Christmas predictions 2025: A potential cracker for red meat and dairy

Monday, 1 December 2025

As Christmas approaches, demand for red meat and dairy is set to be shaped by a blend of tradition, economic caution and evolving consumer priorities. From price pressures to palate preferences, here’s what we predict for the season ahead.

Despite nearly half of consumers planning to cut back on overall Christmas spending, food remains a ‘protected spend’ in the eyes of consumers, alongside children’s gifts and Christmas trees (Sparkminds, November 2025), suggesting that festive meals will continue to be a central focus.

As a result, 80% of consumers who celebrate Christmas are planning celebrations that are the same size, if not larger, than Christmas 2024, with almost two-fifths of gatherings likely to feature six or more people (AHDB/YouGov, November 2025).

And while this could make you presume that consumers will be looking to cheaper proteins to accommodate these large gatherings, this doesn’t appear to be the case.

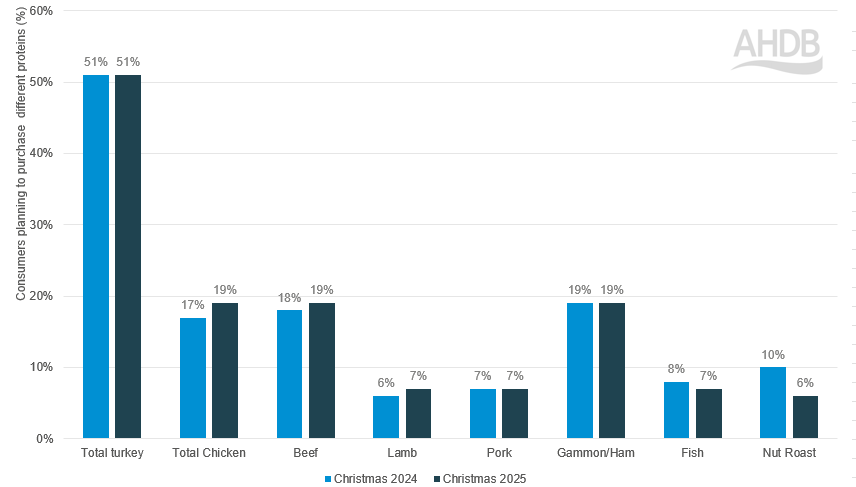

Planned Christmas Day protein purchases for 2024 and 2025

Source: AHDB/YouGov, November 2024 and November 2025

Unsurprisingly, turkey is likely going to remain the protein of choice for those looking to celebrate, but despite ongoing inflationary pressure and price rises dampening demand throughout much of the year for beef and lamb, they are maintaining their demand for Christmas year-on-year.

Consumers appear ready to prioritise taste and tradition over budget constraints, with 68% planning on doing what it takes to enjoy Christmas (Sparkminds, November 2025), as well as claiming great taste and high quality are the most important factors they consider when purchasing meat for Christmas day (AHDB/YouGov, November 2025).

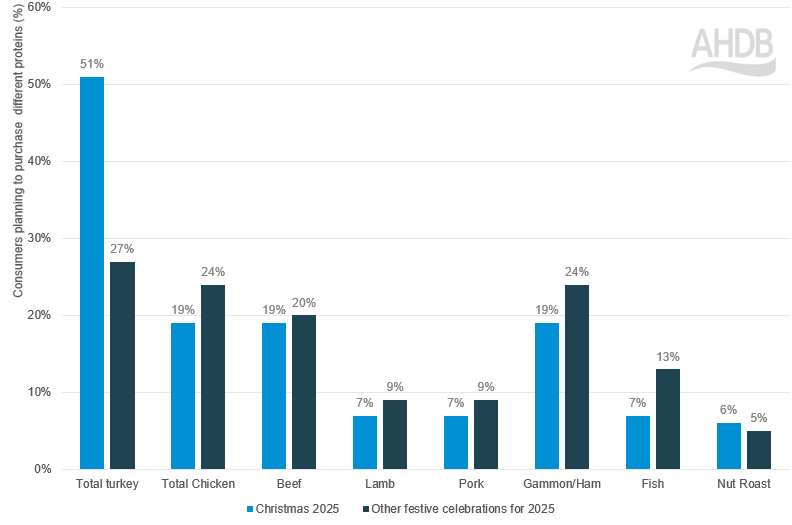

But Christmas Day isn’t the only celebratory occasion important to consumers over the festive period and 75% of consumers plan on having at least one or more celebratory meals over the festive period outside of the big day itself, most of which will be at home (AHDB/YouGov, November 2025).

Importantly for red meat, during these occasions, turkey will likely play a smaller role, with beef, lamb, pork and gammon increasing their share on plates (AHDB/YouGov, November 2025).

Planned protein purchases: Christmas Day vs other festive meals

Source: AHDB/YouGov, November 2025

For retailers and processors, this suggests shoppers may be looking for something a little more special than they would be purchasing for their usual everyday meals, and for longer than just the week leading up to Christmas.

While 9 out of 10 consumers are planning to buy groceries and/or dairy products from their usual retailer for Christmas, they are more open to shopping around for the meat purchases.

Thirteen per cent claim to be planning to purchase meat for Christmas from an alternative, more expensive retailer for (AHDB/YouGov, November 2025).

