Summer 2019: What retailers need to know

Wednesday, 13 November 2019

Unlike the heatwave of summer 2018, this year’s summer felt somewhat subdued. Last year, scorching temperatures coupled with high profile sporting events helped to boost grocery spend. This year, unsettled weather hampered grocery growth.

How did AHDB categories fare, and what lessons can we take away for future summers?

Key take aways:

-

Preparing for weather and event patterns will allow the supply chain to better tailor supply and merchandising. See our Importance of Events report

-

Summer means less prep time in the kitchen. Quick and easy products and cuts are, therefore, important

-

Clearly communicate the ability to cook products both indoors and outdoors when the weather is unpredictable

-

Similarly, meal inspiration for both warmer and cooler weather is key, especially as scratch cooking is seeing a resurgence

-

When warmer, meal inspiration should focus on healthier, lighter dishes

What do we mean by ‘summer’?

Kantar defines summer as the 20 weeks to 8 September 2019, with summer purchasing stretching from May Day Bank Holiday through to the August Bank Holiday. As the summer of 2018 was so exceptional, it is difficult to make fair comparisons year-on-year. Where possible we also compare this year’s performance with 2017, which is more comparable in terms of weather and sunshine hours.

Grocery spend up but growth slowed

Because of the cooler weather, total grocery growth slowed, with spend growing by just 0.3% to £43.1bn, according to Kantar (20 w/e 8 Sep 19). Performance of typical hot weather categories (alcohol, soft drinks, ice cream and sun care products) fell back on 2018, as consumers moved towards more ‘comfort foods’ in the cooler weather. Ice cream lost volumes to biscuits and confectionary, while soup and hot beverages grew on the year.

Summer eating and cooking habits

Shoppers have different eating habits and needs when it is warmer. Lighter, healthier and quicker meals are more important, highlighting the opportunity to tailor meal inspiration based on the predicted weather. Rather unsurprisingly, the poorer weather this year meant that BBQ occasions fell from the year before, by 28% (-29 million occasions) (Kantar, 24 w/e Aug 19). However, we still barbequed more than we did in the summer of 2017, with more of us choosing to BBQ midweek than at the weekend.

It is important to remember that BBQs only account for 1.4% of all main meals consumed in summer that contain meat, fish and poultry (MFP) (Kantar, 12 w/e Aug 19). Oven cooking remains the most popular method of cooking MFP regardless of season, but cold meals become more important in the summer months. Communicating summer eating ranges that can be cooked both indoors and outdoors if the weather turns are, therefore, important.

Total MFP volumes slip

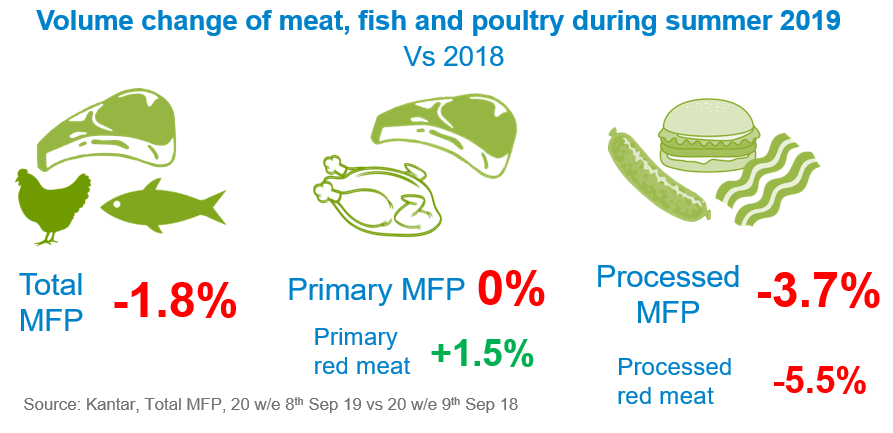

Both the value and quantity of total MFP sold during summer 2019 fell from the year before, with spend down 1.4% to £7.1bn and volume down 1.8% to 1.2bn kg (Kantar, 20 w/e 8 Sep 19). For red meat, the decline came because a lower volume of processed meat was sold (-13m kg), which outweighed a growth in volume sales of primary cuts (+3m kg).

When we compare this performance with that of 2017, spend on total MFP in 2019 was marginally higher (+0.3%), but volumes were still down (-1.0%). The category saw consumers shopping less often and for lower volumes, rather than leaving the category completely.

The biggest differences in MFP sales between 2018 and 2019 came during April–May, when much stronger weather last year helped to boost sales. Sales were actually consistent between both years from June to early August, when sunshine hours were similar.

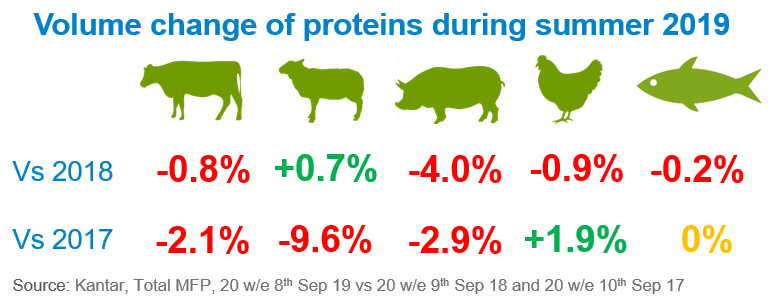

When we look at individual proteins, we see varied performance. Compared with last year, lamb sees positive volume growth, while pork was down substantially. Poultry, fish and other red meats are more stable year-on-year, but red meat sees a decline over the longer-term.

Lamb volumes rise

Total lamb volumes rose year-on-year, with the recent AHDB campaign, coupled with more promotional support, aiding this. Growth came from primary; roasting, diced, stewed and mince, outweighing chop declines. Despite being a small segment of the lamb category, ready-to-cook lamb also enjoyed growth, playing into summer consumer demands of shorter prep times. Despite growth being up year-on-year, longer-term lamb volumes are significantly down.

Primary beef volumes up

While total beef volumes fell year-on-year, primary volumes rose by 1.8%, helping to compensate for burger losses in 2019. Growth in the primary category came from mince, stewing and roasting, which better suited the cooler weather. Steak struggled this summer compared with last, with volumes down 8.7%, but volumes were up from two years ago. A large proportion of steak volume sales were lost to mince, potentially influenced by an increasing price gap. A fall in burgers and grills drove processed losses year-on-year, despite volumes being higher than two years ago. Continuing the long-term trajectory for burgers with NPD, following flavour trends and promotional support will help maximise impact.

Pork slips

Pork volumes were down 4.0% from 2018, driven by losses in both primary and processed, but particularly sausages and bacon. Pork was the only red meat not to see primary volumes recover from 2018. Despite roasting joints and mince increasing in volumes, falling sales of chops and steak drove the decline. The story is similar when comparing to 2017.

How did dairy do?

We saw total dairy volumes slip back by 0.9% from 2018. Falls in volume sales of milk and fromage frais contributed to the decline, with fromage frais showing the largest year-on-year volume decline of 19.7%. Cheese, butter and cream all grew in volume from 2018, with butter showing the largest growth of 5.2%.

Butter purchasing dipped in summer in both 2018 and 2019, but appeared to recover quicker this year than last. These falls may come from a decline in baking during the warmer weather. Encouraging shoppers to continue baking in summer may help attract core butter shoppers to maintain their spend from the chillier months when baking is potentially more attractive. Recent economic uncertainty has led to a revival of scratch cooking, which may be a beneficial trend here. See our latest analysis on home baking for more information.

What about potatoes?

Shoppers spent more on potatoes this summer, but volumes fell by 3.3% as shoppers bought less volume per trip (Kantar, 20 w/e 8 Sep 19). Volume sales of some salad varieties like Charlotte fell back on the year, potentially due to the cooler weather dampening demand for lighter dishes. Some of the fall in volume was likely due to the tightness in the potato crop because of the drought last summer. Consequentially, packhouses and supermarkets were careful in managing supplies and promotions to ensure that shelves remained stocked.

For processed potatoes, the largest year-on-year volume growth was seen in reconstituted potatoes (i.e. instant mash), followed by frozen chips, potato savoury snacks and frozen potato products. Declines came for canned potatoes, chilled potatoes and crisps, despite crisps remaining the UK’s favourite savoury snack. Chilled potatoes suffered with losses of baby/new potatoes outweighing growth of mash, which was driven by the cooler weather.

Related content

Topics:

Sectors:

Tags: