings remain relevant to all

Food safety and cleanliness was the fastest growing consumer need when eating-out in 2020 (Lumina intelligence Eating Out Panel) and is predicted to remain a priority. While communication in this area will reassure consumers, contactless offerings are a way to overcome this fear. Some operators adapted to this quickly but as this ‘grab and go’ mentality is here to stay operators need to plan for these measures to be in place long term.

What are the opportunities?

- Technology led innovation to minimise contact for ordering and payment. Examples include the new McDonalds ‘click and serve’ app offering digital ordering, payment and food delivery to your car parking spot, and the “Chipotle Digital Kitchen” in New York, a digital only restaurant fulfilling pickup and delivery orders only.

- Format led innovation to minimise human contact. Examples include the Costa ‘street facing’ counter in London for those who do not want to enter, and Burger King’s new concept stores in the US which allow consumers to pick up their burgers from lockers or conveyor belts.

Vending machines are another format innovation. Marks & Spencer are trialling machines at service stations offering sandwiches, crisps and chilled ready meals, while KFC in China has introduced autonomous roaming food trucks to encourage unplanned food occasions outside of cities.

Uncertainty around the economic recovery and heightened levels of unemployment have changed consumer eating habits. With many cutting back on discretionary spending, FTG may suffer. Typical recessionary behaviours include eating-out less, more scratch cooking and taking lunch out-of-home - 54% of consumers expect to only take packed lunches when they return to their place of work (Lumina Intelligence Channel Pulse, wave 23).

What are the opportunities?

- Value tactics such as meal deals, promotions and loyalty schemes will encourage those more price conscious consumers. Examples include Asda’s new ‘cheapest’ meal deal at £1.60 and coffee shop reward systems or subscriptions.

- To drive up spend for those who are less price conscious, encourage trade up through premium new product development, customisable offerings and utilising different day parts such as FTG dinner or desserts.

- FTG is a cheaper alternative to dining in so utilise new occasion offerings, for example, picnic sets for outdoor socialising or lunch boxes for park meet ups

As consumers gradually get back to some normality, trends seen pre-pandemic will regain traction. The need for indulgence, as well as health, high quality and sustainability credentials are all areas on consumer agendas for FTG to tackle. To find out more please see the foodservice trend article.

*Food-to-go is defined as all ready to consume food & drink that is purchased away from home and consumed off premise, but not at home