Feed report: 25 November 2021

Thursday, 25 November 2021

By Vikki Campbell

Grains

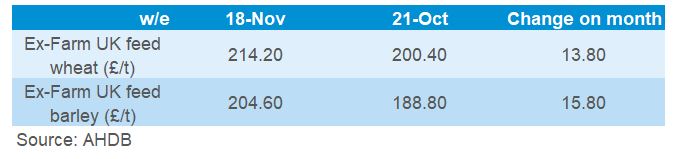

Both ex-farm feed wheat and barley continued their climb over the past month. Prices have been supported by both global and domestic factors.

The global tightness in wheat markets continues. The latest USDA World Agricultural Supply and Demand Estimates (WASDE) further trimmed global wheat ending stocks, beyond what the trade had been expecting. Further support has been added to wheat markets recently, with rising Russian export taxes on the horizon, coupled with harvest rain in Australia and flood disruptions to Canadian exports. With global wheat fundamentals so tight this season, price support could well remain until the 2022 crop comes on line.

Globally, maize prices have softened slightly of late, although a floor has been placed on this movement in the face of continuing strong demand. To date, reasonable growing conditions in Argentina, coupled with Brazil still looking to plant a timely safrinha crop should the soyabean harvest complete in a timely fashion, as currently in place to do, have limited gains. However, with a moderate La Nina now active over South America, any changes to weather will be closely monitored.

Closer to home, the support to domestic prices offered by the global strength has been exacerbated by logistical issues. Muted farmer selling, combined with many struggling to get “wheels” under their grain, has seen delivered premiums stretch this season. This is particularly notable the further away from port the destination e.g. the North West. With supply chain concerns looking set to continue at least until Christmas, it would be surprising to see a significant softening of grain prices in the coming weeks.

Proteins

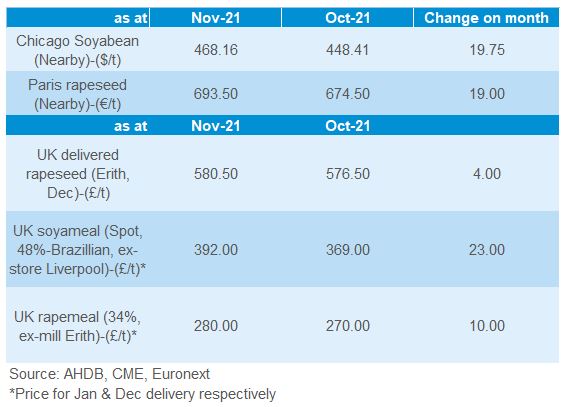

Paris rapeseed futures have been continuing their climb over the past month, with little in the short term to infer any reduction in the tight supply situation. Australia may offer the market a breath when it’s canola crop comes on line. Current crop conditions are reportedly better than last year, and Australian authorities are currently forecasting a 5Mt+ canola crop.

Meanwhile, soyabeans have been largely trading in a range over the past month. With Chinese buying off the forecast pace and good planting and growing conditions in South America largely the norm, some of the heat has been taken out of prices. However, should there be a weather event or Chinese buying pick up speed, we may see further price support.

On a domestic front, rapeseed prices have continued to increase. Buoyed by rising global veg oil prices, a lack of liquidity on the home market and logistical challenges, delivered rapeseed (Erith) for Dec-21 reached £580.50/t on 18 November.

Currency

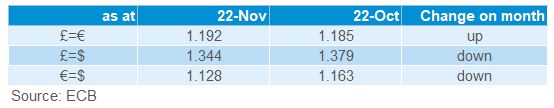

Sterling continued to strengthen against the Euro this month, with strong UK economic data pointing to a potential interest rate hike in the near future. While Europe is also seeing rising inflation, the coronavirus outbreak is the largest threat, with more governments moving towards lockdowns.

Both dollar and sterling markets were taking in the raft of change proposed and inferred to monetary policy amid high inflation rates. However, this week the dollar has weakened slightly, as is often true on the run in to Thanksgiving

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.