Consumers relationship with the environment and food choices

Wednesday, 28 July 2021

Consumer food choices can be influenced by a multitude of factors. Typically taste and enjoyment are the key motivators for consumer’s meal choices but consumers are complex and there can often be multiple factors below the surface that influence purchase decisions. Climate change and the environmental impact of food production is one area where there has been growing interest from consumers.

This area has received greater media exposure over the last couple of years, rightly or wrongly referencing farming and food production practices as contributing to the climate emergency. There are strong examples of initiatives on farm to tackle climate change and benefit the environment but from a consumer perspective it is vital those messages reach them in a digestible way. Communicating technical and often complex messages about the environmental credentials of food production can be challenging at best. To achieve cut through with consumers, messages need to be focused and opportunities to amplify these across the industry should be harnessed, while identifying common goals to unite and safeguard our planet in the long term.

On balance, most consumers believe farmers care about the planet, with 64 per cent in agreement (AHDB/Blue Marble Trust Consumer Insight Research 2020). In addition, with more people buying locally since the Covid pandemic began, farmers and independent retailers have a great opportunity to capitalise on shoppers’ approval ratings.

There are lots of different exposure points for consumers on environmental messaging, with technological advances resulting in lots of content across a wide range of topics they express an interest in. In the longer term, there has been a significant rise in the desire from consumers to see businesses tackle environmental topics, with the agricultural industry not alone in being urged to promote initiatives to achieve this.

Consumer-friendly initiatives

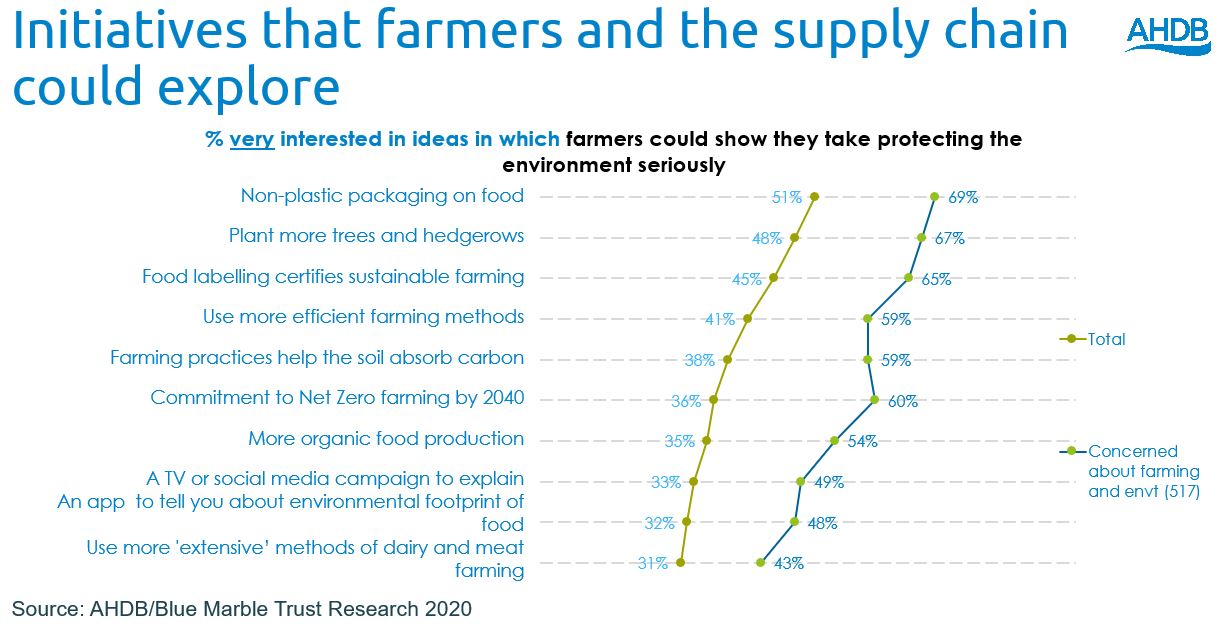

AHDB’s consumer research on the environment highlighted strong interest in a diverse range of initiatives. Two of the top three are visible at point of sale: using non-plastic packaging and food labelling to certify sustainable farming. For those who tell us they are concerned about farming and the environment, a commitment to Net Zero by 2040 received a strong response. The ideas of using more efficient farming and more organic farming are endorsed.

The concept of an app to inform people about the environmental footprint of food and the use of ‘extensive’ farming practices are least appealing – but these are not always understood and may need explanation. When it comes to what people can do themselves, food waste and plastics are top concerns.

Since 2019, the term regenerative agriculture or ‘regen-ag’ has grown, with google searches in the UK peaking in March 2021. But AHDB’s research shows awareness of regenerative agriculture was limited. To encourage shoppers to choose regenerative produced food and drink, consumer knowledge and understanding of product benefits needs to be improved, to justify the price premium.

For the ruminant sector, there are initiatives such as grass-fed, which for beef, lamb and dairy could provide a positive and unique selling point for British produce. But as with regenerative agriculture, consumer understanding of the benefits of grass-fed systems is quite limited, with consumers often saying tangible benefits like “access to outdoors” are more desirable.

Category context: Meat

It’s important to recognise that strong environmental messaging can reassure consumers about foods they might already be eating. This is the case for red meat where, despite strong retail sales in 2020, in the longer term there has been gradual erosion of consumption, with some consumers being unconscious meat reducers. AHDB’s consumer tracker found that health is the most cited reason for reducing meat consumption – but in the longer term it is the environment which has experienced the strongest growth.

While the primary drivers for meat consumption remain more functional drivers like taste and enjoyment, it important to acknowledge and respond to the rising consumer interest in the environment. Therefore, it is vital that the industry pro-actively communicates clear messages on the environmental footprint of UK meat production. Looking ahead, it is essential that red meat is communicated as a tasty and nutritious product, alongside statements about the environment, as demonstrated in AHDB’s recent ‘We Eat balanced’ campaign.

Category context: Dairy

Around one in three consumers has concerns about how milk is produced. Environmental concerns sit alongside animal welfare as the top two claimed reasons for thinking about cutting back on dairy products, highlighting the growing scepticism about the environmental credentials of dairy. According to AHDB/YouGov Consumer tracker, six years ago 67% of consumers felt that dairy farming was good for the countryside, this had fallen to 42% in May 2021. There has also been a gradual easing in agreement that the dairy industry is environmentally responsible (31% vs 44% six years ago). As more and more consumers start to consider the environmental credentials of their food it will be vital for the industry to manage communication around these issues.

Looking ahead

We know that the pandemic has had a significant impact on consumer buying behaviour. With price, value for money and buying local becoming more of a priority during the lockdowns in 2020. While taste and enjoyment are primary purchase drivers among the majority of categories, concerns around reputational issues such as the environment are likely to rise on the consumer’s radar in the long term.

It is vital that industry addresses concerns around the environment, communicates the nutritional benefits of sector products and promotes Britain’s high production standards to underpin a strong quality message behind buying British. Simultaneously consumers will be adjusting over the next few years to a hard economic reality that will start to influence behavioural change in British homes.

AHDB has combined the evidence on consumer demand with how product supplies are changing to produce a forward picture on Agri Market Outlooks across all our sectors.

Topics:

Sectors:

Tags: