Meat’s opportunity to work harder online

Monday, 27 June 2022

In 2021, online’s share of grocery sales plateaued at 10.3%, up 3.9 percentage points (%pts) on pre-pandemic levels (2019) according to IGD. However, its growth is predicted to accelerate with share hitting 11.2% in 2027, accounting for £1 in every £9 spent on grocery (IGD, UK Channel Forecasts, June 2022). This will be driven by channel innovation, new fulfilment capacity, expansion of rapid delivery services and an appeal among budget conscious consumers. 72% of shoppers buy groceries online because they find it easier to control their spending (AHDB, Online Meat Shopper Journey, 2019), resonating with the current cost of living crisis.

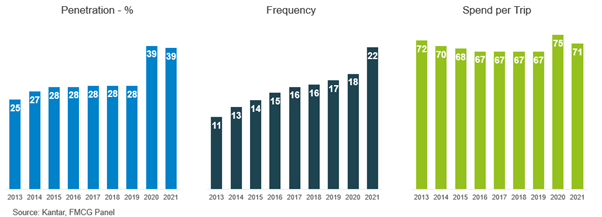

Undoubtedly the pandemic had a huge impact on online grocery shopping with the number of households using the channel increasing by 11%pts at the peak in 2020, according to Kantar. The channel typically over indexes among family shoppers but the pandemic bought in a new older shopper. Since then, penetration has reached saturation, remaining at 39% in 2021. However, among those already shopping online, the frequency of grocery shops is increasing (an average of 22 times online in the year), with an average spend of £71 per shop.

With penetration gains halting, the strategic priority for the online channel should be focusing on existing shoppers first:

Strategic online priorities

- Increase basket size to drive higher spend

- Increase online shopping frequency through catering to more shopper missions

- Recruit new online shoppers

In the last year, meat, fish and poultry (MFP) sold online has been worth £2.6bn, accounting for 12.2% of total MFP sales (Kantar, 52 w/e 15 May 22). It is a particularly important category to drive higher spend due to its price point.

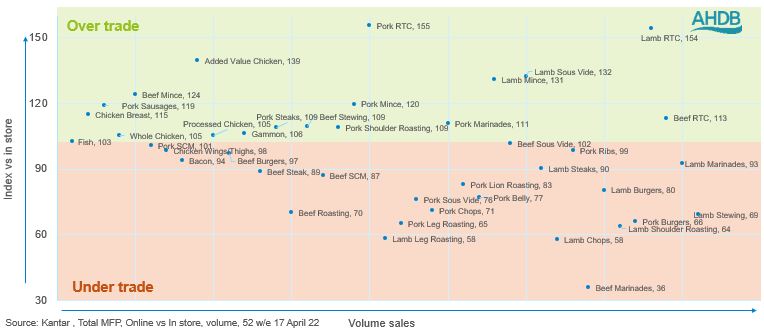

Sales of MFP online have been boosted by the increase in shopper numbers with volumes up 57% compared to pre-pandemic (Kantar, 12 we 17 April 2022). However, MFPs growth online is slowing faster than total grocery and as yet some MFP categories do not achieve their fair share of the online market. Fish, pork and added value have done particularly well online versus pre-pandemic, with promotional support boosting these categories. As shopping online naturally means shoppers can’t interact with products (56% claim they find it hard to buy meat online because they can’t see it according to AHDBs latest research), higher priced proteins and cuts, like lamb roasting and beef marinades, under perform online.

Therefore, for meat to reach its full potential online the category needs to better engage shoppers through improving the shopper experience.

In 2021, AHDB published in-depth research into how to improve the in-store shopping experience, with impact in market starting to come through. However, as the online experience differs significantly to in-store we have commissioned a unique project to look at how to engage shoppers with meat online. Ultimately, the research aims to find out what communication, along the online shopper journey, would improve category purchase intent and perceptions. The answer isn’t simple as ‘no one size fits all’. A mixture of messages, on different pages, for different cuts and proteins, covering inspiration, farming, health and quality, is the optimum. The flexibility of an online platform allows a ‘mix and match’ approach to communication, delivering unique messages for a range of meat products.

AHDB will be working with industry processors and retailers over the next few months to start implementing positive changes for the meat category online and the full report will be available on the website from September so watch this space.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.