So, while most consumers’ Christmas spend will likely remain through their normal retail channels, premium retailers and butchers will likely gain share of meat sales.

A very convenient Christmas

Convenience is also set to play a bigger role. With a fifth of consumers finding Christmas cooking stressful, and those aged 18–34 especially keen on preprepared proteins, we anticipate a rise in demand for ready-to-cook and sous-vide options that save time without sacrificing taste and quality, despite the associated higher price tag.

Social media interest earlier in the year over £195 beef Wellingtons, and continued reliance of consumers on air fryers for cooking meals – with 41% of consumers anticipating they will use one for cooking at least part of their Christmas dinner – will likely have shoppers looking to pick up ready prepared dishes to alleviate the pressure on Christmas day chefs.

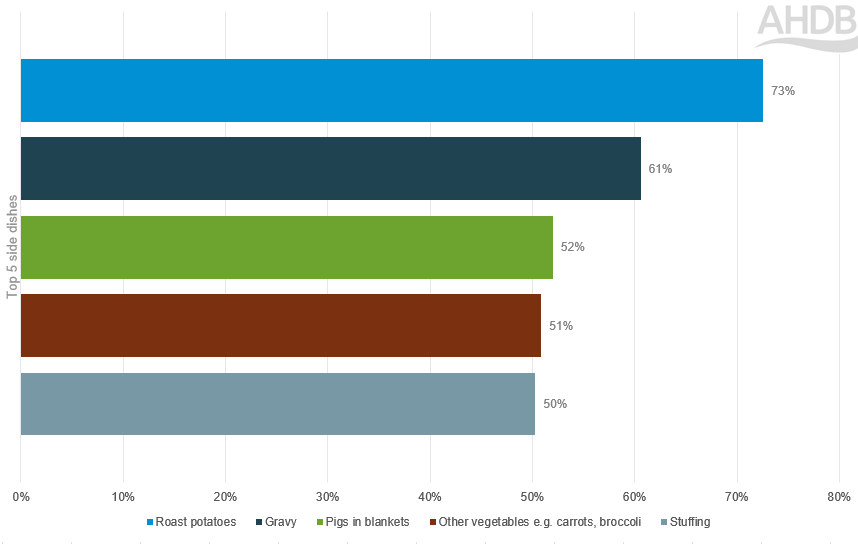

Timeless favourites will accompany centrepiece proteins

Side dishes will continue to reflect nostalgia and comfort. Roast potatoes, pigs in blankets, and classic vegetables are expected to remain staples on plates with lashings of gravy.

Top side dishes planned for Christmas 2025

Source: Sparkminds, November 2025

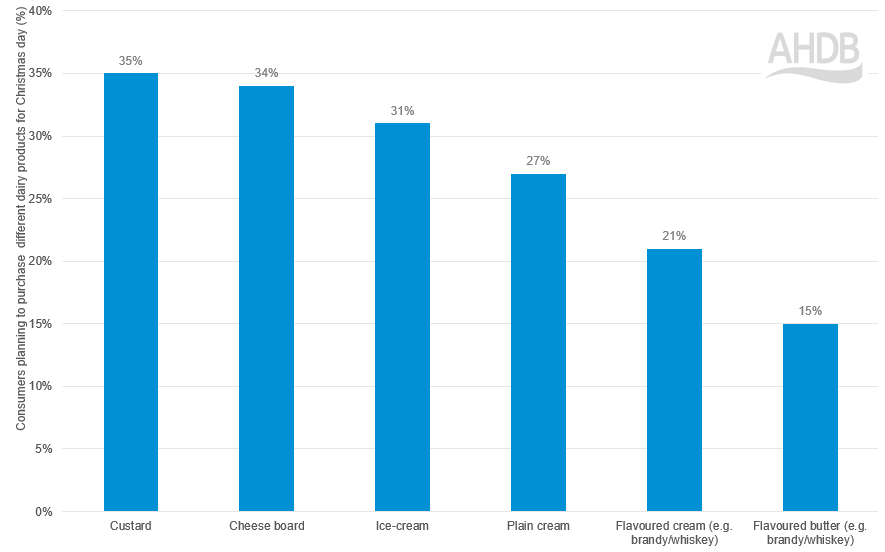

Cheese and cream to take centre stage this Christmas

Dessert will be a battleground of nostalgia and indulgence, with Christmas pudding, mince pies and Christmas cake among the top choices for Christmas Day for over two-fifths of consumers (Sparkminds, November 2025).

This is great news for dairy, as these desserts pair perfectly with custards and creams, which are considered essential by around a third of consumers (Sparkminds, November 2025).

Essential dairy products for Christmas Day

Source: Sparkminds, November 2025

Eight out of ten consumers plan to eat the same or more cheese over the festive period than they normally would (AHDB/YouGov, November 2025).

Cheeseboards dominated by Cheddar, Brie and Stilton will be essential for over a third of households (Sparkminds, November 2025).

Cheese selection packs will therefore likely see a boost in sales, offering a convenient way to indulge.

Christmas 2025 is set to be a season where consumers balance financial caution with a desire to preserve festive magic.

Expect robust demand for seasonal red meat and dairy, a rise in convenient meal solutions, and a table rich in tradition and indulgence.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: