Oil drags domestic rapeseed down: Grain market daily

Wednesday, 1 December 2021

Market commentary

- UK feed wheat futures (May-22) dropped a further £4.90/t yesterday to close at £228.50/t. The contract has lost ground on five consecutive sessions.

- UK feed wheat followed other key grains contracts down including US maize, US wheat and French wheat on the back of the new covid-19 variant (Omicron) concerns.

- Despite Australian wheat production anticipated at record highs, premium wheat is hard to come by. Australian premium wheat (FOB, Western Australia) is now priced US$47/t over Australian standard wheat (Refinitiv), compared to US$8-US$10 a few months ago.

Oil drags domestic rapeseed down

Domestic rapeseed prices have slipped in the past two weeks. Last Friday, delivered rapeseed into Erith (delivery +1 month) was quoted at £579.00/t, down £30.50/t from two weeks previous when it reached a new high. It is key to note that despite the large drop, it is still at unprecedented levels prior to this season. But, why the drop?

Global oilseed markets had found support over recent months on the back of a tight global supply and demand picture. UK prices tend to track movements in Paris rapeseed futures, which are influenced by the wider oilseeds and oils complex. Since last Wednesday the May-22 Paris rapeseed futures contract has experienced four consecutive days of losses, losing €48.00/t in that time (Wednesday-Tuesday). The contract has lost a total of €62.50/t since its peak on 12 November 2021.

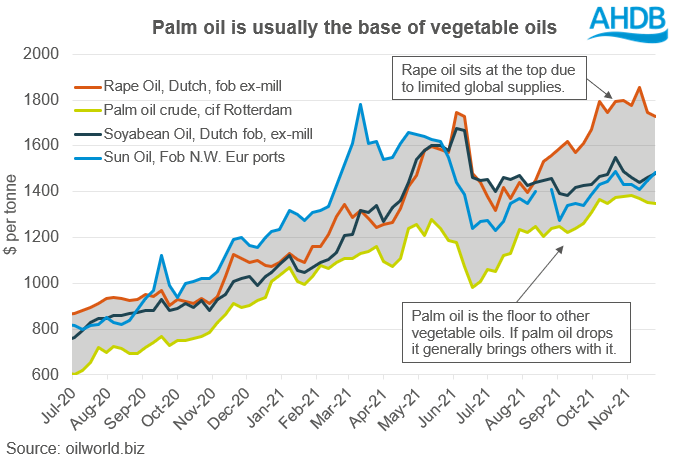

The recent losses imitate those of the wider complex. US soyabeans and soya oil futures have lost ground lately and palm oil too. Palm oil is generally the base for vegetable oils so losses in this market lowers the floor of other vegetable oils and subsequently oilseeds. This said, to hold its competitiveness, if other oils devalue palm will also slip.

Recent announcements about border closures because of heightened concerns surrounding the Omicron covid-19 variant have dampened oil prospects. Potential global lockdowns could reduce the demand for edible oils, putting pressure on the market. In the short term, there may be a technical correction in the market following the recent sharp decline but unsettled global demand may prevent much gain over the coming weeks.

As previously mentioned, physical domestic prices for rapeseed tend to track Paris futures, which will inevitably follow global markets. But the exchange rate also plays a part. Sterling has lost ground against the euro, finishing yesterday at £1 = €1.1730, a drop of 1.34% Tuesday-to-Tuesday. If sterling continues to weaken, it would soften any declines in the Paris futures market. However, the value of the pound versus the euro is still relatively strong.

To find out what physical domestic rapeseed prices are doing visit our delivered prices page, updated every Friday.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.