- Home

- Knowledge library

- Consumer Insights: The importance of events for red meat and dairy

Consumer Insights: The importance of events for red meat and dairy

In 2023, there were 52.7 million in-home and carried-out meal occasions which contained AHDB sector products. When combined, this results in beef, lamb, pork and dairy being present in 84% of all meals eaten in the year, and was worth £23.5 billion (Kantar Usage).

Because of the incredible presence red meat and dairy has on the plates of consumers, it is important to understand how and when they are eating these products, to ensure that the supply chain is adequately prepared for consumer demand, particularly around celebratory events.

Brits love to get behind a seasonal event – whether it is a national holiday, a family celebration or just making the most of good weather. More than three-quarters of shoppers say that they look forward to hosting, and special events are seen as a good excuse to indulge and purchase special or unique items to create memorable experiences (IGD, 2024).

Who is this analysis for?

This report aims to help supply retailers and processors with insight about how red meat and dairy perform at key seasonal events throughout the year and future opportunities to help boost sales.

It may also be of interest to British farmers, as we explore production, trade and price trends associated with celebratory events, giving consumer context to when these peaks in demand are likely to occur.

| Key seasonal events | Dates |

|---|---|

| Valentine's Day | 2 weeks ending 19 February |

| Pancake Day | 2 weeks ending 26 February |

| Mother's Day | 2 weeks ending 19 March |

| Easter | 2 weeks ending 9 April |

| Ramadan/Eid | 2 weeks ending 23 April |

| King's Coronation | 2 weeks ending 7 May |

| Father's Day | 2 weeks ending 18 June |

| Summer | 16 weeks ending 3 September* |

| Halloween and Bonfire Night | 2 weeks ending 5 November |

| Christmas | 2 weeks ending 24 December |

Key findings

- Understanding seasonal demands for red meat and dairy categories allows the industry to plan for peaks in demand, and capture trends. This can help influence shoppers to pick up products for these important occasions throughout the year

- Even though seasonal events may last just a day or two, they can significantly impact the overall yearly performance of red meat and dairy products

- Shoppers are often looking to treat themselves at these holiday celebrations and are less likely to stick to a strict budget when it comes to food – either when eating in home or when dining out

- Promotions are particularly effective for driving performance for key cuts, particularly around Christmas and Easter. Exploring retail strategies which are proven to be successful at larger events, such as temporary price reductions (TPRs) and meal deals, could help smaller events see similar successes

- Events play an important role for producers, driving demand both domestically and abroad. The demand peaks have various implications for the market, and knowing when these key times are can help farmers with their planning

Consumer trends at special occasions

Food features prominently in many celebrations, with 82% of hosts saying they will purchase special food and drink for events (IGD, 2024). Shoppers claim that they are less likely to stick to a strict budget when it comes food for these occasions, whether they are in or out-of-home occasions.

Gifting and decorations tend to be the areas where budgets are more likely to be enforced.

Percentage of shoppers that will stick to a budget for all events by activity (IGD ShopperVista, 2024):

- Gifts – 59%

- Decorations – 56%

- Grocery – 48%

- Dining out – 48%

While we have seen food costs soar and rising prices become more pressing in the minds of shoppers for their everyday food shopping purchases, events seem to be less impacted by this.

Almost two-thirds of shoppers say that they were planning on spending the same amount or more than last year on food, drink, and grocery shopping for the events they are going to celebrate, and more than a quarter were yet to decide (IGD, 2024).

We can also see that hosting social gatherings at home encourages two-thirds of hosts to purchase more premium products.

This is even more pronounced among those who have cut back on their food/drink spending for at-home socialising, rising to 71%, indicating a reluctance to compromise on quality for these occasions, and a quality-over-quantity mindset (Mintel, 2023).

The best meal to celebrate with?

When thinking from a total food perspective, lunchtime meals generally fulfil more functional needs, such as planned meals, a quick bite, for fuel or using cupboard ingredients.

However, evening meals are more likely to be seen as a planned occasion for time together, a treat or for romance (Kantar Usage).

This means that there is an opportunity to expand celebrations to an all-day affair, and looking at how red meat and dairy could be included in lunch and breakfast meals could boost sales, particularly of less traditional cuts and products.

