- Home

- Knowledge library

- Consumer Insights: Shopper behaviour to meat and meat-free

Consumer Insights: Shopper behaviour to meat and meat-free

This research was undertaken by AHDB with The Smithfield Collective to understand shoppers’ behaviour towards vegetarian and vegan foods that are designed to compete with meat.

We have covered the answers to these areas within three articles.

Who is this analysis for?

We aim to help retailers and processors with evidence to protect and grow red meat sales. This may be useful for industry bodies who may wish to use it to challenge their intellectual property, and for British farmers to understand how AHDB is looking to protect their interests.

Key findings

- There is potential for confusion for shoppers in meat-free products. There is a spectrum and products from unfamiliar brands, using particularly ‘meaty’ names or which look very realistic are the most likely to be unclear at first glance.

- Consumers think meat-free products are trying replicate meat with 69% agreeing alternatives try to describe themselves in a way that sounds like meat.

- Half of shoppers agreed alternatives shouldn’t use words like steak or bacon.

- Shopping bays where meat and alternatives were very mixed together caused the most confusion.

- Once the number of meat-free products on the shelf was highlighted, 57% said they initially didn’t realise how many products on the shelf were meat-free.

- It was not clear at first glance for brands which have both meat and alternative products.

- The shopping missions are very different for meat and meat-free products, so 60% of shoppers agreed meat-free products should be displayed in a different place to meat products.

- Shoppers are fond of meat packaging with 70% likeability on average across the three meat packs we tested. This was much higher than the meat-free packs.

- Being able to see the product is hugely important for meat and is a key indicator of quality to the consumer.

- Having cooked product imagery on pack was a key learning for increasing perceptions of the product as tasty and good quality.

Background

Meat-free has been an area of growth in previous years and many new products appearing on shelves, however it remains a small part of the market, at 2% volume share and has recently fallen into decline.

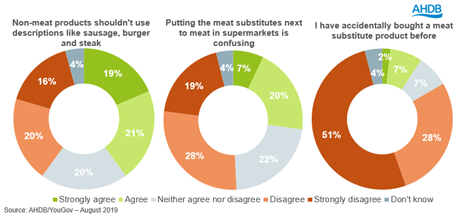

AHDB have undertaken previous research which shows that while only a minority have bought a meat-free product by mistake, there are many who believe they shouldn’t use meat descriptors.

Research on how to best to re-engage shoppers with the meat aisle in store showed there are improvements to be made to meat packaging. An industry hypothesis was shoppers were more drawn to plant-based and meat-free packaging.

Results of trials and research by supermarkets on whether having meat-free products and meat in the same aisle had mixed results.

Prior to the Covid-19 pandemic, Tesco ran a trial to investigate the sales impact of moving meat-free products into the meat aisle. Placement is a known lever to drive behaviour change. According to IGD, ten meat-free products were moved from a chilled, plant-based aisle into the meat, fish and poultry aisle in large Tesco stores. The initial results included 21 weeks of data to 23 February 2020 and compared sales results of the trial stores with 10 matched control stores.

Some customers struggled to find their usual products, which was an initial barrier, but informing store colleagues of changes and having shelf call outs helped to resolve the issue. However, the trial was a success for plant-based, with sales being positively impacted during the trial but without a reduction in meat sales.

More recently, Asda trialled merchandising plant-based products directly alongside meat within the aisle (i.e. plant-based sausages next to pork sausages). This led to a 30% reduction in sales of those products compared to stores arranging the products in a segregated bay within the meat aisle.

There were three objectives of the research:

- To identify if shoppers are confused or misled by descriptions used on plant-based products

- To discover the impact on shopping experience if vegan and plant-based products were included alongside meat products in-store

- To understand the reactions from consumers around plant-based labelling compared to similar meat products to identify areas where meat could improve

Methodology

We carried out the research with market research company The Smithfield Collective – an agency who conduct bespoke qualitative and quantitative projects in the UK and around the world to deliver people-centred insights and strategies.

There were two stages to the research: a quantitative phase followed by a qualitative stage.

Quantitative phase

The first stage was a fifteen-minute survey including a virtual shelf shopping experience. We asked 1,004 UK adults between 24 November and 6 December 2022.

All respondents were solely or jointly responsible for grocery shopping. 95% were meat eaters with 3% vegan or vegetarian and 2% pescetarian, which is in line with national averages. Looking at their shopping behaviour, 89% had bought a fresh red meat product in the last three months and 44% had bought a meat-free product. There were a range of attitudes towards meat with 57% saying they were cutting back, with health and financial reasons being the biggest drivers.

Qualitative phase

The second stage was in-depth interviews lasting around 45 minutes with eight respondents between 30 January and 3 February 2023.

Of these, four respondents were committed to meat while four were cutting down on meat. Five sometimes bought meat-alternative products while three had not bought meat-free products before.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.