The heatwave of summer 2018

Friday, 16 November 2018

Did the heat cause consumers to spend more on meat, fish and poultry? This article explores trends in consumer behaviour during the heatwave. With episodes of extreme weather more likely in the future, how resilient will sales of meat be? How can we unlock summer sales beyond the BBQ occasion?

Summary and implications for future summers

Growth in consumer spending has been evident this summer, fuelled by high-profile sporting events and a hotter than average summer. This carries an opportunity for the industry as a whole, with more revenue to go after, particularly with consumers reopening the door to more protein-heavy meals. However, while burgers and sausages did well at the BBQ occasion, overall red meat consumption lost out to lighter protein options, such as fish and chicken. To gain a market edge and increase competitiveness, the red meat industry needs to tap into the trends for lighter eating, quicker preparation times and easier preparation methods. It is important not to focus only on innovation for the BBQ occasions as it makes up only a small percentage of total occasions. Instead, some focus needs to be allocated to snacking and cold meals/picnic/assembly type-meals to unlock growth. Added- value meat products, such as marinades and sous vide continue to do well and this is another area to develop further, with flavours and cuisines that will appeal outside of the barbecue occasion.

Market performance in depth:

Total grocery market growth

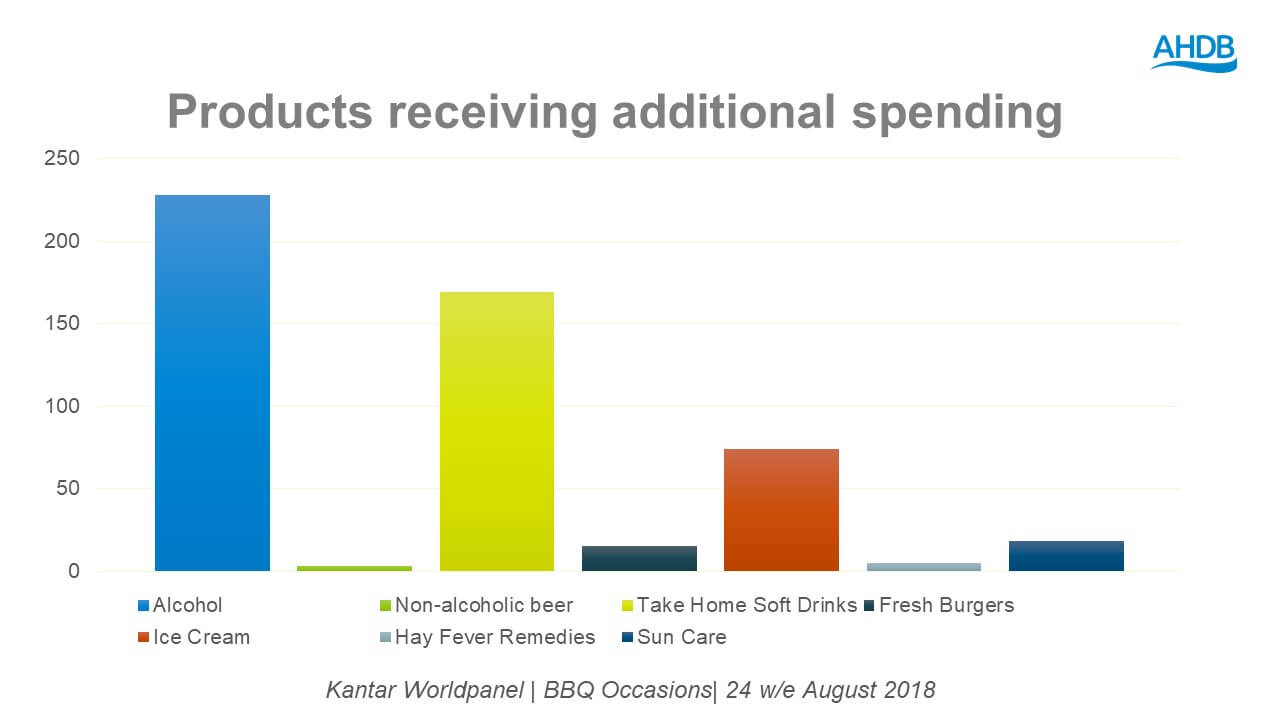

The thermostat wasn’t the only thing that was high this summer. According to Kantar Worldpanel, the hot weather coincided with an increase in total grocery spending, resulting in the market growing by 3.8% in the 12 w/e to 9 September. The products benefiting most from this were associated with the hot weather, with consumers spending an additional 24.5% on ice cream and 27.5% on sun care. This correlates with the fact that there were 70 more hours of sunshine in July than the last two years. This lead to the UK’s joint hottest summer on record, with summer 2018 sharing title with 2006, 2003 and 1976.

Kantar Worldpanel reported that all retailers enjoyed increased sales over the heatwave period, particularly Aldi, Co-op, Asda and Morrisons. Aldi was the fastest growing retailer at 13.9%. The Co-op was not far behind as the second fastest growing retailer at 8.5%. Asda was the best performing of the big 4 at 3.1%, ahead of Morrisons at 3%.

Summer 2018 also saw various significant events in the sports calendar, encouraging consumers to spend. The World Cup attracted football fans and patriots across the UK. A successful performance by England also helped to boost the grocery market, with total groceries increasing in value by 7% and alcohol sales growing by 20%, against the previous World Cup in which England crashed out in the group stages. Wimbledon also affected consumer behaviour, causing shoppers to purchase products commonly associated with tennis more than usual, such as strawberries (+18.1%) and fresh cream (+4.4%).

Foodservice

One area that didn’t improve in the heatwave was foodservice, with the amount of consumers eating out declining across all day-parts except breakfast since Q2 2017, according to MCA’s Eating Out Panel Q2 2018 report. The number of consumers eating out is down year-on-year, which has been the sharpest decrease since Q3 2016.

Lighter meals, such as breakfast and snacking, were the occasions that performed a little better. According to MCA’s Eating Out Panel Q3 2018 report, this summer saw the highest snack visit spend on record, with average spend growing by 4%. The channels that gained the most share over the summer were coffee shops and cafes (+1.6%), pubs (+0.6%) and fast food (+0.7%).

However, increased heat meant consumers stayed in more for dinner (the highest spend occasion). Frequency of going out for dinner declined year-on-year (to September 2018), with 2% fewer dinners being eaten out per person, per month. The retail picture supports this, as Kantar Worldpanel reported that premium products in retail grew 3% over the summer. This suggests that consumers were staying in more but upgrading their products to still get a ‘going out feel’.

BBQ occasions grow in the heat

We saw 35% growth in BBQ’s (34 million more occasions) during the period of the heatwave. Unlike previous years, weekend BBQ’s made up 55% of BBQ occasions, overall. This may be a result of more consistent “guaranteed” hot weather, allowing consumers to plan social events ahead, rather than the temperamental weather usually experienced throughout UK summers.