Key events

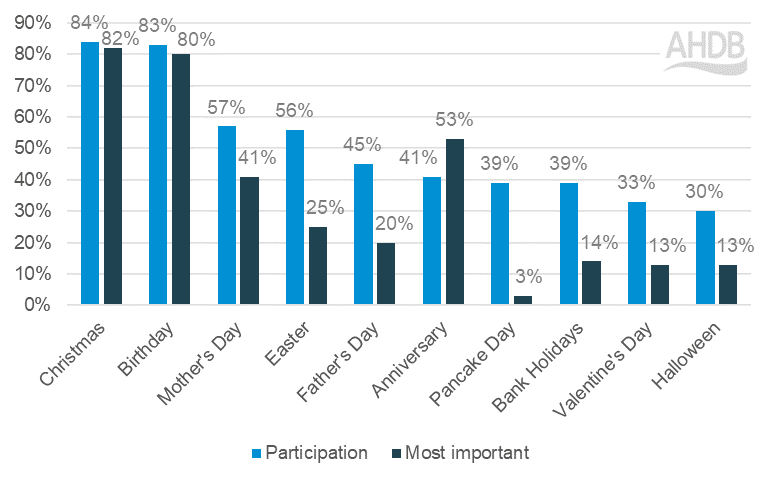

Christmas is seen to be the most important, and most celebrated, event of the year for shoppers, outranking even birthdays and anniversaries.

Events which shoppers claim they will participate in, and those which are most important to them

Source: IGD ShopperVista, 2024. Shoppers self reported all events which they will participate in this year. Importance is based on the percentage of shoppers who placed the event in their top three.

Research by IGD shows that there is not a clear correlation between participation and level of importance for different events for shoppers – further supporting the idea that shoppers will happily take any excuse for a celebration.

In the minds of shoppers, events are often heavily associated with specific food and drink, as well as how they are celebrated.

Some events lend themselves to in-home celebrations and family time, such as Christmas and Easter, while others, such as the summer season and bank holidays, are seen as an opportunity to eat out and socialise with friends.

Understanding the different drivers for each occasion means that trends can be catered for and boost the presence of red meat and dairy on the plates of consumers.

Impact of events on AHDB sectors

Meals which contain dairy are more likely to be used for social and relaxing meal occasions, while meat, fish and poultry (MFP) are more likely to be used at celebrations and planned occasions, such as together time and special occasions (Kantar Usage).

Planned and together time account for the largest share of MFP meal occasions.

Occasion types where meals containing MFP see greatest uplifts compared with total food (Kantar Usage, 52 w/e 24 December 2023):

- Celebration +26%

- Romantic +25%

- Together time +53%

- Special +35%

- Planned +47%

What does this mean for farmers?

Events play an important role for producers, driving demand both domestically and abroad. The demand peaks have various implications for the market, though supply chains have been developed to effectively respond to the seasonal demand flows.

Varying finishing, maturation and storage times all also have an impact on when product is available on the market.

Key seasonal performance broken down by sector

How shoppers use red meat and dairy at mealtimes offers a real opportunity for AHDB sectors.

When shoppers have visitors over, they are looking to create memorable occasions for their guests, and there is opportunity for red meat and dairy to inspire hosts with recipes and more premium or treaty products.

Compared with total food, these categories are more likely to be selected for treat and enjoyment reasons than any other (Kantar Usage).

Understanding seasonal demands for red meat and dairy categories allows the industry to plan for peaks in demand, and capture trends. This can help influence shoppers to pick up products for these important occasions throughout the year.

In the following reports, we have broken down key seasonal performances for beef, lamb, pork, and dairy, highlighting areas of opportunity for driving sales.

The importance of events for beef

How important are seasonal events for beef demand? Is beef just for Valentine's Day or Christmas? We explore the impact seasonal events have on seasonal demand

The importance of events for lamb

How important are seasonal events for lamb demand? Are there opportunities outside of Easter? We explore the impact seasonal demands have on lamb performance

The importance of events for pork

How important are seasonal events for pork demand? When do consumers like to celebrate with pork? We explore the impact seasonal demands have on pork performance

The importance of events for dairy

How important are seasonal events for dairy demand? Which events see greatest performance for dairy products? We explore the impact seasonal demands have on dairy performance

*The 16 w/e 3 September are used to define the summer season. For beef, lamb, pork and dairy, we have analysed the best two weeks within the period to compare with an average for the rest of the year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.