Analyst Insight: Black Sea exports trimmed in March WASDE

Thursday, 10 March 2022

Market commentary

- London feed wheat futures (May-22) closed yesterday at £297.50/t, regaining some of the losses from the previous day. The number of May-22 contracts traded has increased again over the past two days. Yesterday, 646 contracts were traded, the largest number since 15 December 2021 (Refinitiv).

- Paris rapeseed (May-22) gained a further €8.25/t yesterday closing at €891.00 continuing to reach record highs for the third day running.

- Brent crude oil (nearby), which has been trading near historic highs of late, dropped yesterday to close the day at $111.14/barrel, down $16.84/barrel from the day before. This follows news that the UAE support an increase in OPEC+ oil output in a bid to ease current supply pressures. The market will likely remain volatile in the short-term though.

Black Sea exports trimmed in March WASDE

Last night saw the release of the latest USDA World Agricultural Supply and Demand Estimates (WASDE). As expected, Black Sea exports were trimmed making global availability of key agricultural commodities even tighter.

Wheat

As a direct result of the current Black Sea tensions, exports from Ukraine and Russia have been seriously hampered. The USDA have cut Ukrainian exports by 4.0Mt and Russian exports by 3.0Mt. This pegs full season (2021/22) forecasts at 20.0Mt and 32.0Mt respectively.

Ukrainian ports remain closed and although exports via rail are expected to continue, they will be lower volumes in comparison to ships. Whilst Russian ports remain open some say that shipowners are cautious about sending their ships to the region.

On Monday, Russian consultancy Sovecon cut its export forecast for Russia by 0.8Mt to 33.5Mt some 1.5Mt higher than the USDA. So far this season (Jul-Feb) it pegs Russian wheat exports at 27.7Mt.

Partially offsetting Black Sea export reductions in the WASDE report, is the increase to Australian (+2.0Mt) and Indian (+1.5Mt) export forecasts. Indian is the third largest wheat producer globally but historically not a key exporter. The USDA currently peg Indian wheat exports at 8.5Mt versus the five-year average (2016-2020) of 0.9Mt.

Australian exports were also increased. Pegged at 27.5Mt the USDA’s estimate sits 2.2Mt above the ABARES (Australian government agency) March estimate. Australian traders are quoting infrastructural and labour as the key constraints for Australian exports.

Maize

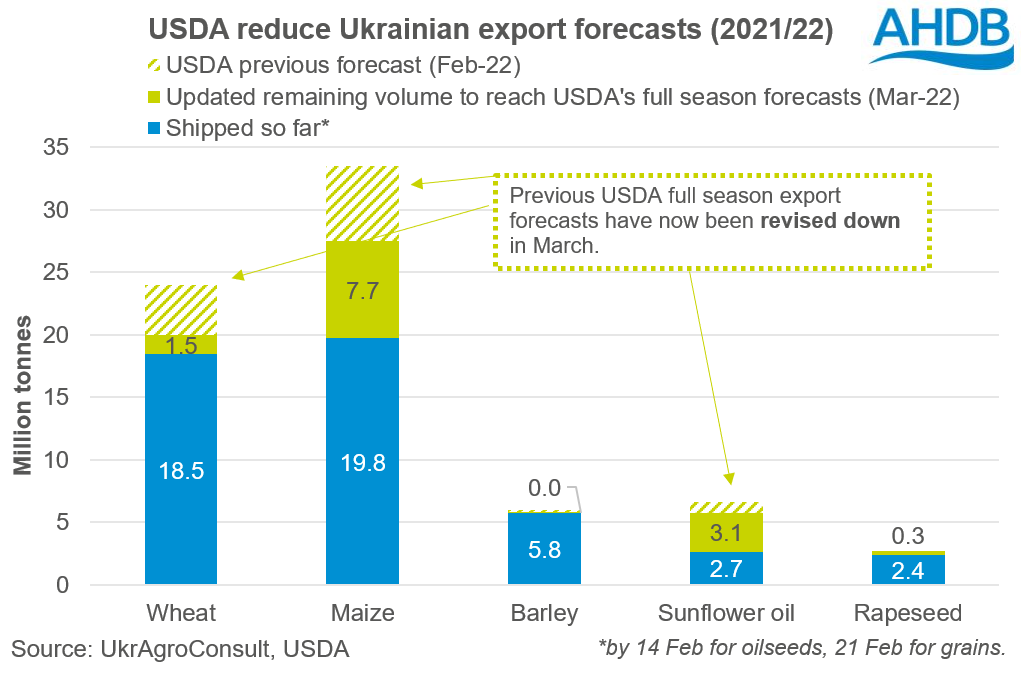

Maize exports have also been reduced from war-torn Ukraine. Ukraine is a key player for global maize exports, accounting for c.14.5% of global exports (2016-2020). Updated estimates peg Ukrainian maize exports at 27.5Mt, down 6.0Mt from February. UkrAgroConsult estimated 19.8Mt of maize was already exported by 21 February 2022 meaning the USDA estimate another 7.7Mt will be exported in the 2021/22 marketing year.

US maize exports have been increased by 1.9Mt, to 63.5Mt, on expectation that some demand will shift. Brazilian exports have been left at 43.0Mt with production still estimated at 114.0Mt despite Conab (Brazil’s official forecaster) trimming its forecast to 112.3Mt in February. Current estimates rely on a decent safrinha crop, which Conab estimate will account for 77% of total production (2021/22).

Sun oil

Ukraine and Russia are key players in global sun oil markets. Collectively the countries account for c.58% of global sun oil production and c.76% of global exports (2016-2020). The USDA have trimmed its export forecast by 1.1Mt combined. UkrAgroConsult stated that sun oil exports up to 14 February 2022 totalled 2.7Mt meaning a further 3.1Mt will need to be exported by the end of 2021/22 to reach the USDA forecast of 5.8Mt.

Soyabeans

Focusing on exports, 5.5Mt has been cut from the major exporters forecast primarily driven by cuts to Brazilian soyabean exports. Now estimated at 85.5Mt, Brazilian soyabean exports were trimmed by 5.0Mt following a cut (-7.0Mt) in production. The USDA still peg Brazilian soyabean production (127.0Mt) 1.5Mt higher than Brazil’s official forecaster, Conab.

What does this mean for the UK?

As a result of these cuts, availability of these commodities is potentially at risk. Most commodities will likely remain supported at least in the short-term. Considering much of the cuts are as a direct result to the Russian-Ukrainian war, if things were to subside there, we could see the support soften. However, as things stand exports from this region for wheat, maize and sun oil will likely remain disrupted.

Any impact on global grain or oilseed futures markets (particularly Chicago and Paris) will somewhat translate into UK prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.