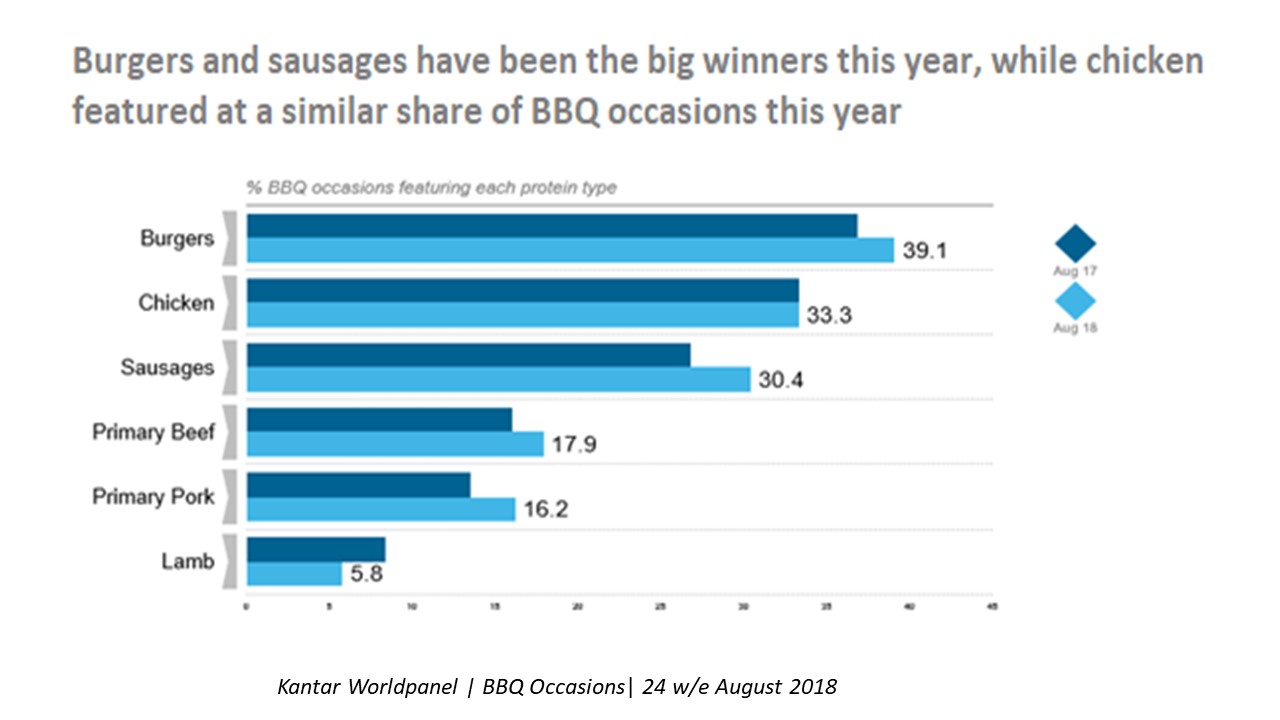

Traditional BBQ favourites, such as sausages (+4.5%) and burgers (+2.3%), experienced some of the greatest growth from August 2017, featuring at more occasions than the previous year. In occasion terms, burgers (39%), chicken (33%) and sausages (30%) were the key proteins. Kantar also reports that the type of protein used depends on the size of the BBQ occasion, with burgers leading in larger occasions and chicken being used more for smaller occasions.

However, it is important to note that BBQ occasions make up only 0.4% of total meals consumed this summer and so have less impact on overall protein performance than expected.

Overall Protein: Red meat underperforms

During the summer overall, meals containing protein returned to growth, gaining 109 million more occasions, year-on-year (compared with decline the previous two years). However, the growth was fuelled predominantly by lighter proteins, such as fish and chicken and, to a lesser extent, pork. Lamb continued to underperform.

In sales terms, sausages, wet/smoked fish, fresh burgers and grills, and fresh chicken all did well, seeing a year-on-year growth from last summer. Sausages increased in value by 5.1% and in volume by 3.9%. Fresh chicken grew at a similar level, rising in value by 3.6% and volume by 6.5%, with a similar performance for fish. Fresh burgers and grills also grew by a much larger rate of 14.4% in value and 13.6% in volume.

However, gains for burgers were offset by losses from roasting, and casseroling cuts and fresh beef, lamb, pork and frozen poultry all had a less than sunny summer. Kantar Worldpanel report that fresh beef decreased by 5.2% in value and fresh pork by 3.8% in value. Fresh lamb took a greater hit, with 7% reduced value.

Added value bucks the trend

There was an increase in raw added- value products this summer, such as marinades, minted or flavoured meat and poultry, with the 12 w/e 17 June 18 period being the second most significant period for raw added-value in the last five years. Shoppers spent 4.7% more on added-value meat and poultry products this spring/early summer compared with last year. This may be due to the added convenience raw added-value products have, needing less time to be spent in the kitchen.

Cold foods popular to beat the heat

Cold prepared foods featured at 188 million more occasions this summer, despite falling in previous years. The heat discouraged more involved cooking and instead highlighted the need for quick and easy food. This again ties in with the consumer trend this summer to spend less time preparing food, with average preparation time reducing to under 25 minutes. This was not a switch primarily to sandwiches, as these fell overall, but was more connected to foods such as salads and ‘nibbles’. An example of this can be seen in sausage rolls, which increased in popularity across all day-parts to become the No. 1 snack in sandwich retailers in Q2 2018, according to MCA.

Sliced cooked meats increased 3.1% in value and 1% in volume when comparing Jan-Sept this year with Jan-Sept 2015. Fewer planned meals, and more quick bites in the heat made sliced cooked meats an easy option for consumers.

Topics:

Sectors:

Tags: